GuocoLand top bidder for Lentor Central plot; Tampines EC site sets price record

Singapore

RESIDENTIAL land prices continue to rise, reflecting developers' optimistic outlook on private home prices and continuing hunger for land, going by the latest state land tender closings.

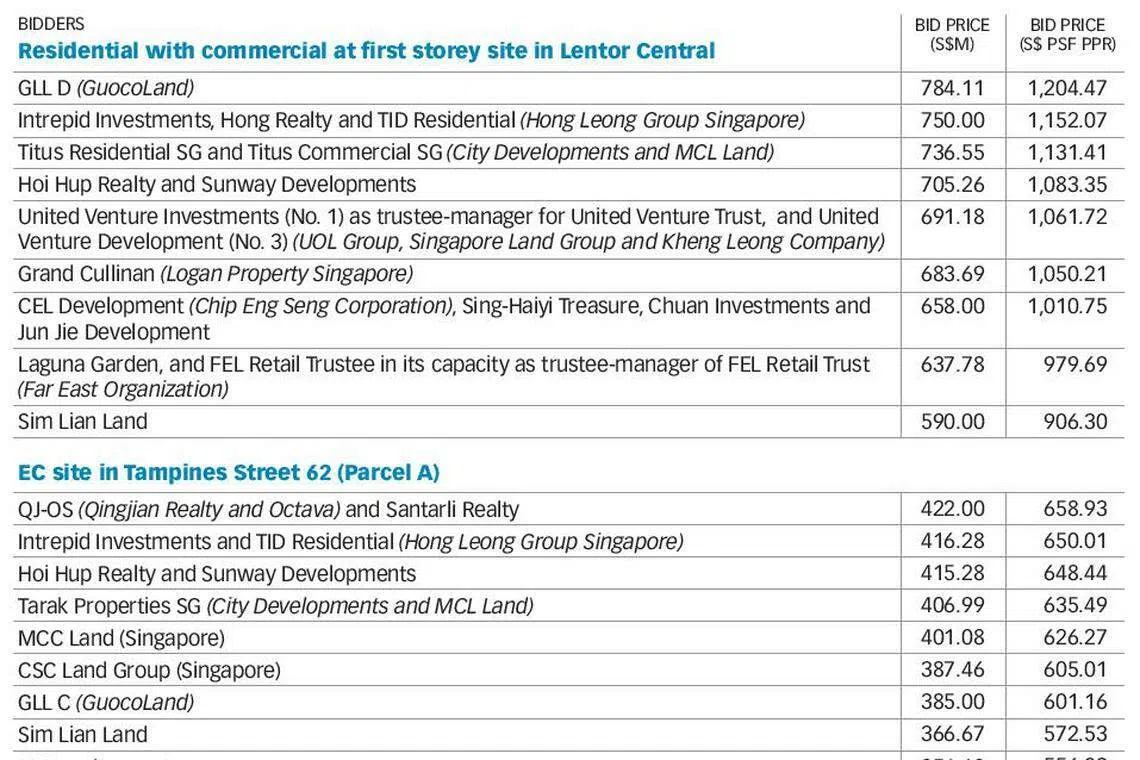

GuocoLand emerged as the highest bidder for a plot next to the upcoming Lentor MRT station on the Thomson-East Coast Line (TEL); the site is designated for private housing development with commercial space at first storey. GuocoLand's bid of S$784.1 million, or S$1,204 per square foot per plot ratio (psf ppr) surpassed the expectations of property consultants polled by BT before the tender close.

The tender for the other plot that also closed the same day, for an executive condominium or EC site in Tampines Street 62, saw a fresh record price for EC land, toppling the S$603 psf ppr set in May for a plot in Tengah Garden Walk.

In the latest tender, the top bid for the Tampines plot was S$422 million or S$659 psf ppr, exceeding the forecasts of most property consultants. The highest bid was placed by a consortium comprising a Qingjian Realty and Octava Pte Ltd joint venture, and Santarli Realty. The top bid was 1.4 per cent higher than the second highest offer, from Intrepid Investments and TID Residential, of S$650 psf ppr. ECs are a public-private housing hybrid.

The tenders for both plots drew nine bids each.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

JLL senior director of research and consultancy, Ong Teck Hui, said: "The recent return to Phase 2 (Heightened Alert) has not dampened demand for sites, as it is probably seen as a short-term event while current tender sites could be launched for sale a year or more later amid positive market conditions.

"The keen tender participation and optimistic top bids are indicative of strong demand for residential sites by developers to replenish their land banks."

In similar vein, PropNex CEO Ismail Gafoor said: "The resilient home prices and healthy buying demand also demonstrate the strength of the housing market, and this has in turn boosted developers' confidence."

For the Lentor Central plot, the top bid by GuocoLand - part of Malaysian tycoon Quek Leng Chan's Hong Leong Group of Malaysia - was 4.5 per cent higher than the second highest bid of S$1,152 psf ppr, from a tie-up comprising Intrepid Investments, Hong Realty and TID Residential; the trio are part of the Hong Leong Group Singapore, helmed by Mr Quek's Singaporean cousin Kwek Leng Beng.

Interestingly, the third highest bid, at S$1,131 psf ppr, was from a tie-up between City Developments Ltd (CDL) and Hongkong Land unit MCL Land. CDL is the SGX-listed property and hotel arm of Hong Leong Group Singapore.

CBRE's head of research for Southeast Asia, Tricia Song, noted that the top three bids for the Lentor plot surpassed the S$1,118 psf ppr winning bid for the private housing plot in Ang Mo Kio Avenue 1 at the May state tender, reflecting "consensus confidence in the Lentor site due to its proximity to a MRT station, an absence of new supply in the area, and its location in a serene low-rise estate".

That said, Lam Chern Woon, head of research and consulting at Edmund Tie & Co, highlighted that the nine bids received for the Lentor plot is fewer than the 15 bids for the Ang Mo Kio Avenue 1 site in May. This, he says, "reflects cautiousness among developers due to the ongoing uncertainties within the construction sector". Moreover, the high absolute price quantum for the Lentor plot vis-a-vis the S$381.4 million top bid for the Ang Mo Kio site, could have deterred smaller developers. The maximum gross floor area (GFA) for the Ang Mo Kio site is about half that of the Lentor plot.

GuocoLand's proposed scheme for the Lentor Central plot envisions a mixed-use, transit-oriented development of 25 storeys with around 600 residences with the convenience of having a substantial amount of F&B and retail space, including a supermarket and more than 10,000 sq ft of childcare facilities. "Located in the Thomson area that has mostly landed homes, residents will also enjoy unblocked views of the surrounding areas. Living there also means having vast amount of nature reserves and parks in proximity," said GuocoLand's spokesperson.

The plot is also close to established schools such as Presbyterian High School, Anderson Primary School, and CHIJ St Nicholas Girls' School.

Meanwhile, Qingjian Realty, which heads the consortium that placed the record top bid for the Tampines Street 62 EC site, said it is "very confident in the Tampines area as it is a mature estate".

"In planning for about 600 units, we envision a good mix of different bedroom types, from two to five-bedders," said Qingjian Realty's deputy general manager, Yen Chong.

ERA Realty Network's head of research and consultancy, Nicholas Mak, predicts that the consortium would have to launch the project at above S$1,250 psf. "The current median transacted prices for new EC units sold by developers in Q2 2021 is S$1,154 psf. This new land price will make all the existing EC projects relatively cheap by comparison."

Mr Ismail predicts the launch price for the EC on the Tampines Street 62 plot at S$1,150-1,250 psf.

As for the Lentor Central plot, he estimates the potential selling price for the future development at S$1,950-2,000 psf.

READ MORE:

- Record bid for Tengah EC site, 15 bids for Ang Mo Kio condo plot signal developers' hunger for land

- URA, HDB launch Lentor Central, Tampines Street 62 GLS sites for tender

- 10 bids for plot near Farrer Park MRT station

- MND raises private housing supply for Confirmed List under H2 2021 GLS Programme

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.