HDB resale prices climb 2.6% in Q2: flash estimates

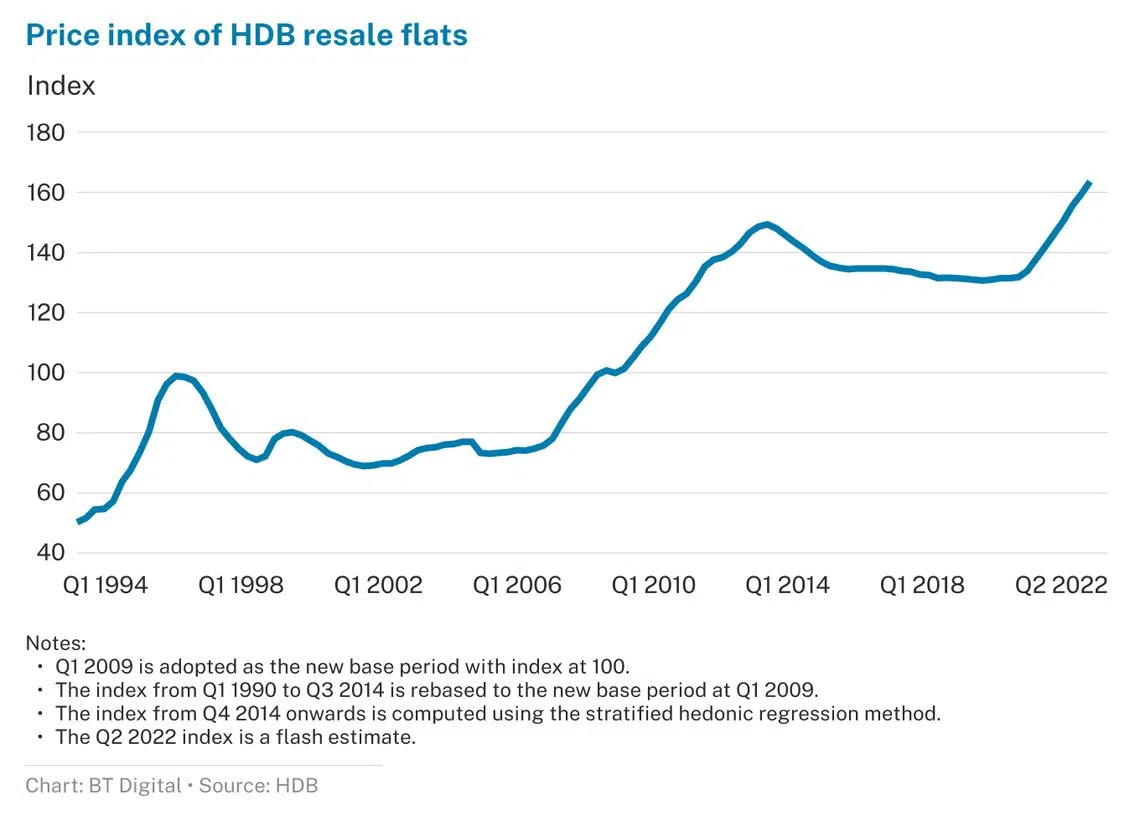

HOUSING Board (HDB) resale prices rose 2.6 per cent in Q2 2022 to mark a ninth consecutive month of quarterly growth, according to HDB’s flash estimates of the Resale Price Index (RPI) released on Friday (Jul 1).

The growth in resale prices came at a faster rate than that of the previous quarter (2.4 per cent) – but remains under the 3 per cent quarter-on-quarter growth booked in Q2 2021. Prices have risen by 5.1 per cent over the past 6 months, and 11.8 per cent on a year-on-year basis.

Based on HDB data as at Jun 30, the median resale price of flats increased in 21 out of 26 towns overall, rising 3 per cent in non-matured estates and a steeper 6.9 per cent in matured estates. Central Area, Ang Mo Kio, Serangoon and Queenstown saw the highest increase in median resale prices at 18 per cent, 17.5 per cent, 14.2 per cent and 11 per cent, respectively.

OrangeTee & Tie senior vice-president of research and analytics Christine Sun said the continual price growth comes as no surprise, as she observed a substantial improvement in buyer confidence.

“Our economy is almost fully reopened and growth has picked up faster than in many other countries. Further, the public housing market is usually less susceptible to macroeconomic fluctuations, unlike investment properties. Critical drivers like our employment rate and income growth remain healthy, which have kept the public housing demand stable,” she observed.

While Sun believes most flat owners “may not be too adversely affected” by recent hikes in interest and mortgage rates, she cautions that the impact may be more keenly felt when private loan rates move above 3.5 per cent.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

“When interest rates for home loans are high, borrowers may be reluctant to spend too much on a new flat since buyers are faced with less affordability and lower borrowing power. Housing demand and prices may moderate when more buyers turn cautious in their home purchases,” said Sun.

Full figures for the RPI, which provides general price movements in the resale public housing market, are due for release on Jul 22, 2022.

HDB in its press statement said it is on track to launch up to 23,000 new flats in 2022.

SEE ALSO

This includes the planned offering of 4,900 build-to-order (BTO) flats in August, and some 9,500 BTO flats in November.

August BTO launches will be in towns and estates such as Ang Mo Kio, Bukit Merah, Choa Chu Kang, Jurong East, Tampines and Woodlands. The November launches will span Bukit Batok, Kallang Whampoa, Queenstown and Yishun.

Lee Sze Teck, senior director of research at Huttons Asia, said market dynamics from an increased supply of BTO flats as well as price resistance from buyers has “worked well” so far in stabilising the pace of price increases.

He is expecting HDB resale prices to rise by up to 10 per cent for the whole of 2022, after “adjusting towards more stability” in the second half of the year.

Lee also highlighted a recent surge in million-dollar-flat transactions which hit 165 as of Q2 2022 - more than 60 per cent of 2021’s total transactions. He believes such transactions could exceed 300 for all of 2022.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.