HDB resale prices inch up 0.1% in December as volume drops nearly 20%: SRX

[SINGAPORE] Resale prices of Housing Board (HDB) flats edged up 0.1 per cent last month, reversing the 0.1 per cent dip recorded in November, according to flash estimates from SRX Property on Thursday.

There was also a near 20 per cent drop in flats changing hands: 1,585 resale units were sold in December, 19.9 per cent fewer than in November. The drop, while in line with the property market's quieter year end, was bigger than December 2016's 14 per cent month-on-month sales decline, according to SRX figures.

Year-on-year, the number of HDB resales last month was 13.9 per cent higher than the 1,391 units sold in December 2016. But resale volume is down by 56.6 per cent compared to its peak of 3,649 units in May 2010.

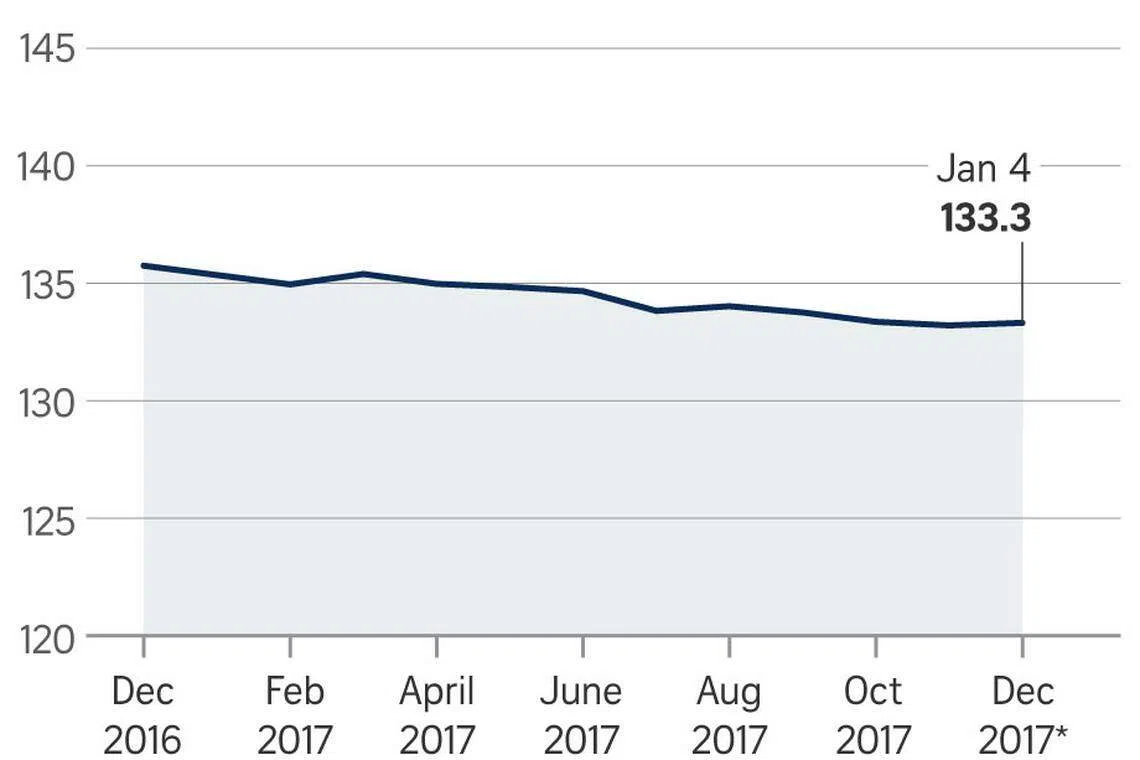

With its latest monthly figures, SRX's full-year HDB resale price index is down 1.8 per cent, close to the 1.5 per cent full-year decline shown in HDB's official flash estimates released on Tuesday.

According to the HDB flash data, resale prices dipped 0.2 per cent in the final three months of 2017, while SRX's prelinary estimates show a 0.3 per cent slip.

SRX is Singapore's only portal that publishes transaction data on a monthly basis.

According to its index, HDB resale prices have declined by 12.5 per cent since their peak in April 2013.

Contributing to the decline seen in the SRX full-year index was the price drop in mature estates, where the fall is 1.2 per cent year on year, compared with a 2.3 per cent increase in non-mature estates.

Month-on-month, the marginal price increase in December was not seen across all flat types. The resale prices of 3-room and executive flats rose by 0.2 per cent and 1.5 per cent respectively, while prices of 5-room flats remained unchanged and 4-room flats saw a 0.9 oer cent drop.

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Property

DBS puts 46 retail units, HDB shops on market for S$210 million

US mortgage rates jump above 7% for the first time this year

Far East Shopping Centre back on market at unchanged S$928 million asking price

London mansions sold at 30% discount spell gloom for luxury market

Delfi Orchard up for collective sale at S$438 million guide price

US existing home sales drop in March; median price increases