Measured bid counts in latest Government Land Sales tenders for private housing

Singapore

BIDDING turnouts at two of three state tenders that closed on Tuesday were noticeably subdued, reflecting developers' sentiment following the latest property cooling measures.

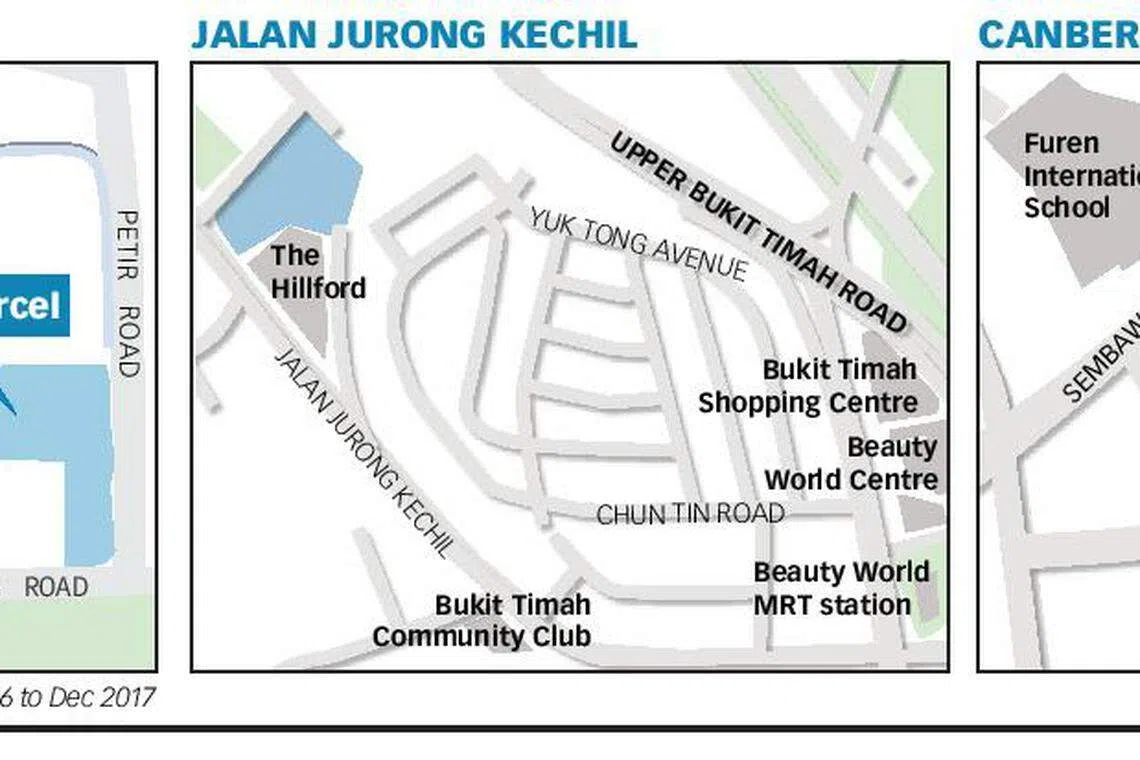

Just five bids competed for the plot on Dairy Farm Road. Over at Jalan Jurong Kechil, three offers were submitted, far fewer than the record 24 bids submitted last year for a nearby Toh Tuck Road plot that has since been developed into Daintree Residence.

The executive condominium (EC) market, however, continues to register healthy interest amid a shortage of supply. A site along Canberra Link pulled in nine bids, said the Housing and Development Board (HDB) on Tuesday evening.

These were the first state tender closings since the property cooling measures kicked in on July 6.

Tan Huey Ying, head of research and consultancy for JLL Singapore, said: "The tender results reflect developers' cautious stance in general, and for private housing sites in particular... given that the additional cooling measures have a greater impact on demand for private homes."

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

In the 99-year, 153,223 sq ft Jalan Jurong Kechil residential site, the highest offer came from a tie-up between COHL Singapore and CSC Land Group (Singapore); the bid was S$215 million, or a land rate of S$1,002 psf.

CSC Land Group (Singapore) is a unit of China Construction (South Pacific) Development Co Pte Ltd; COHL Singapore belongs to Jiak Kim Propco Sarl, which has a Luxembourg address, a search with the Accounting and Corporate Regulatory Authority (ACRA) found.

Two other bids were submitted - one from Hao Yuan Investment for S$163.8 million, and another from Sim Lian Land for S$130 million.

Ms Tay said that the COHL/CSC bid would give rise to an estimated selling price of S$1,600 to S$1,700 per sq ft - just under the S$1,702 per sq ft average transacted price for the nearby Daintree Residence.

At the Government Land Sales (GLS) site at Dairy Farm Road, United Engineers' UED Residential submitted the top bid of S$368.8 million, or S$830.4 psf per gross floor area (GFA).

Closely following was the offer from MCC Group's MCC Land (Singapore) and Greatview Group and Yu Zhisong's Greatview Investment, for S$364.9 million.

The lowest bid was from Wee Hur Development, which placed a S$228.8 million offer.

COHL Singapore and CSC Land Group (Singapore), and Chip Eng Seng Corporation's CEL Property Development were also in the fray.

The 211,486 sq ft site is for residential development with commercial uses on the first storey.

United Engineers' group managing director Roy Tan told The Business Times by phone that he was pleasantly surprised by the outcome. "We put in a reasonable bid that was not too aggressive... and put in a sufficient discount to the Hillview Rise site," he said.

The nearby Hillview Rise GLS site was clinched by Hong Leong Group on July 3 for S$460 million, or S$1,067 psf ppr.

Dr Lee Nai Jia, senior director and head of research at Knight Frank, said the prices at the two GLS sites are "reflective of what has been transacted in that area... rather than future pricing". He added that the tender results could be a "wake-up call" to en bloc hopefuls such as the nearby Dairy Farm condo. "Developers are still going in, but the prices are more rationalised now," he said.

Marketing agent Teakhwa Real Estate, which is marketing The Dairy Farm's en bloc effort, told BT on Tuesday evening that the development's reserve price will stay at S$1.68 billion.

Managing director Sieow Teak Hwa said The Dairy Farm's location is nearer the train station than the plot for which the tender just closed, and The Dairy Farm is freehold to boot.

"The price is reasonable when compared with other available en bloc sites," he said.

The Urban Redevelopment Authority (URA) said that a decision on the award of the tenders will be made after the bids have been evaluated.

For the Canberra Link EC site, HDB announced on Tuesday evening that Hoi Hup Realty and Sunway Developments' bid came out tops at S$271 million, or S$558.22 psf.

The second highest bidder was Greatview Investment and MCC Land (Singapore), with a bid of S$258.9 million. The lowest bidder was JBE Development with a bid of S$201.8 million or S$415.72 psf.

The 99-year land parcel was launched for tender on June 28, for a 194,187 sq ft site that will yield an estimated 450 units.

This was after a 2.7-hectare 820-unit EC site in Sumang Walk was awarded to City Developments and TID Residential. Their bid of S$509.4 million, or a record S$583 psf for EC land, had beat out 16 other contenders.

Nicholas Mak, executive director for ZACD Group, said: "The supply and demand mismatch in the EC market (depleting unsold stock and limited sites for EC development) has strengthened the attractiveness of the Canberra Link EC site. To some developers, EC development is a safer development option in this uncertain market."

Copyright SPH Media. All rights reserved.