Number of ultra-rich living in Singapore rose last year despite pandemic: Knight Frank

SINGAPORE'S number of ultra-wealthy people continued growing strongly in the 2019-2020 period despite the pandemic, making it the Asian country with the second highest rate of growth in this segment.

The number of ultra high net worth individuals (UHNWI) in the city-state rose 10.2 per cent or by 345 to 3,732 in 2020, says The Wealth Report 2021 put out by Knight Frank. The report defines UHNWIs as those with net worth of at least US$30 million, including their primary residence. The figures refer to the UHNWI population living within each country.

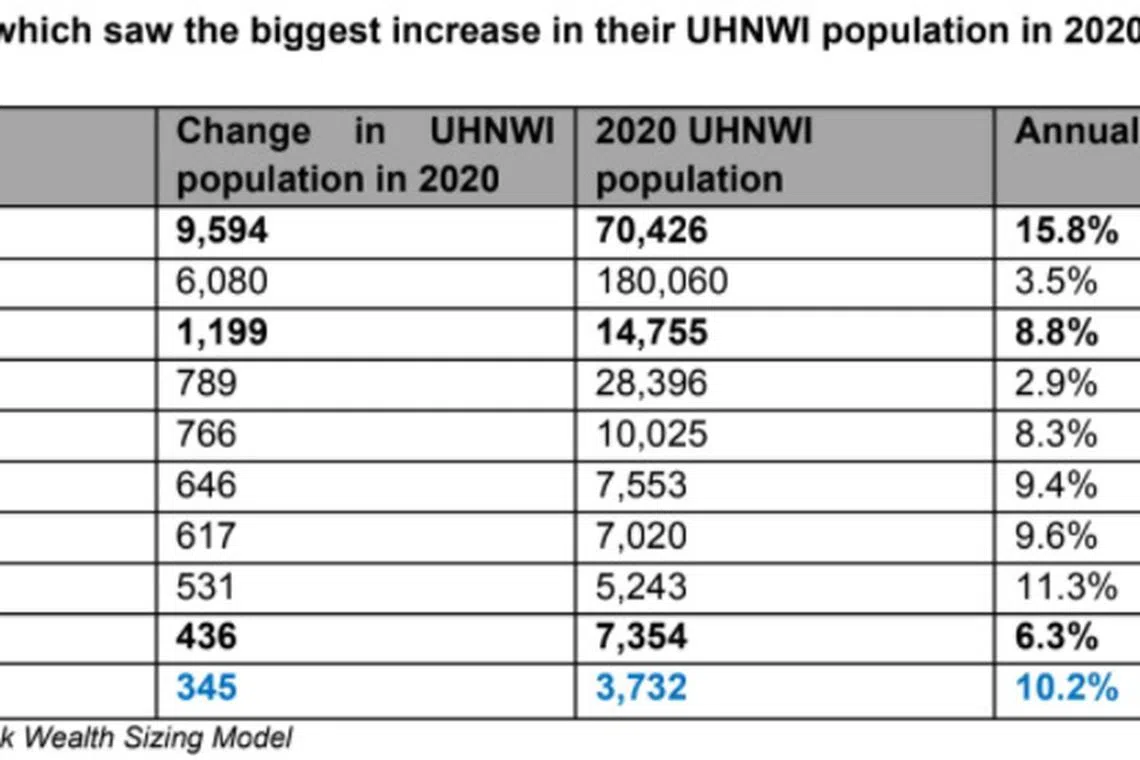

Globally, among the top 10 countries with the fastest-growing UHNWI populations, Singapore is ranked third. China is first with a 15.8 per cent growth rate, and Sweden, second with 11.3 per cent.

Knight Frank's current report said that the number of UHNWIs rose by 2.4 per cent globally last year, one-third of the growth rate in 2019. This brought the total of these millionaires and billionaires to more than 520,000.

China produced 9,594 more UHNWIs, followed by the US (6,080) and Japan (1,199). In absolute numbers, the ultra wealthy in China now number 79,426, followed by Japan's 14,755. The US has the world's most ultra wealthy at 180,060.

In the 2020 edition of The Wealth Report, which looked at figures for the 2018-2019 period, Singapore was ranked eighth with a growth rate of 10 per cent. And of the top 10 locations with fast-growing populations of UHNWIs, seven were in Asia, led by South Korea with a growth rate of 22 per cent.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

On the continued strong growth in the number of the ultra-wealthy in Singapore in the middle of a pandemic, Leonard Tay, Knight Frank Singapore's head of research, said the country continues to attract new wealthy individuals due to its stability, amid geopolitical tensions in other parts of the region and the world.

"In addition, Singapore is smaller in terms of UHNWI population when compared to the other Asian countries in the list. With a lower base, a relatively decent growth in quantum results in a higher percentage increase," he said.

Wendy Tang, Knight Frank Singapore's group managing director, said: "Singapore remains an attractive destination for the globally mobile, and the steps our government has taken to keep the country safe from the virus and to help businesses and residents financially to weather this catastrophe has elevated its standing among the world's wealthy, and further cemented the country's traditional safe-haven status.

"When coupled with strong and enduring economic fundamentals, stable governance, and an attractively competitive tax regime, Singapore offers a break in the clouds that pushed some of the world's mega-rich to have a presence here in recent years."

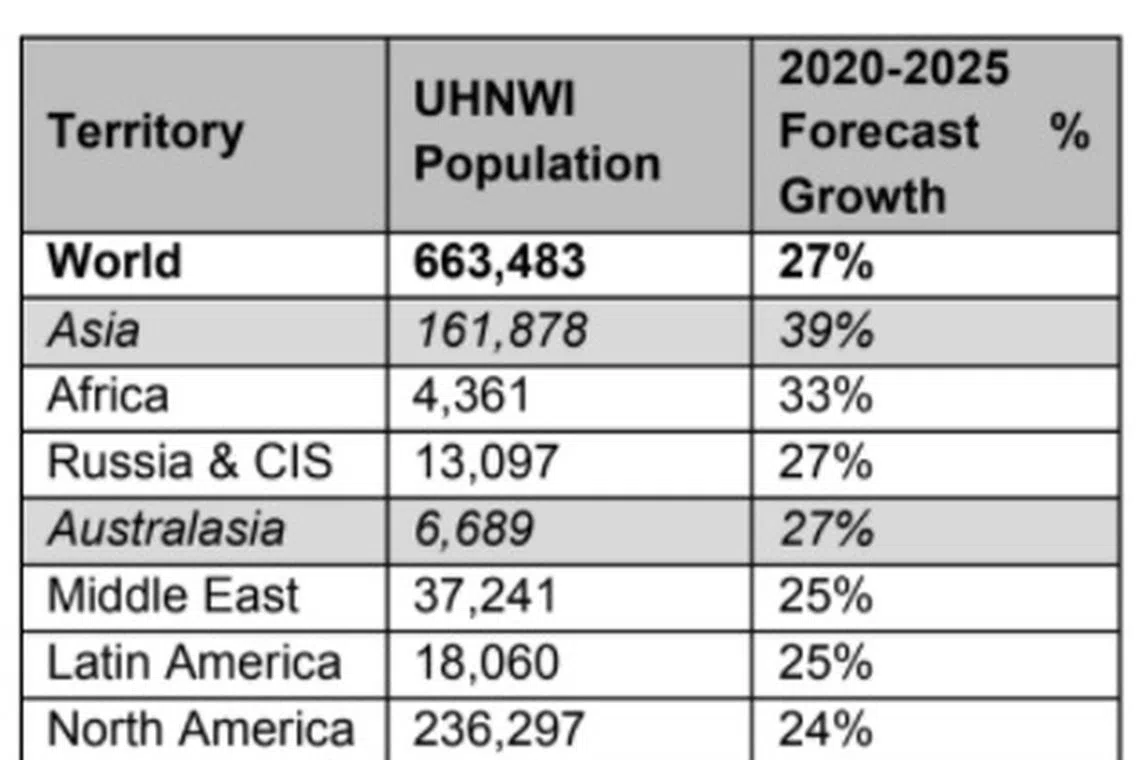

Taking a five-year view, Knight Frank said the Asia-Pacific's UHNWI population is predicted to grow by a third to 168,567 in the five years to 2025 - faster than the global average of 27 per cent to 663,483. The growth for North America will be 24 per cent to 236,297.

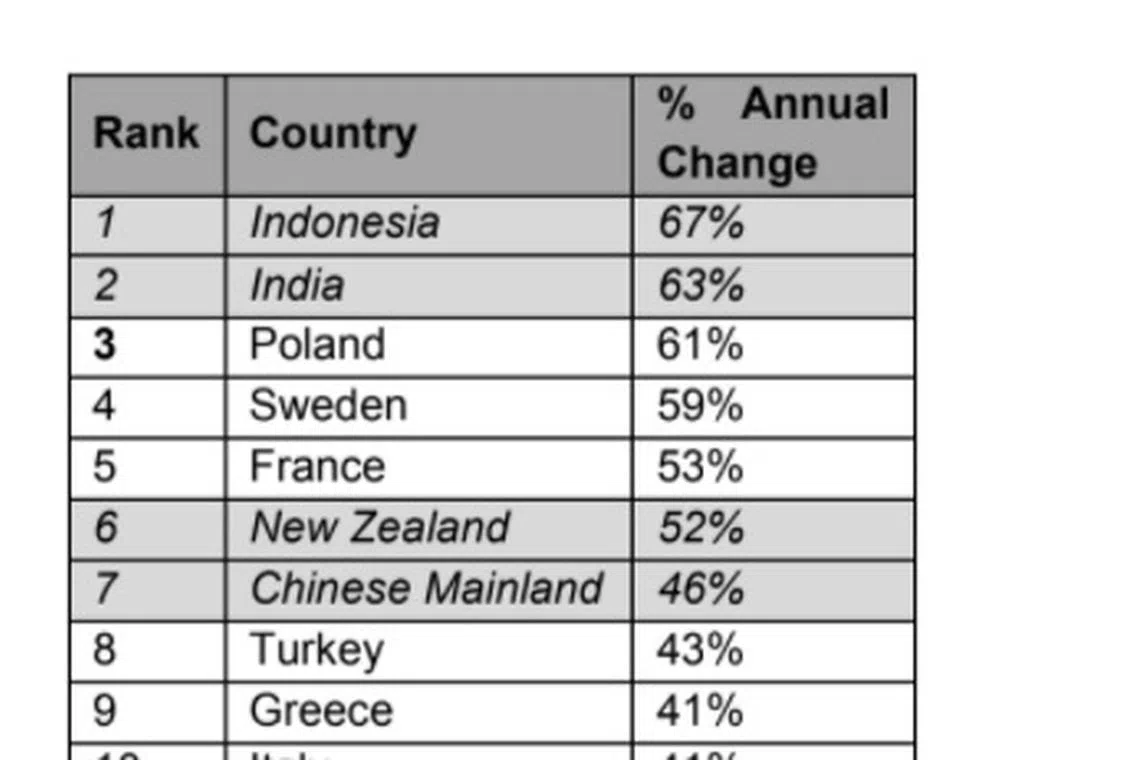

The Asia-Pacific's increase will be led by Indonesia (67 per cent), India (63 per cent), New Zealand (52 per cent) and China (46 per cent).

Over the same five year period, the number of millionaires and billionaires in the Asia-Pacific is set to rise by 37 per cent and 46 per cent respectively. The region is already home to more billionaires than any other region, with 36 per cent of the global total.

By 2025, the region will host almost a quarter of all UHNWIs, 17 per cent more than a decade ago.

In Singapore, the ranks of the ultra-wealthy will swell by 31 per cent between 2020 and 2025 to 4,888, noted Ms Tang. She added that the nation is a hub for South-east Asia, a region where the middle class is one of the fastest-growing in the world.

The report also ranked Singapore was the fourth most desirable place for wealthy Asian homebuyers, behind the US, the UK and Australia. Japan ranked fifth.

Mr Tay said home buyers from India, Japan, Malaysia and South Korea ranked Singapore in their top five list of locations when considering investment homes abroad.

He noted that Singaporeans themselves prefer their own home country to other locations, citing the proximity of leisure facilities and amenities, as well as transport links as key factors in their decision making.

The 2021 report ranked Auckland as the world's most desirable residential city, where prices have risen 17.5 per cent as measured by Knight Frank's Prime International Residential Index (PIRI). Including Auckland, cities in the Asia-Pacific occupy five of the 10 top spots in the PIRI ranking.

Victoria Garrett, Knight Frank head of residential in the Asia-Pacific, said: "The low borrowing costs and the improved vaccine optimism seen towards the end of 2020 were the main drivers that aided some of the prime residential markets in the Asia-Pacific through the pandemic storm.

"Grounded by travel bans, the desire to live in green open spaces that make for a better work-life balance has never been greater. Wellness, wellbeing and family have been at the forefront for many homebuyers in Australia and New Zealand, who have been looking within their country to upgrade their main residence or purchase a holiday home closer to home. Expats have been returning home and luxury buyers are also looking to upgrade their main residence or invest in a secondary residence as a result of the bullish stock market."

Mr Tay noted, however, that prices of prime homes in Singapore have not grown in similar fashion; in fact, they contracted by 0.2 per cent in 2020.

The prolonged and continuing travel measures restricting the inflow of visitors into the city-state prevented potential foreign investors interested in purchasing homes in Singapore from physically viewing these units. As a result, there was an overall 20.4 per cent year-on-year decline in sales of luxury homes compared to 2019. Together with a lack of new launches, the top-tier class of homes in Singapore struggled to gain traction in the year of the pandemic.

Mr Tay said: "Foreign homebuyers purchasing an investment residential property in Singapore do contribute to a significant portion of the demand for luxury homes, and with many deciding to adopt a wait-and-see approach in the pandemic year, price movement was fairly static.

"Nevertheless, Singapore continues to be an oasis for investments due to the stable political environment, as well as the extensive measures implemented to mitigate recurrences of infections."

The demand for luxury homes in the city-state is projected to grow in 2021, as investible properties remain at comparatively affordable price points. This is expected to strengthen foreign buyers' confidence in the market, which could translate into greater sales of prime non-landed residential units once the Covid-19 vaccine distribution proves to be successful and travel restrictions ease, he said.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.