Pandemic uncertainty clouds new private home sales sentiment

Containing spike in cases may restore confidence, but prolonged spread may moderate market activity: analysts

Singapore

AS LONG as uncertainty from the pandemic reigns, monthly new private home sales could fall to around 1,000 units or even lower for the remaining eight months of 2021 with developers delaying launches, and also limited mass market projects.

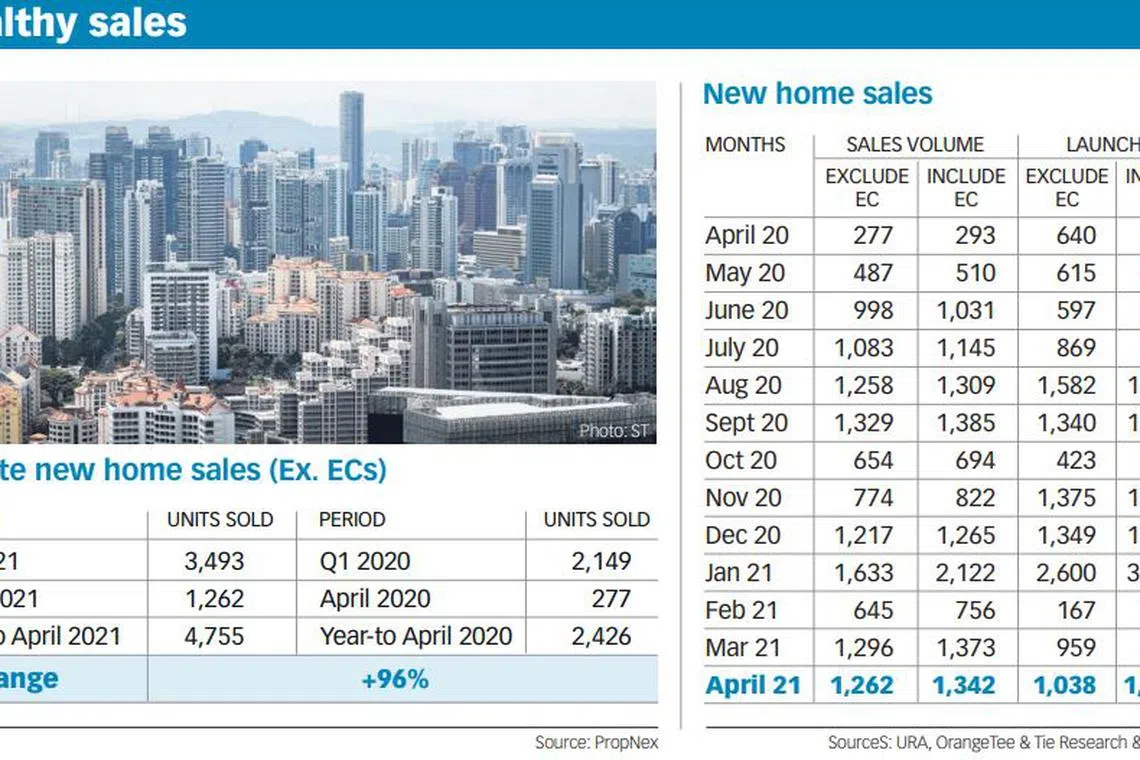

Seven of the past 12 months saw monthly new private home sales gallop well above 1,000 units. They ranged from a low of 1,083 in July 2020 to 1,633 in January 2021. Including executive condominiums (EC), there were eight months where transactions exceeded 1,000 units - from 1,031 in June 2020 to 2,122 in January 2021.

ECs are a private-public housing hybrid.

Developers in Singapore sold 1,262 new private homes in April, down 2.6 per cent from 1,296 in March.

This brings private new homes sales to 4,755 units in the first four months of 2021, almost double the 2,426 in the same period last year.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

"It is now uncertain whether the strong market momentum witnessed so far will continue, as some buyers are likely to be cautious due to the current upsurge in Covid-19 infections," said Ong Teck Hui, JLL senior director, research & consultancy.

"An early containment of the infection would restore confidence and sustain sales take-up but a prolonged infection spread could moderate market activity," he said.

Including ECs, April 2021 sales reached 1,342, easing 2.3 per cent against March 2021, according to the Urban Redevelopment Authority on Monday.

The official data was similar to consultants' flash estimates published by The Business Times on May 14. It also showed increasing buyers' interest for posh condos.

But with the nation in Phase 2 (Heightened Alert) and restrictions on activities, monthly sales for the rest of 2021 may be lower.

Preliminary figures showed around 400 sold in the first two weeks of May, said Mark Yip, Huttons Asia chief executive.

After eight successful launches (excluding ECs) in the first 4.5 months of 2021, the market is taking a breather and there will be no launches in the second half of May and the whole month of June, he added.

"The lowered capacity to one person per 16 square metres and two per group in showflats from May 16 to June 13, 2021, will lengthen the decision-making process for buyers and further lower the transaction volume in May and June from April's 1,262 units," he said.

Virtual tours of the showflats may help to mitigate this, he said.

Despite healthy demand, the pandemic "continues to cloud the road of economic recovery and the normalisation of all human activity", said Leonard Tay, Knight Frank Singapore head of research.

"Where infections in the community were fairly negligible just a few weeks ago, the unpredictable nature of the virus does not respect the hard-won ground gained in Q1 2021 and threatens to regress business and social activities back to previous phases of more prohibitive social limits, perhaps even back to the circuit breaker of a year ago," he said.

Despite the increased restrictions until June 13, it is likely that the primary market will still chalk up around 10,000 new sales for all of 2021, he said.

"However, this is contingent on normal activity resuming after June 13, that no new measures are announced, and that the country-wide vaccination programme progresses unwaveringly to reach a pivotal stage where the resurgence of community infections is muted," said Mr Tay.

Ismail Gafoor, PropNex chief executive, too expects total year sales to cross 10,000 units, "barring any unforseen events and new cooling measures".

If there is a silver lining, some hope that the slower sales last month, and going forward, may stave off policy measures to cool the market.

Private property prices were up 3.3 per cent quarter on quarter and 6.6 per cent year on year in Q1 2021 - this marks the fourth straight quarterly improvement, after a soft 1 per cent fall in Q1 2020.

Buyers in April continued to focus on more expensive condos.

There was a significant increase in condominiums sold at higher prices in April, said Christine Sun, OrangeTee & Tie senior vice-president, research & analytics.

"The proportion of non-landed homes (excluding ECs) sold above S$2,000 per square foot (psf) leapt from 26.2 per cent in January and 38.8 per cent in February to 55.4 per cent in April this year, indicating stronger consumer confidence and appetite for pricier homes," she said.

"It is notable that as higher-end projects are coming onto the market, the median price of new home sales sold has moved up sequentially from S$1.28 million in January to S$1.57 million in April, while psf prices have moved from S$1,744 to S$2,046," said Catherine He, CBRE Southeast Asia director, research.

Ms He also ventured that "going forward, with expected construction delays, it is expected that genuine home buyers will turn to the resale market, thereby affecting new home sales numbers".

In July, there may be up to five launches - Klimt Cairnhill, Pasir Ris 8, Perfect Ten, The Watergardens at Canberra and Parc Greenwich (EC), said Huttons' Mr Yip.

"Assuming that all goes well and activities return to Phase 3, sales activities will be back to their normal trajectory of 800 to 1,000 units per month," he said.

READ MORE:

- More snapping up luxe condos even as new private home sales in April slow

- Spike in Singaporeans buying posh residential properties

- Singapore private home prices rise 3.3% in Q1 on 'extremely strong' demand

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.