Price premium of HDB resale flats in mature estates may shrink further

THE price gap between Housing Board (HDB) flats in mature estates and those in non-mature estates is likely to continue to narrow in the coming years, Huttons Research said.

This comes as buyers are shunning decaying leases despite amenities and accessibility, while some younger estates are also transforming and winning favour with residents, the real estate consultancy noted in a report on Friday.

If the trend persists, "it is possible that we will see a million-dollar flat in a non-mature estate soon", said Lee Sze Teck, director of research at Huttons Asia.

Last month, HDB resale prices rose more quickly in non-mature estates, climbing 12.4 per cent year on year and increasing 1.4 per cent from April, flash figures from property portal SRX showed. Mature estates, meanwhile, saw prices grow by 11.6 per cent year on year and 0.9 per cent month on month.

Singapore's mature estates include Ang Mo Kio, Bishan, Central Area, Clementi, Pasir Ris, Tampines and Toa Payoh. Non-mature HDB estates include Bukit Batok, Choa Chu Kang, Jurong East, Punggol, Sengkang and Woodlands.

With a more central location as well as numerous amenities and facilities nearby, flats in mature towns tend to command a premium over those in non-mature estates. Sellers also expect this because they too had paid a premium when they first bought their flats, Huttons wrote.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

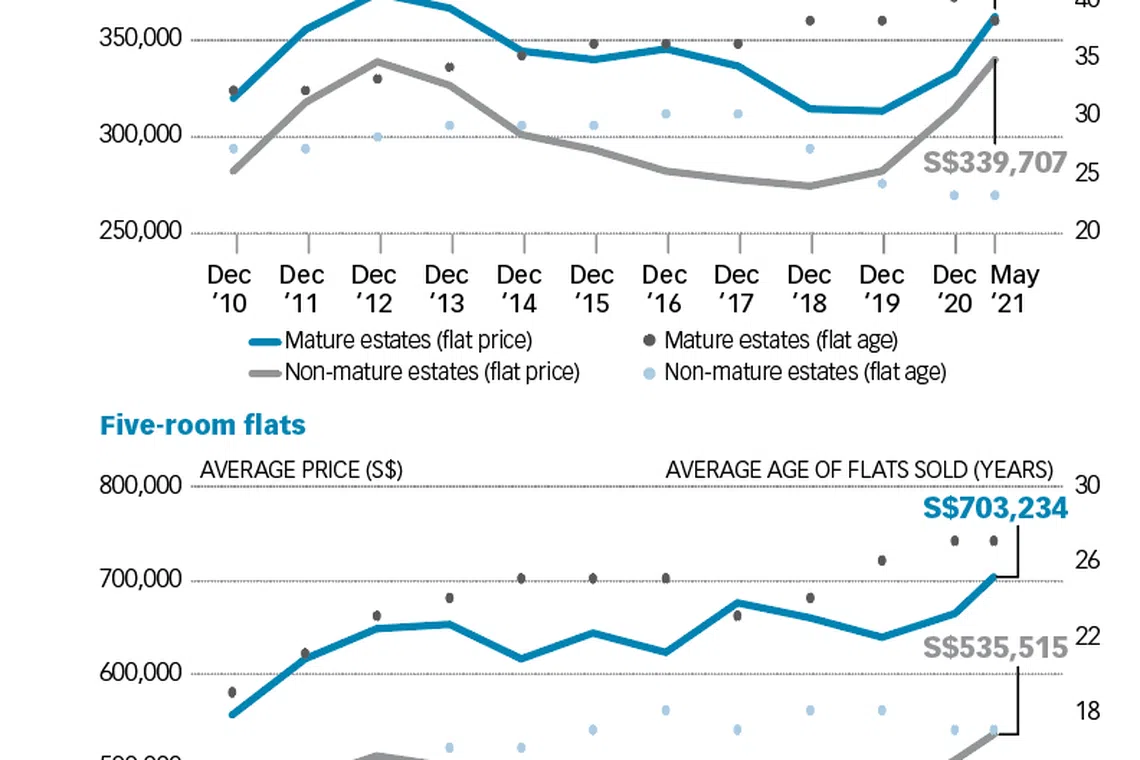

Generally, that should be the case, given real estate's "location, location, location" mantra. But the differentiation between mature and non-mature estates has blurred in recent years, with average resale prices in the latter areas climbing at a faster rate, the research team found from its analysis of price data from 2010 to May 2021.

One possible reason for the shrinking premium is the age or remaining land tenure of the flats that changed hands, Huttons said. "Even if your flat is in a mature estate, you will not be able to fight against a decaying lease, which seems to have a greater impact."

The gap narrowed for three-room and five-room flats in the past decade, partly because there was an increase in new supply of such flats being built and sold in non-mature estates. That meant the average age of these flat types transacted in non-mature estates came down more quickly than in mature estates.

However, four-room flats' price gap remained fairly stable as both mature and non-mature towns saw an influx of such homes. Their average ages therefore started to decline across the country at around the same time.

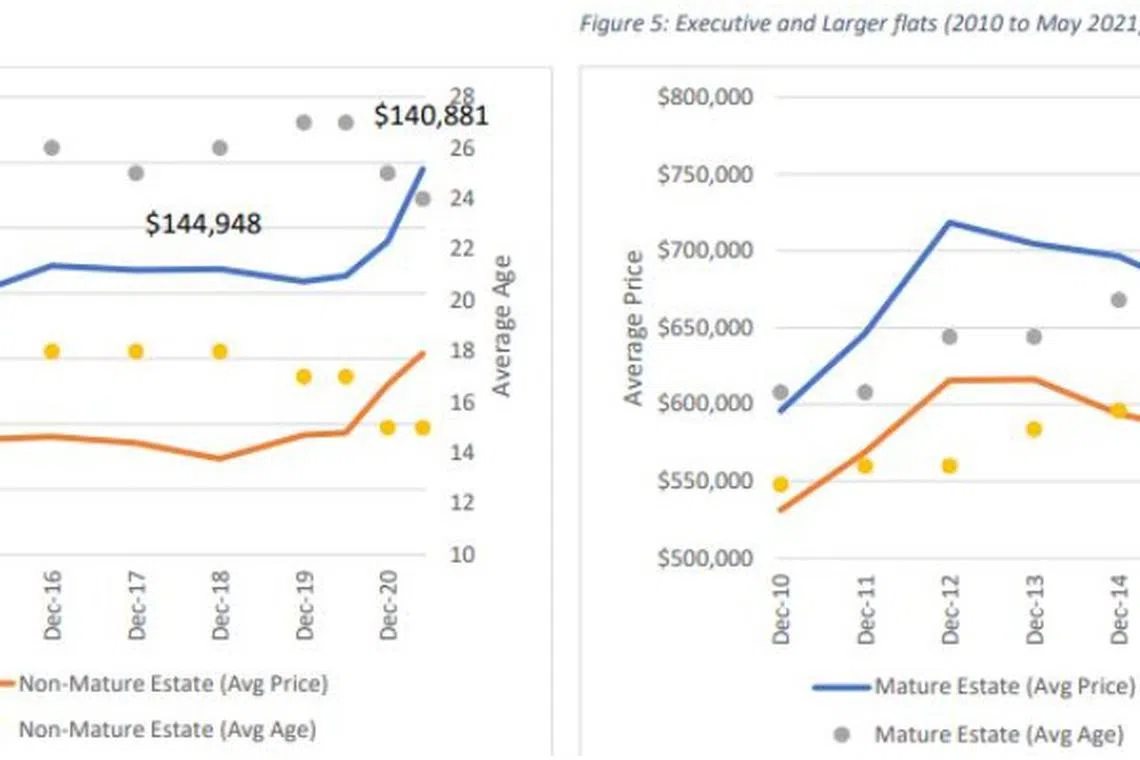

Executive and larger flats also saw the price premium thinning. Huttons attributed this to robust demand for bigger living spaces since the start of the Covid-19 pandemic, driven by work-from-home arrangements and movement restrictions. That helped prices rise more significantly in non-mature estates, even though the public housing authority had stopped building larger homes in recent years as family demographics changed.

Four-room flats (left) and executive apartments (right):

Meanwhile, the reverse was seen for two-room flats, with their average transacted prices in non-mature estates fetching a premium over those in mature estates. This came as the former's transactions involved much newer flats; on average, they were less than 10 years old, versus mature towns' flats which were more than 35 years old.

"It appears that age plays a more important role in the value of flats in recent years, rather than the location in a mature or non-mature estate," the Huttons analysts wrote.

"This is a valid concern, as no one likes the thought of their home depreciating to zero as the lease runs down," they said.

Some homebuyers may also be turning to newer estates as the prices of available HDB resale flats in mature estates have surged beyond their budgets, said ERA Singapore head of research and consultancy Nicholas Mak.

In addition, Huttons noted that as connectivity and amenities improve in non-mature estates, some of their resale flat prices have inched close to mature estates'.

For example, a five-room flat in non-mature Punggol fetched S$910,000, approaching the S$1.095 million price tag for a five-room flat in Clementi.

Punggol is one of several non-mature estates that underwent a "huge transformation" over the last 10 years; it now houses Punggol Waterway Park, Waterway Point mall and numerous schools, with the upcoming Punggol Digital District likely to make the estate even more attractive, Huttons said. The town is also well-planned with a "unique character", and some flats there do not have the typical cookie-cutter designs seen in certain mature estates, it added.

READ MORE:

- HDB resale prices climb for 11th straight month in May: SRX

- Higher prices, Covid-hit household income lower relative affordability of HDB resale flats in 2020

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.