Private housing supply from H2 2019 GLS confirmed sites cut by 15%: MND

THE government is reducing the supply of private residential units on its confirmed list for the second-half 2019 Government Land Sales (GLS) Programme, the Ministry of National Development (MND) said on Thursday morning.

Through the confirmed list, MND will release about 1,715 private residential units (including 480 executive condominium or EC units). This works out to be 15 per cent lower than the H1 2019 confirmed list of 2,025 private residential units (including 385 EC units).

MND said this was due to a large supply of around 44,000 private housing units in the pipeline, which consists of 39,000 unsold units from GLS and en-bloc sale sites with planning approval, and 5,000 units from sites pending planning approval.

There are also around 24,000 existing private housing units which are vacant, MND added.

In contrast, demand has "continued to fall" since the July 2018 property market cooling measures, MND said. Overall transaction volume also declined for the third straight quarter in the first quarter of 2019, while developers' demand for land has also moderated.

The H2 2019 GLS Programme will comprise five confirmed list sites and eight reserve list sites.

These sites can yield about 6,430 private residential units (including 480 EC units), 92,000 square metres (sq m) gross floor area (GFA) of commercial space and 1,100 hotel rooms.

The private housing supply works out to be 0.7 per cent lower than the 6,475 private residential units (including 910 EC units) in the confirmed and reserve lists of the current H1 slate.

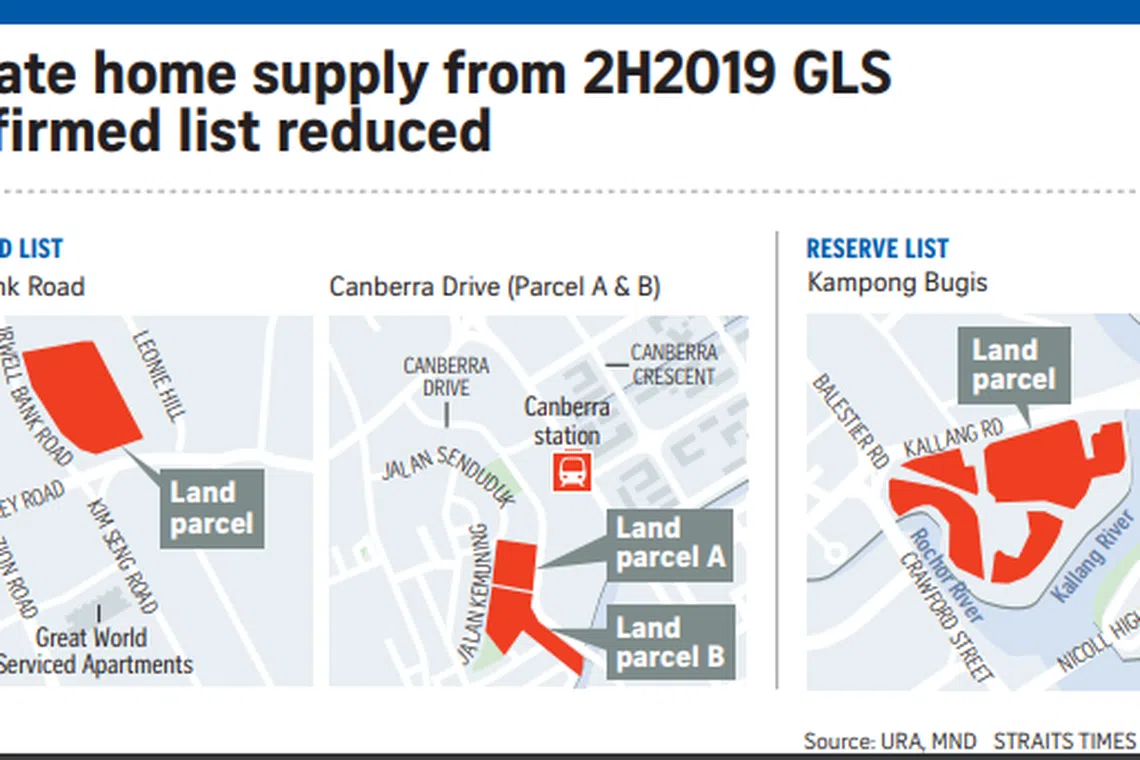

Residential sites under the confirmed list are located at Bartley Road/Jalan Bunga Rampai, Irwell Bank Road, two parcels at Canberra Drive, and Fernvale Lane which is an EC.

On MND's reserved list are four private residential sites (including one EC site), three white sites and one hotel site.

These yield about 4,715 private residential units (including 595 EC units and an estimated 1,000 units from the first phase of the Kampong Bugis site), 92,000 sq m GFA of commercial space and 1,100 hotel rooms.

For private housing supply, this works out to be 6 per cent higher than the H1 2019 slate of 4,450 private residential units (including 525 EC units). Commercial space yield for H2 is also 12 per cent higher than H1's slate of 82,000 sq m GFA.

The three white sites are located at Marina View, Woodlands Avenue 2 and Kampong Bugis. The white site at Woodlands Avenue 2 will be for a mixed-use development in order to sustain the development of Woodlands Regional Centre as a major commercial node outside the city, MND said.

The Marina View white site was carried over from the H1 2019 GLS Programme, while plans for the Kampong Bugis white site were first mentioned in a 2017 exhibition seeking feedback from the community.

The new hotel site at River Valley Road under the reserve list will be integrated with the Fort Canning MRT station.

Reserve-list sites are launched only upon successful application by a developer or when there is sufficient market interest in a site. Confirmed list sites, meanwhile, are launched according to schedule regardless of demand.

CBRE South-east Asia head of research Desmond Sim said the H2 2019 GLS programme reflects the state planners' prudence towards the market, with demand being calibrated with "unsurprisingly" more sites on the reserve list than the confirmed list.

"The reserve list will remain the best indicator of land appetite, while the confirmed list will ensure a steady source of residential land supply in the market," Mr Sim said.

He added that state planners appear to favour mixed-use sites with some zoning flexibility as it allows greater coverage across all zones and time span.

Leong Boon Hoe, List Sotheby's International Realty (List SIR) chief operating officer, said the reduction in the confirmed sites shows that the government is aware of the slowdown in the residential market.

Among the five residential sites offered, Mr Leong said the Irwell Bank Road site looks the most attractive with respect to its location attributes. List SIR also expects bidders of Irwell Bank Road to be more circumspect in their bids.

Copyright SPH Media. All rights reserved.