Singapore private home prices up 1.5% in Q2; rents rise 1.3%: URA

PRIVATE home prices in Singapore rose 1.5 per cent in the second quarter of this year after a 0.7 per cent decline in the previous quarter, lifted mainly by non-landed properties in the core central region (CCR) and the rest of the central region (RCR).

This is the first increase in Singapore's private residential price index since the property cooling measures were introduced in July last year, noted Christine Sun, head of research & consultancy at OrangeTee & Tie. "Higher launch prices of new homes may have contributed to the recent price increases. The higher launch prices are within expectation due to the higher land cost and many projects commanding a price premium due to their excellent location, freehold status, and distinctive designs."

According to data released by the Urban Redevelopment Authority (URA) on Friday, prices of landed properties dipped by 0.1 per cent in the second quarter, compared to a 1.1 per cent increase in the previous quarter.

However, prices of non-landed properties in the CCR were up 2.3 per cent in Q2, versus a 3 per cent decline in the previous quarter. Prices of non-landed homes in the RCR rose by 3.5 per cent, in comparison to a 0.7 per cent decrease in the previous quarter. Meanwhile, prices of non-landed properties in outside the central region (OCR) edged up 0.4 per cent, versus a 0.2 per cent increase in the previous quarter.

Catherine He, associate director of research at CBRE, said: "A year after the latest cooling measures were implemented, prices displayed resilience to register a healthy rebound this quarter. This happened after two consecutive quarters of decline, bringing the year-to-date change for 2019 to 0.8 per cent."

She attributed the increase in the RCR segment to the certain successful launches such as Amber Park, The Tre Ver and Parc Esta.

Christine Li, head of research (Singapore and Southeast Asia), at Cushman & Wakefield, highlighted that interest from overseas buyers - particularly in the high-end segment - appears to have held up, even post-cooling measures.

"In addition, the recent turmoil in Hong Kong and the United Kingdom due to the Hong Kong protests and Brexit could bode well for the residential market here as high-net-worth individuals start to eye other wealth centres such as Singapore to preserve their wealth," she said.

"Geopolitical and trade tensions in the region have led to increased foreigner interest in Singapore properties," she added, pointing to the increase in foreigners buying non-landed properties above S$4 million, even after the cooling measures.

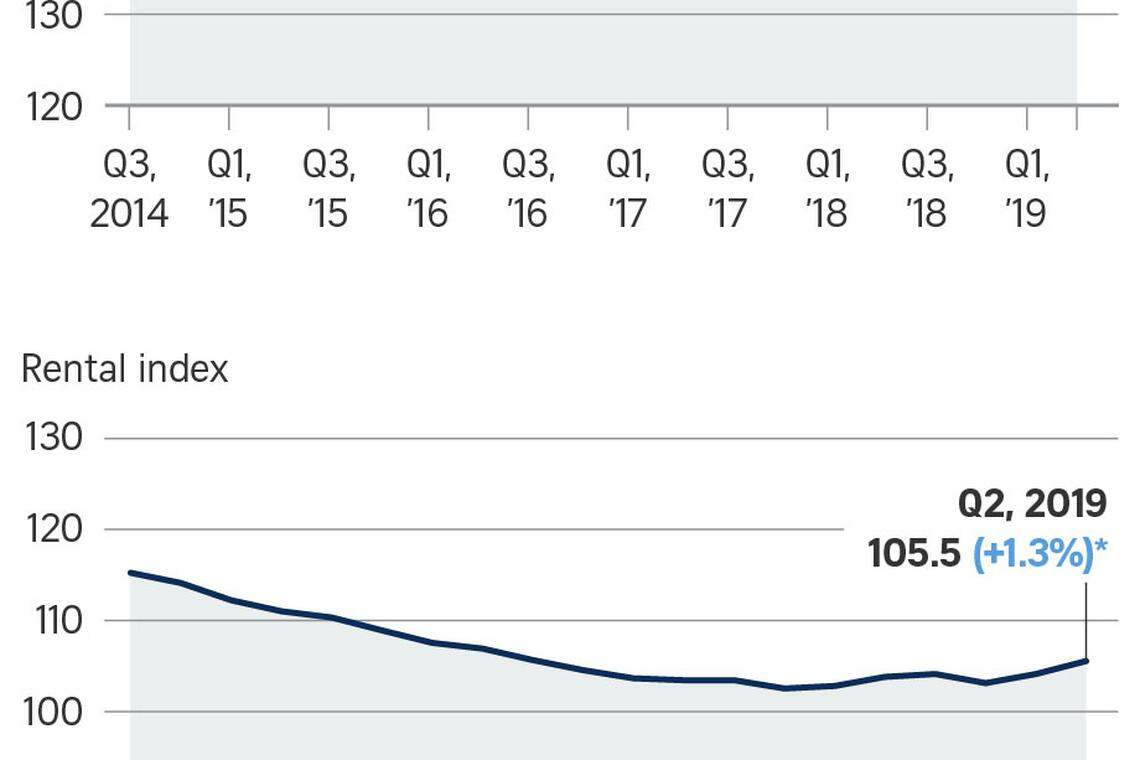

URA's data also showed that rents of private homes increased 1.3 per cent in the second quarter, up from 1 per cent in the previous quarter. The vacancy rate edged up 0.1 percentage point to 6.4 per cent.

During the second quarter, developers launched 2,502 uncompleted private homes (excluding executive condominiums or ECs) for sale, less than the 2,989 units launched in Q1. In the quarter under review, they sold 2,350 homes, more than the 1,838 units sold in the previous quarter. No EC units were launched for sale in Q2, but developers sold 10 EC units from previous launches over the period.

There were 2,371 resale transactions in Q2, which made up nearly half of all sale transactions. In comparison, 1,858 resale units were transacted in the previous quarter.

As at the end of the second quarter, there was a total supply of 50,674 uncompleted private homes (excluding ECs) in the pipeline with planning approvals. Of this, 33,673 units remained unsold as at the end of the second quarter. The supply of EC units in the pipeline stood at 3,022, of which 1,865 EC units remained unsold.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Property

Homebuyers shun new real estate in Vancouver, hurting builders

US pending home sales jump in March to hit highest in the year

Blackstone strikes US$1.6 billion student housing deal with KKR

European real estate deals slump to lowest level in 13 years

Singapore Q1 industrial rents rise further as occupancy dips and prices fall: JTC

Condo resale volumes rebound in March; prices inch up 0.4%: SRX, 99.co