Why environmentally friendly buildings can be investment worthy

Global head of real estate and co-chief executive officer at Pictet Alternative Advisors shares the opportunities that lie in sustainable real estate

Investors have now realised that sustainable investing is not just about doing what is good for the planet and humanity - it can be good for investment performance too. This is particularly true for real estate investment.

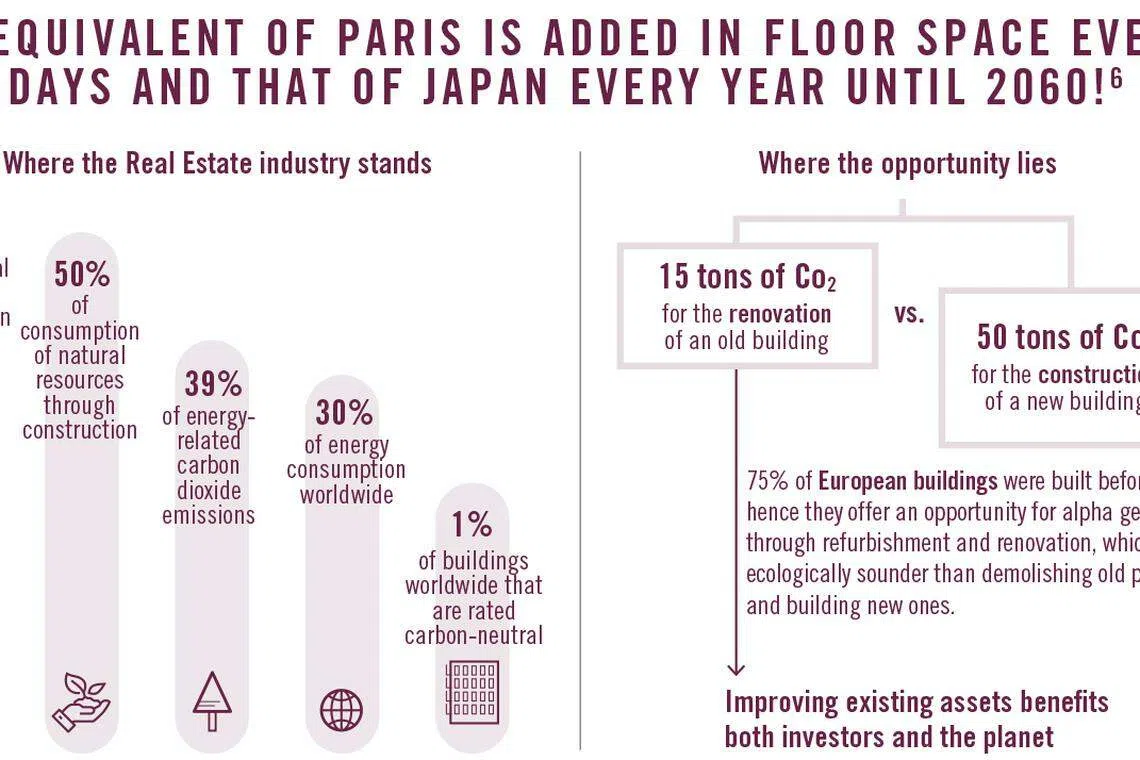

Buildings account for 30 per cent of the global energy use through their construction and operation. They are also responsible for nearly 40 per cent of energy-related carbon dioxide emissions1. The ecological footprint becomes even bigger when you consider how much water and raw materials they use up.

Yet, while the past year gave us a glimpse of life without daily commutes to shared office spaces and flights, it remains difficult to imagine life without the buildings that provide us with daily shelter. Indeed, we are now ever more focused on the spaces that we live and work in, as extreme weather events increase, and pandemic-imposed isolation leaves us hungry for face-to-face interaction with colleagues and loved ones. Indeed, rather than doing away with these buildings, we must find ways of making them more efficient and wellness enhancing. The pandemic has accelerated certain existing underlying trends, and there will undoubtedly be many buildings requiring updates, and change of use for the available spaces. These refurbishments will need to also focus on improving the energy and wellness footprints of these buildings.

Striving for intensity reduction

The United Nations estimates that, in order to limit the rise in global temperatures to less than 2 deg C by 2030, the property industry must reduce the average energy intensity of buildings by at least 30 per cent. As is the case with most sectors, innovation and technology can help.

Things like sensors that optimise energy consumption through smart management of heating, ventilation and other building operation processes are already in use in some commercial buildings. New materials, meanwhile, can make construction and development more sustainable as well as reduce building waste and noise pollution. So too can streamlined processes such as modular construction, where parts of the building are constructed in a controlled factory environment to minimise material waste.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Better for all

Environmentally friendly buildings make for better real estate investments, too. Research shows that buildings with stronger environmental credentials generate higher rents, lower rates of obsolescence, improved tenant satisfaction and lower voids. With the environment becoming a priority for those who construct, manage and live and work in buildings, the performance gap between green buildings and their less efficient peers should widen further over the coming years.

Crucially, progress needs to focus on existing buildings as over 40 per cent of total carbon emissions for a building's life cycle happen when it is built. This, coupled with the fact that 70 per cent of all buildings in the world are more than 20 years old4 presents a tremendous opportunity to refurbish, enhance, and at times repurpose older buildings. As investors, we believe that investing in making buildings sustainable is not only the responsible thing to do for our planet, but also a way to add value for investors.

Learn more about how you can grow your wealth with sustainable investments.

Footnotes: 1 Sources: UN environment Carbon status report 2017. 2 Source : Data for 2017-18. Cushman & Wakefield, Global Investment Atlas 2019-20 3 Source : Median values, Sustainability Review/ MDPI: A Review of the Impact of Green Building Certification on the Cash Flows and Values of Commercial Properties, N. Leskinen et al, 2020 4 Source : Propmodo, 2019

Disclaimers: This advertisement has been issued by Bank Pictet & Cie (Asia) Ltd ("BPCAL") in Singapore which is a wholesale bank regulated by the Monetary Authority of Singapore under the Banking Act Cap. 50 of Singapore, an exempt financial adviser under the Financial Advisers Act Cap. 110 of Singapore and an exempt capital markets license holder under the Securities and Futures Act, Cap. 289 of Singapore.

The value of an investment can go down as well as up, and investors may not get back the full amount invested. Nothing in this document shall constitute financial, investment or legal advice. The information presented in this document are provided for reference only and are not to be used or considered as an offer, a recommendation, an invitation to offer or solicitation to buy, sell or subscribe for any financial instruments. This document is intended for general circulation and it is not directed at any particular person. This document does not have regard to the specific investment objectives, financial situation and/or the particular needs of any recipient of this document.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.