Close to 60% of Singapore’s industries record ‘above average’ growth by Q3 2024; external environment conducive: MAS

But while near-term prospects are clear, 2025’s outlook is more uncertain

SINGAPORE’S economy has gained a firmer footing, with a majority of the economy at or exceeding pre-pandemic growth norms, the Monetary Authority of Singapore (MAS) said on Monday (Oct 28).

Gross domestic product out-turns have improved discernibly, progressing from “below average” growth in 2023 (1.1 per cent), to “around average” in H1 2024 (3 per cent) and “above average” in Q3 2024 (4.1 per cent), the central bank said in its half-yearly macroeconomic review.

Average, in this case, refers to the pre-Covid GDP average growth from 2015 to 2019.

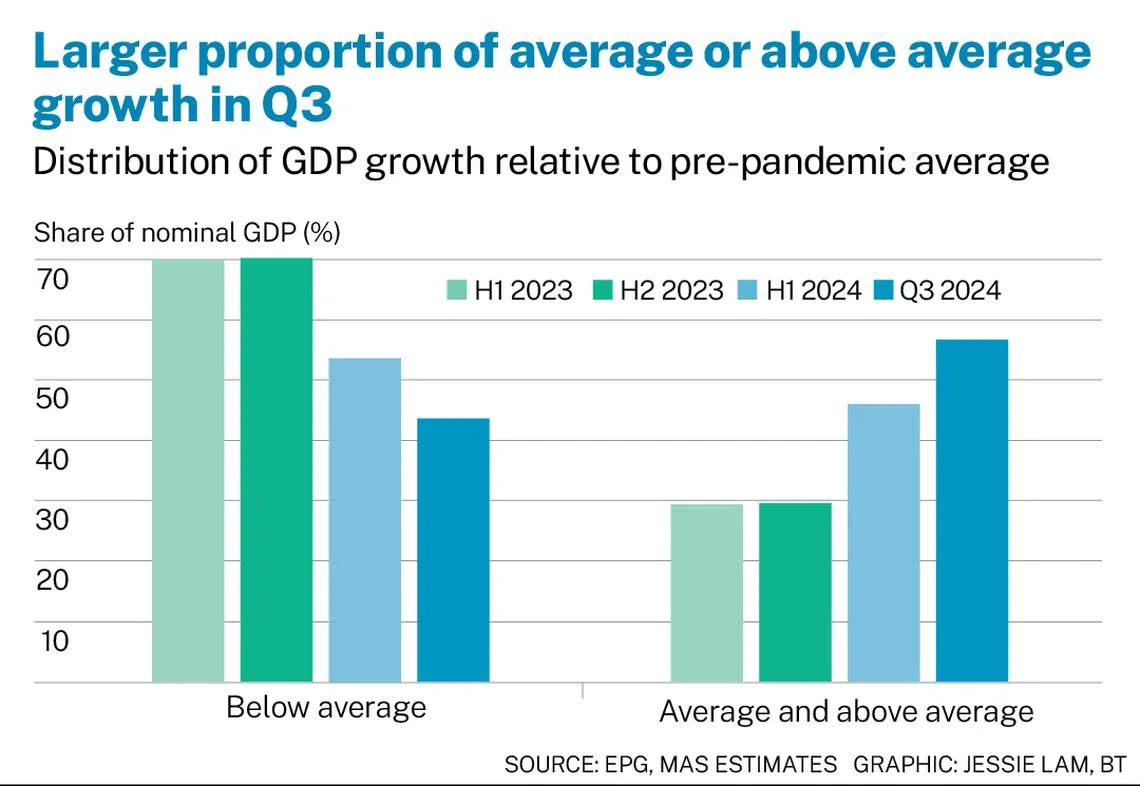

The share of industries (based on nominal GDP) recording below average growth also declined, from around 70 per cent in 2023 (*see amendment note) to around 50 per cent in H1 2024, and about 40 per cent in Q3 2024. Thus, close to 60 per cent of the industries recorded average or above average growth by Q3.

MAS expects the economy to expand at its potential rate in 2024 and 2025. It continues to project Singapore’s 2024 full-year GDP growth to come in around the upper end of the 2 to 3 per cent forecast range.

It should be “broadly similar” next year, MAS said on Monday, adding: “GDP growth in both years is expected to be underpinned by the trade-related and modern services clusters.”

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The slightly negative output gap – where the economy’s output is less than what it can produce – is likely to close “before the end of this year” and “turn only slightly positive on average in 2024”, the central bank added.

This is slightly stronger than in October’s monetary policy review, where MAS had projected that the negative output gap would close “in H2 2024”, and said that the economy should expand at “close to” its potential rate in 2025.

Singapore’s potential growth – the rate of growth it can sustain in the medium term without excess inflation – has not been stated explicitly by MAS, but is generally seen as being 2 to 3 per cent. A negative output gap means that there has been spare capacity in the economy due to weak demand.

MAS did not explicitly provide its output gap forecast, but based on its published charts, Bank of America economists Ang Kai Wei and Rahul Bajoria inferred that the output gap will close at zero per cent in 2024, and reach 0.2 to 0.3 per cent of GDP in 2025.

The duo noted that September’s industrial production data was “far better than implied” in advanced estimates for GDP, with a further surge in volatile pharmaceuticals offsetting the pull-back in electronics. Overall, Q3 GDP is “mechanically higher” at 4.8 per cent year on year, they said.

For Q4, they expect GDP growth to come in at 3.3 per cent on a yearly basis, and -1 per cent on a quarterly, seasonally adjusted basis, “assuming some technical pull-back in industrial production”.

They raised their full-year 2024 GDP forecast to 3.3 per cent, from 2.6 per cent previously.

Global growth

The MAS’ outlook comes against the backdrop of a broadly resilient global economy. For both this year and 2025, global GDP growth is forecast close to its trend at 3.2 per cent, it said.

Growth in most of Singapore’s key trading partners remained resilient in Q2, underpinned by robust exports and domestic demand. Expansion was more broad-based in H1, compared with H2 2023’s US-led expansion, the central bank said.

While China experienced a sharp deceleration in Q2, from a strong showing in Q1, activity in most Asean countries was relatively resilient, buoyed by the ongoing tech cycle recovery, as well as firmer domestic demand.

In the advanced economies, particularly the US, domestic demand will continue to drive growth, it said, with improving real wage growth and normalising inflation.

The easing of monetary policy in many such economies in recent months will help to support economic expansion over 2025, Singapore’s central bank said.

A growth uptrend is also expected for Asean economies, on the back of the broadening of the tech cycle upturn beyond artificial intelligence (AI); higher household spending and increased investment activity.

The easing of monetary policy by the US has also alleviated pressures on regional currencies, MAS pointed out, allowing them to shift focus from safeguarding external stability to supporting economic activity through lower policy rates, if needed.

Meanwhile, global disinflation has progressed further in recent months, with services inflation finally easing meaningfully alongside a moderation in labour cost pressures.

“The last mile of disinflation is expected to remain on track, as the global economy comes into balance,” MAS said, adding that post-pandemic supply-demand imbalances have been broadly resolved in key economies.

It also expects the generally conducive external environment to support the Singapore economy’s expansion in 2025.

Citing International Monetary Fund forecasts, MAS said most of Singapore’s major trading partners are expected to post generally stable growth in 2025, in line with that of 2024.

“Although growth in the US and China is expected to moderate in 2025, improved prospects in the eurozone and several Asean economies should provide some countervailing support,” it added.

Steady in Singapore

In Q3 this year, economic recovery became more entrenched, following H1’s lacklustre performance. The firmer footing was underpinned by three factors: a broadening manufacturing sector recovery; increased trading activity in the financial sector; and the return of Chinese tourists.

“Recovery in the global goods trade and the tech cycle should continue apace next year,” MAS said, noting a broadening of demand beyond AI-related infrastructure to consumer cycles amid the ongoing replacement cycle.

It expects growth to pick up further from end-2024, as manufacturers ramp up shipments of AI-enabled PCs and smartphones. Increased AI adoption should also provide a tailwind for the information and communications sector as domestic firms ramp up their digitalisation plans, it added.

As for the financial sector, growth will likely be supported as global policy easing is expected to gather pace in 2025.

Still, the central bank warned: “While near-term prospects are firm, the outlook for 2025 is less certain.”

The upcoming US presidential elections, an escalation in geopolitical tensions, or a sharper growth slowdown in China could weigh on Singapore’s economic prospects, it said. Additionally, the durability of the AI-led global tech cycle recovery remains uncertain and could be sensitive to aggregate demand conditions.

*Amendment note: An earlier version of this story said the share of industries recording below average growth was 65 per cent in 2023, and reflected this in the graph. This data is outdated, and should in fact be around 70 per cent. The story has been revised to reflect this.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.