Quick takes on Trump’s new tariffs: what they mean for markets, the dollar, and inflation

The Trump administration has started sending letters out to trading partners on Monday but indicated that negotiations would continue

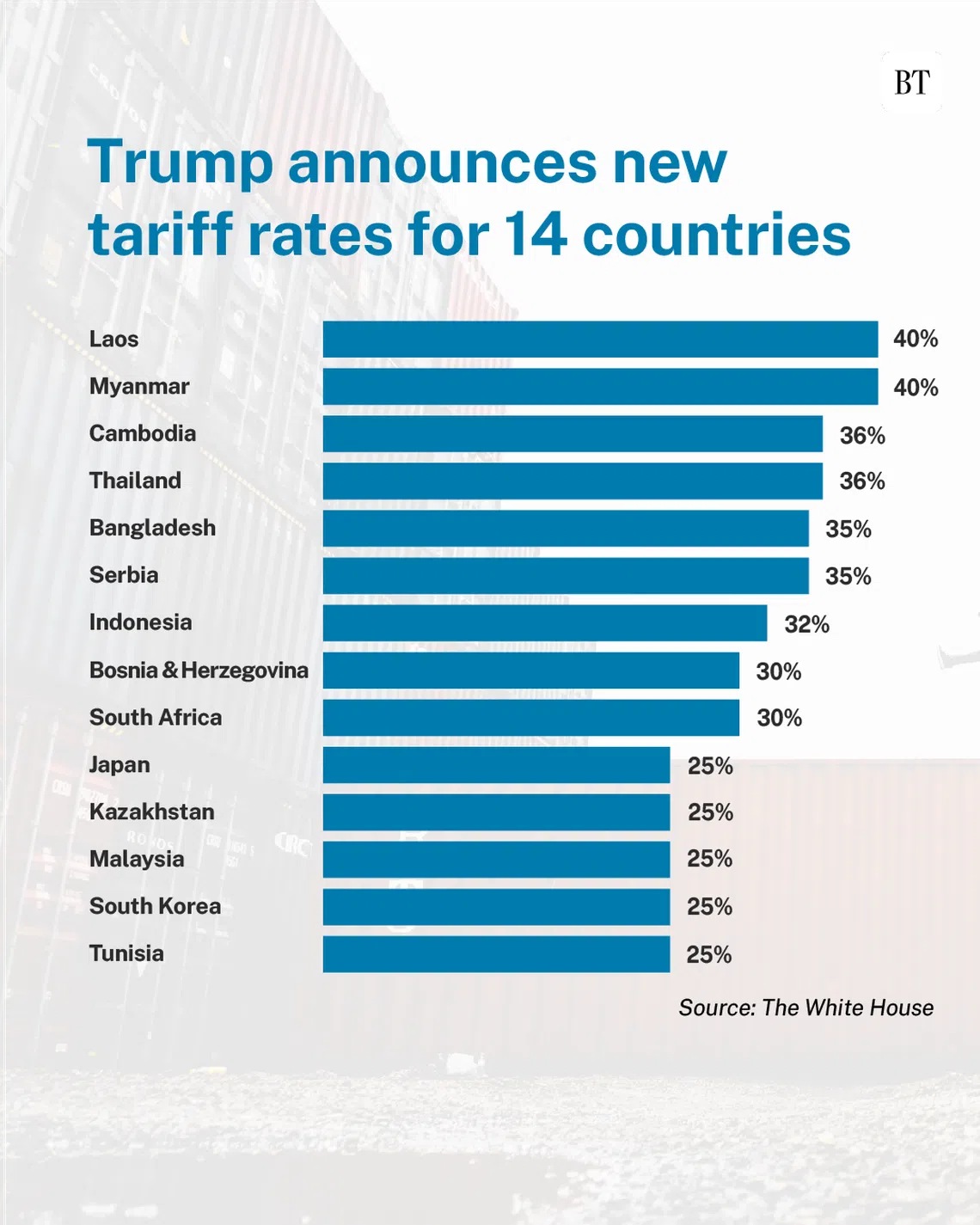

[SINGAPORE] US President Donald Trump on Monday (Jul 7) announced tariff rates for 14 countries that will take effect on Aug 1. Trump’s latest trade war salvos come ahead of the 90-day pause that was to end on July 9.

In April, Trump had announced ‘liberation day’ tariffs for the US’ trading partners but lowered them to a flat 10 per cent for the duration of the pause.

On Monday, he started sending letters out to trading partners but indicated he was going to continue negotiations. So far, only deals with the UK and Vietnam have been reached.

Singapore is among the countries that have not received letters yet.

This is a breakdown of the tariffs Trump announced.

How will markets and other players be affected? Here’s what analysts said on Tuesday:

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Vasu Menon, managing director, Investment Strategy, OCBC

“The expectations that Trump is once again engaged in a negotiating tactic rather than making serious tariff threats, offers hope to investors. There was no big fallout for Asian markets when trading resumed on Jul 8, a day after the White House sent letters to leaders of several countries announcing blanket tariffs ranging from 25 per cent to 40 per cent starting Aug 1.”

“Eventually, the possibility that the tariffs imposed will be nowhere as high as the draconian figures suggested on Apr 2, may bring relief to markets.”

Eugene Leow, senior rates strategist, DBS

“US Treasuries sold off alongside stocks as news of the new reciprocal tariffs hit. Market participants were probably too sanguine over the past couple of weeks. News that Vietnam managed to secure a 20 per cent tariff rate lulled the market into complacency and expectations built that any tariffs would be around that level with allies getting a lower than 20 per cent rate. Unfortunately, this optimism turned out to be false.”

“Japan, South Korea and Malaysia got hit with a 25 per cent rate. The silver lining is that these tariffs are only going to be effective Aug 1, implying that there are still three weeks for negotiations. Taken together, overly buoyant sentiment has been pared down, but the shock factor is nowhere near as close to what was seen on Liberation Day.”

Chua Han Teng, economist, DBS

“US tariffs on imported Vietnamese goods will be at 20 per cent, which (is) much lower than the punishing 46 per cent announced on Liberation Day. New duties for key regional competitors (Malaysia: 25 per cent, Indonesia: 32 per cent, Bangladesh: 35 per cent, Cambodia and Thailand: 36 per cent) were also announced on Jul 7. However, uncertainty remains regarding the interpretation of transshipment goods that will face 40 per cent US tariffs.”

Maybank

“Notably, China, India, Singapore and Taiwan were some Asian (markets) not served letters yet. Letters also mentioned that these tariffs would be separate from sectoral tariffs. Trump said that the letters were “more or less” final offers and that the Aug 1 deadline was “firm but not a 100 per cent firm”.”

“Markets dislike uncertainty and these measures (and Trump’s words) certainly injected a fresh dose of worry which showed up as US equities and US Treasuries (10Y: +4 basis points) sold off. Currencies largely remained within range, although the euro found some support after the tariff letters.”

“We think that there could be further volatility to come, although we also retain our conviction on our longer-term weaker USD view. Gradually building up a short USD position on rallies in the greenback may be the most sensible and prudent way to express such a view as volatility rises.”

Arif Husain, head of global fixed income and CIO at T Rowe Price

“Crosscurrents from tariffs (upward inflation pressure), US dollar weakness (higher inflation), and possible slowing demand (lower inflation) are buffeting the inflation outlook.”

“But I expect the tariff effects to dominate and push inflation higher in the second half of the year despite a moderation in services inflation.”

Ipek Ozkardeskaya, Senior Analyst, Swissquote Bank

“We’re back to square one in terms of the US tariff disaster, as the US has started sending letters to countries revealing their tariff rates – and the rates don’t look much different from those announced on the so-called Liberation Day.”

“The levies on some Asian nations are clearly pointing the finger at China – due to transhipments. Looking at the first wave of numbers, only one country appears to have pulled itself out of the tariff turmoil with minimal damage: the UK, with a tariff rate of 10 per cent.”

“The deadline extension is not good news, per se. It simply adds to the uncertainty. It’s yet another sign that ... tariffs set in the coming days and weeks ... will be constantly changed – raised, lowered – and used as a go-to threat in every situation.

“It’s probably time to start pricing back in the trade risks that were priced out far too quickly ... Trump isn’t chickening out, and inflation is knocking on the door. One reason why the tariff-led price pressures were initially contained is that many companies chose to swallow the costs while waiting to see if the tariffs were just a negotiation tactic. But if the tariffs are here to stay – and are constantly changing – businesses will have no choice but to adopt prices.”

“Prices will rise, earnings will be pressured, the Fed will wait as US growth slows and inflation risks loom – and global investors may increasingly cut exposure to US assets.”

-Please check back for more analyst takes.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.