Singapore’s 2025 core inflation averages 0.7%, down from 2.8% in 2024

December’s core and headline inflation stayed unchanged at 1.2%

[SINGAPORE] The Republic’s full-year core inflation for 2025 came in at 0.7 per cent, slightly above the official forecast, but far lower than the 2.8 per cent recorded in 2024, data from the Department of Statistics showed on Friday (Jan 23).

Headline inflation for the full year stood at 0.9 per cent, compared with 2.4 per cent in 2024.

The Monetary Authority of Singapore (MAS) and the Ministry of Trade and Industry (MTI) had previously expected core inflation for 2025 to come in at 0.5 per cent, and headline inflation at 0.5 to 1 per cent.

The full-year figures come alongside the release of December’s numbers, which were in line with the median forecast by private-sector economists polled by Bloomberg.

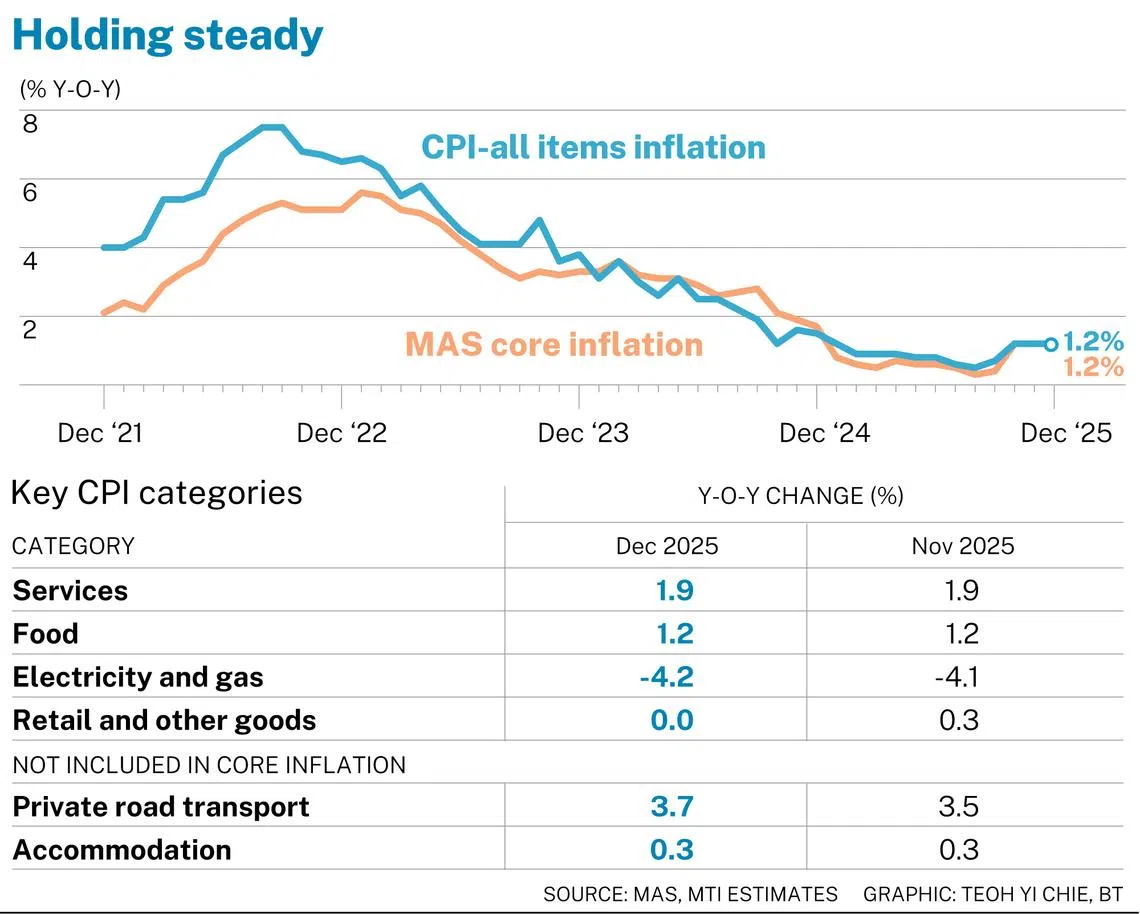

Last month’s core inflation, which excludes accommodation and private transport, held steady at 1.2 per cent as food and services inflation remained unchanged, said MAS and MTI.

Headline inflation similarly kept at 1.2 per cent due to core and accommodation inflation remaining unchanged, the authorities said.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

On a month-on-month basis, the core prices rose by 0.4 per cent in December, while the all-items consumer price index (CPI) prices rose by 0.3 per cent.

In a joint statement on Friday, MAS and MTI noted that Singapore’s imported costs should continue to decline over the course of this year, though at a slower pace.

“While global crude oil prices are projected to fall this year, regional inflation should pick up modestly after their weak outturns last year,” they said.

On the domestic front, unit labour cost growth is expected to increase as productivity growth normalises. Meanwhile, private consumption demand “is likely to remain steady”, they added.

Accounting for these factors, MAS and MTI project core and headline inflation in 2026 to rise from their low levels last year, though they noted the inflation outlook “remains subject to uncertainties”.

The official forecast ranges for 2026 will be updated in the upcoming monetary policy statement, which will be released on Jan 29.

The authorities had previously maintained their 2026 forecasts for core and headline inflation in the range of 0.5 to 1.5 per cent.

Key CPI categories

Accommodation inflation stayed unchanged at 0.3 per cent in December, as housing rents increased at a similar rate as in November.

Food inflation was also unchanged at 1.2 per cent, as the prices of food services increased at a similar pace.

Meanwhile, services inflation held steady at 1.9 per cent, as a smaller fall in airfares was offset by a slower pace of increase in the cost of healthcare services and a fall in holiday expenses.

Private transport inflation rose to 3.7 per cent, from 3.5 per cent in November, following a smaller decline in petrol prices.

Electricity and gas prices fell further by 4.2 per cent, compared with November’s 4.1 per cent drop, due to a larger decline in electricity prices.

Prices of retail and other goods were unchanged, as higher prices for alcoholic beverages and tobacco were offset by falling prices for personal effects and furniture.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.