Singapore’s core inflation eases to 0.5% in July, below forecasts

Headline inflation also slows to 0.6%, down from 0.8% in June

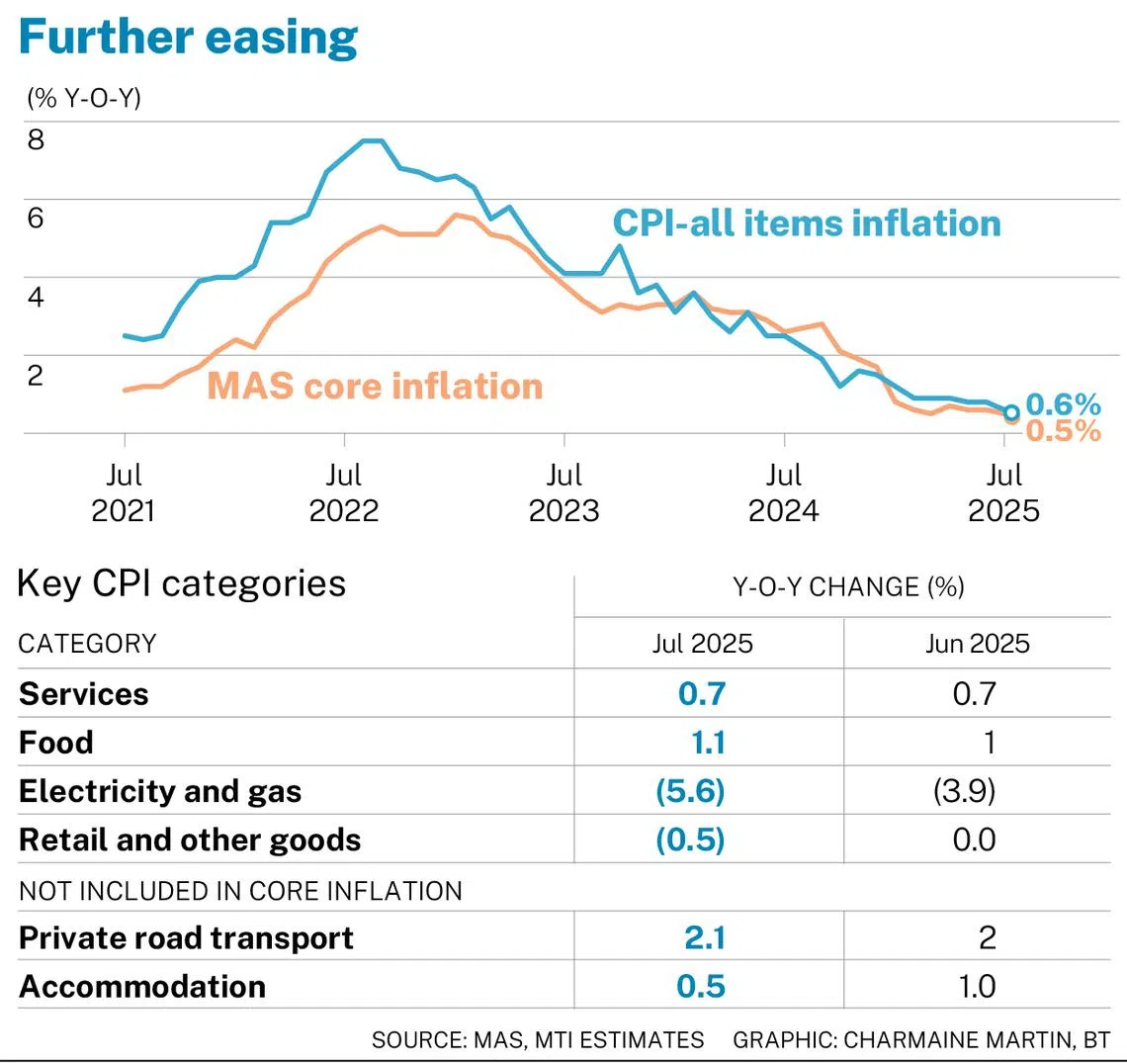

[SINGAPORE] Core and headline inflation slowed in July, contrary to economists’ expectations that both would hold steady at their June rates.

The Monetary Authority of Singapore (MAS) and the Ministry of Trade and Industry (MTI) maintained their forecasts but noted that the outlook remains uncertain.

Despite the surprise, private-sector economists largely kept their projections, with most expecting MAS to hold policy steady at its next decision in October.

Core inflation, which excludes accommodation and private transport, eased marginally to 0.5 per cent in July. This was driven by falling prices of retail and other goods, as well as electricity and gas, said the Singapore Department of Statistics on Monday (Aug 25).

Private-sector economists had expected it to hold steady at June’s 0.6 per cent rate, a Bloomberg poll indicated.

Headline inflation also slowed to 0.6 per cent, down from 0.8 per cent in June, where economists had forecast it would stay.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

On a month-on-month basis, core inflation stayed at minus 0.1 per cent, while all-items inflation fell to minus 0.4 per cent. (*see amendment note)

MTI and MAS kept their 2025 full-year core forecast range at 0.5 to 1.5 per cent for both core and headline inflation, but added: “The inflation outlook in the quarters ahead is subject to both upside and downside risks.”

Inflation could come in higher than expected if geopolitical shocks cause an abrupt rise in imported energy and shipping costs, they said.

“Conversely, should global and domestic growth be more hesitant and weaker than anticipated, core inflation could stay low for longer.”

Private-sector economists generally maintained their full-year forecasts for both core and headline inflation.

For core inflation, projections ranged from 0.5 per cent by Maybank to 0.9 per cent by RHB. For headline inflation, estimates ranged from 0.8 per cent by Maybank to 1.2 per cent by RHB.

UOB economists Alvin Liew and Jester Koh kept their forecasts at 0.6 per cent for core inflation and 0.9 per cent for headline inflation, but flagged the risk of undershooting for the latter.

Holding steady

In its Jul 30 decision, MAS had kept policy settings unchanged, after two consecutive easings in January and April.

Economists expect MAS to hold policy steady in October, though some see a chance of further easing.

Maybank economists Chua Hak Bin and Brian Lee expect MAS policy to be unchanged for the rest of the year, seeing “no urgency” to ease further.

RHB’s base case is also for MAS to maintain its stance in October. But group chief economist Barnabas Gan does not rule out the possibility that the authority might flatten the slope of the Singapore dollar nominal exchange (S$NEER) rate or widen its width.

DBS economist Chua Han Teng said that significant external uncertainties, including geopolitical and tariff tensions, warrant a cautious approach from the authorities.

“That was likely why MAS kept its three monetary policy parameters unchanged during its July decision, preserving its ammunition to respond to any unexpected future negative shocks,” he said.

But Barclays economists Brian Tan and Liu Hongying bucked the trend, lowering their 2025 core inflation projection to 0.6 per cent, from 0.7 per cent previously.

They also kept their base case for MAS to flatten the slope of the S$NEER in October, though they noted the possibility of no further easing, or even policy normalisation in 2026.

MTI and MAS said that in the near term, Singapore’s imported inflation “should remain moderate” as global oil prices continue to ease and food commodity price increases are expected to stay contained.

Ongoing trade conflicts could be inflationary for some countries, but the impact on Singapore’s import prices is likely to be offset by the disinflationary effect of weaker demand, they added.

At home, unit labour costs should moderate due to slower nominal wage growth and rising labour productivity. Higher government subsidies for essential services will also continue to dampen services inflation.

Key CPI categories

In July, most CPI categories experienced lower inflation or outright declines in prices.

The prices of retail and other goods fell by 0.5 per cent, after having held steady in June, due to a drop in the prices of clothing, footwear and household appliances.

Electricity and gas prices fell by 5.6 per cent, deepening from a fall of 3.9 per cent in June, due to a larger decline in electricity prices.

Accommodation inflation eased to 0.5 per cent, from 1 per cent in June, as a result of smaller increases in housing rents and maintenance and repair costs.

Services inflation was unchanged at 0.7 per cent, as the fall in the cost of social services and steeper decline in outpatient care services prices were offset by a smaller decrease in holiday expenses.

But inflation rose marginally for two categories. Food inflation edged up to 1.1 per cent, from 1 per cent before, as the prices of food services and non-cooked food rose at a quicker pace.

Private transport inflation ticked up to 2.1 per cent, from 2 per cent, due to a steeper rise in car prices.

*Amendment note: The article previously incorrectly said that on a month-on-month basis, core CPI stayed at minus 0.1 per cent and the all-items CPI fell to minus 0.4 per cent. CPI figures are index values; changes to the CPI are expressed as inflation.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.