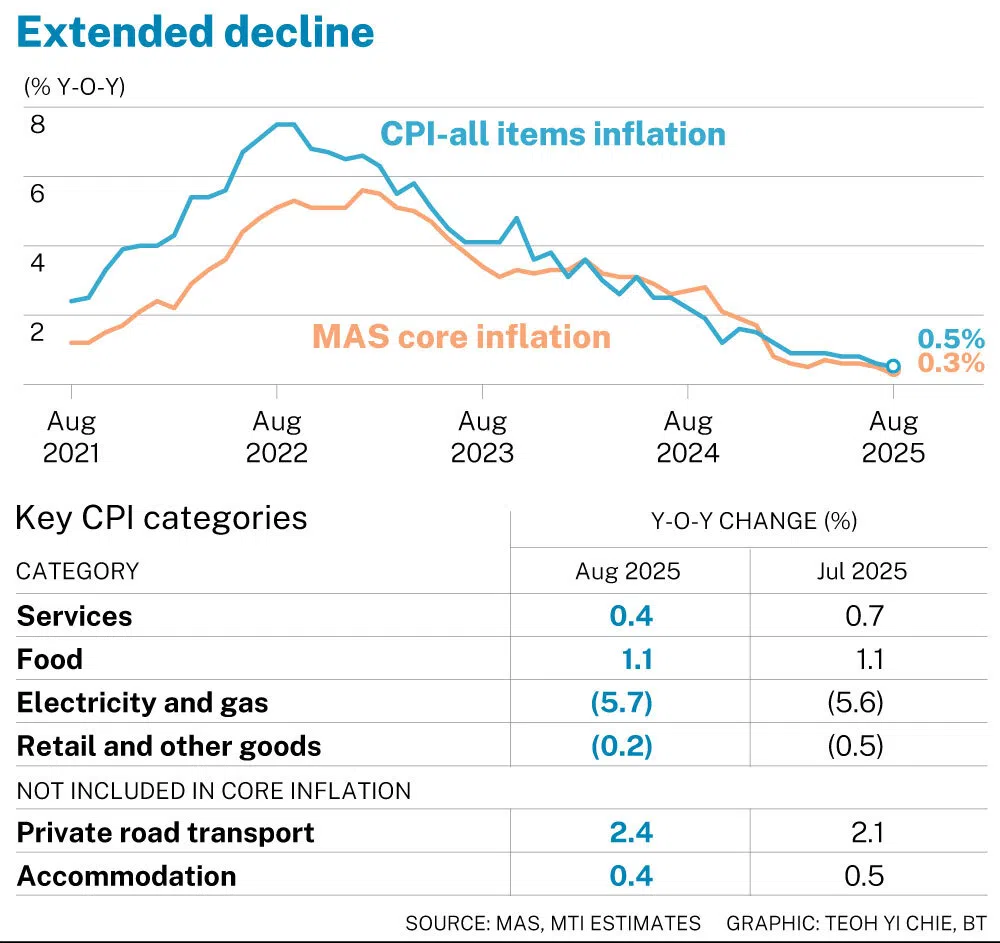

Singapore’s core inflation slows to 0.3% in August, below expectations

Headline inflation also slows to 0.5%, down from 0.6% in July

[SINGAPORE] Singapore’s core and headline inflation eased further in August, contrary to economists’ expectations that both would hold steady at their July rates – though watchers noted that this was due mainly to a sharp fall in prices of travel-related services.

The Monetary Authority of Singapore (MAS) and the Ministry of Trade and Industry (MTI) maintained their forecasts, though they noted that the outlook remains uncertain.

Their joint outlook statement on Tuesday (Sep 23) “was a near carbon copy” of the previous month’s, noted UOB associate economist Jester Koh.

Core inflation, which excludes accommodation and private transport, eased to 0.3 per cent in August, driven by a moderation in services inflation.

Private-sector economists had expected it to hold steady at July’s 0.5 per cent rate, a Bloomberg poll indicated.

Headline inflation slowed to 0.5 per cent, down from 0.6 per cent in July, where economists had forecast it would stay.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

On a month-on-month basis, the core consumer price index (CPI) rose 0.1 per cent, while the all-items CPI rose 0.5 per cent.

MTI and MAS kept their 2025 full-year forecast range at 0.5 to 1.5 per cent for both core and headline inflation, but flagged both upside and downside risks.

Geopolitical shocks could lift imported energy and shipping costs abruptly. But if global and domestic growth is weaker than anticipated, core inflation could stay low for longer, they said.

However, Maybank economists Brian Lee and Chua Hak Bin expect that in MAS’ October policy review, the central bank will suggest that core and headline inflation may come in towards the lower bound of the official range.

Private-sector economists mostly revised their forecasts down slightly, but kept these within the official range.

For core inflation, projections ranged from 0.5 per cent by Barclays, UOB and Maybank to 0.6 per cent by OCBC. For headline inflation, estimates ranged from 0.8 per cent by Barclays, Maybank and OCBC to 0.9 per cent by UOB.

Travel costs drive dip

Economists noted that August’s lower inflation was driven by steeper declines in travel-related services. Modest wage growth, subsidies and a strong Singapore dollar also kept broader demand pressures in check.

The travel component alone accounted for nearly the entire 0.2 percentage point drop in core inflation, with airfares and holiday expenses falling much more sharply than in July, highlighted Barclays economist Brian Tan.

Apart from the fall in travel prices, OCBC chief economist Selena Ling said a softer labour market and global headwinds are weighing on business confidence and limiting firms’ ability to raise prices.

“There is likely another factor, which is that US tariffs may be contributing to a rerouting of Chinese exports away from the US and an influx into the rest of the world including Singapore, so the increased competition drives prices lower,” she added.

DBS economist Chua Han Teng pointed to restrained wage growth, government subsidies and a strong Singapore dollar as factors keeping overall price pressures contained.

Soft global commodity prices have further subdued inflation, he added.

The Maybank economists expect MAS to maintain its current modest Singapore dollar nominal effective exchange rate (S$NEER) appreciation stance at the October review.

But UOB’s Koh sees the decision as a “close call”. He expects that MAS could ease policy either in October or early 2026, by flattening the slope of the S$NEER band.

Key CPI categories

In August, most CPI categories experienced lower inflation or outright declines in prices.

Electricity and gas prices fell by 5.7 per cent, deepening the 5.6 per cent fall in July, due to a larger decline in electricity prices.

Retail and other goods prices slipped 0.2 per cent in August, easing from July’s 0.5 per cent decline, as higher clothing and footwear prices offset a smaller drop in telecommunications equipment costs.

Accommodation inflation eased to 0.4 per cent, from 0.5 per cent in July, as a result of smaller increases in housing rents.

Services inflation likewise eased to 0.4 per cent, from 0.7 per cent in July, due to a steeper decline in the costs of holiday expenses, airfares and inpatient services.

Meanwhile, private transport inflation rose to 2.4 per cent, from 2.1 per cent, on account of a larger increase in car prices as well as a smaller decline in petrol prices.

As for food inflation, it held steady at 1.1 per cent, as a slight moderation in non-cooked food inflation was offset by a mild pickup in food services inflation.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.