Electronics ‘insourcing’, fragmented value chain pose challenges, chances for Singapore: MAS

Sharon See

FACING a slowdown in global electronics trade and an increasingly fragmented electronics value chain, Singapore can still strengthen its hub position by leveraging its geographical advantage and efficient trade-logistics ecosystem, said the Monetary Authority of Singapore (MAS) in its half-yearly macroeconomic review on Wednesday (Apr 26).

“Maintaining Singapore’s relevance in the major electronics trade corridors will not only ensure long-term growth in the manufacturing sector, but also generate positive spillovers to the services sectors such as wholesale trade, transportation, finance and insurance and professional services,” it said.

In the report, MAS highlighted two major shifts in the global electronics trade: reconfigurations of supply chains, and “insourcing” by China and the United States.

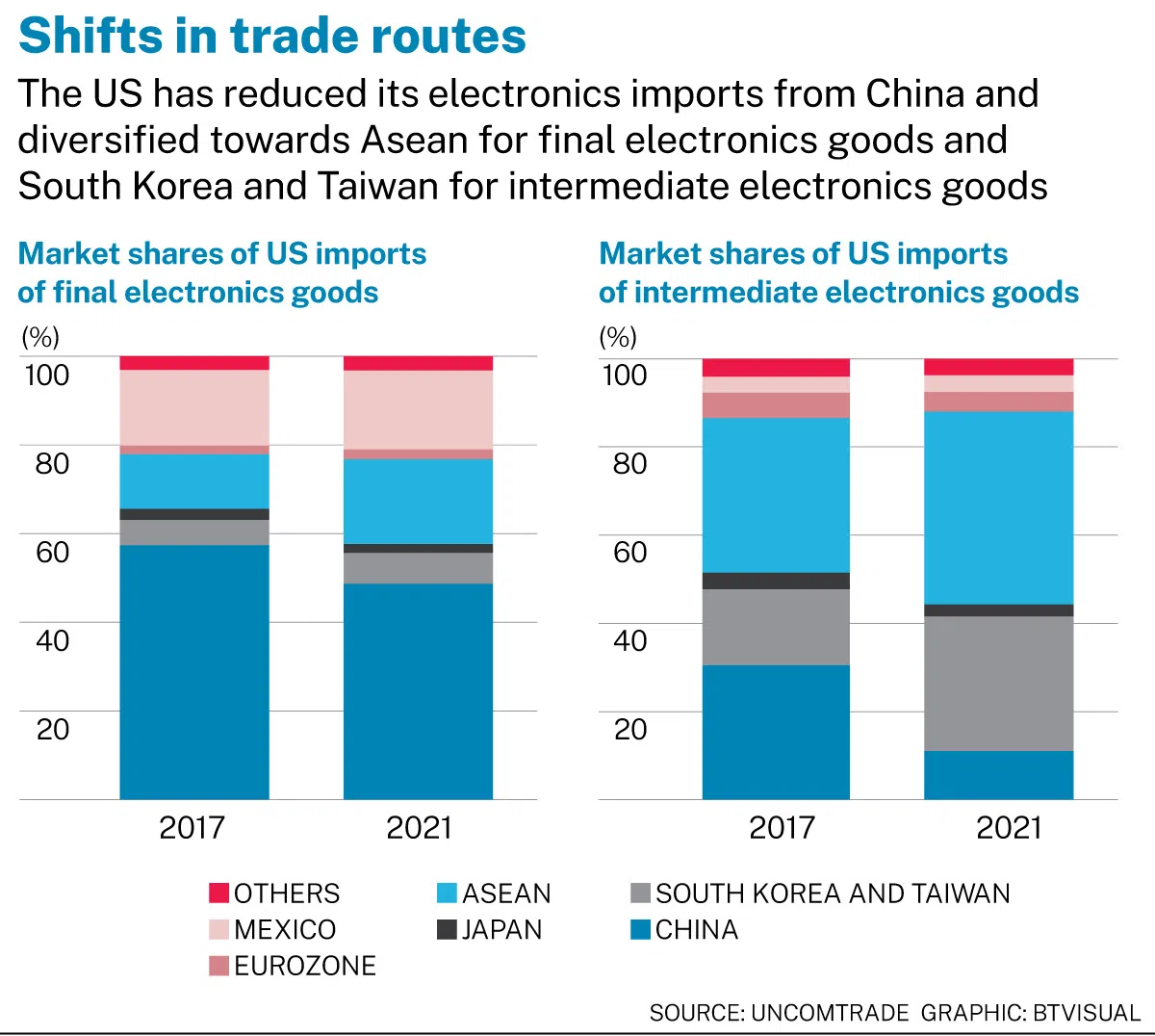

Asia’s electronics exports to the US have continued to expand since the 2018 US-China trade war, but the trade routes may have been diverted to pass through Asean, South Korea and and Taiwan.

The central bank noted that bilateral electronics trade between the US and China shrank by 5.6 per cent from 2017 to 2021, in contrast to a steady increase of 2.7 per cent between 2012 and 2016.

From 2017 to 2021, the US reduced electronics imports from China, turning mainly to Asean for final goods and to South Korea and Taiwan for intermediate products such as semiconductors. But China’s overall electronics exports still trended higher as it diversified towards closer markets such as Vietnam, Taiwan and Thailand.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The other shift arising from trade frictions has been greater “insourcing” of electronics inputs by the major economies, which MAS said could in turn dampen cross-border trade flows.

“While this trend has not been evident in overall merchandise trade and production data thus far, there have been some incipient signs of insourcing in the global electronics industry,” said MAS. For instance, global electronics production has risen faster than electronics imports, unlike earlier periods where imports rose faster.

Insourcing is even starker in semiconductors specifically, it added. China’s domestic chip output grew 32.5 per cent on average in 2020 and 2021, far ahead of the 17.8 per cent growth in semiconductor imports. In the US, however, semiconductor import growth outpaced that of domestic production.

Asia still dominates global electronics trade, accounting for two-thirds of the world’s final electronics exports and 85 per cent of its intermediate electronics exports in 2021, noted MAS. This could reflect “stickiness” of global value chains, given the enormous capital expenditure needed to build new plants.

“In addition, expertise and innovation are concentrated in certain markets, creating a web of entrenched interdependencies along the value chain,” it added.

However, the insourcing trend could intensify, with the US and China expanding domestic capacity, the central bank said. “Greater insourcing among the US and China could have an adverse impact on electronics and overall output in the rest of Asia.”

With insourcing, global electronics trade is likely to slow further in the coming years, and the electronics global value chain could become increasingly fragmented. This presents both challenges and opportunities to Singapore, said MAS.

The country is still a critical node in the electronics global value chain, maintaining a share of about 6 per cent of global electronics exports from 2017 to 2021, said MAS. It remains “an attractive location for semiconductor production” as leading chipmakers seek to reduce concentration risks, and continues to draw investment interest.

Jan Nicholas, Deloitte South-east Asia semiconductor consulting leader, said neither the US nor China can be truly self-sufficient across all parts of the semiconductor value chain even as they push for greater self-sufficiency.

“Both sides will need to rely on friendly or neutral countries to augment their domestic capabilities,” he said. “The Asean countries are well positioned for this, as most of them have been very careful not to align with either side in the current disputes.”

He added that one of Singapore’s largest assets is its strong property rights and intellectual property (IP) protection, noting that this is the core of current trade restrictions. “Singapore could use its neutrality to become a highly-valued centre of IP development.”

But for Singapore to maintain its hub status, Nicholas said it would also need to be a semiconductor talent hub, given the manpower crunch the industry is facing.

Ang Wee Seng, executive director of the Singapore Semiconductor Industry Association (SSIA), said most institutes of higher learning here have partnered multinationals to simulate real-life corporate labs that develop cutting-edge solutions. Some examples are partnerships between the Institute of Technical Education and STMicroelectronics, as well as Singapore Polytechnic and Advantest.

For Singapore to justify the higher costs resulting from high wage rates, it would need to provide high value-add, Nicholas said.

This includes services – engineering or professional services, IC design – or other areas of knowledge work, and shifts to processes that have higher value-add per unit produced, like advanced packaging, or areas of significant growth – such as power semiconductors for electric vehicles (EVs), radiation-hardened semiconductors for space applications. Nicholas added that this fits in with the idea of leveraging Singapore’s strength to create value across Asean and India.

With the rising importance of Asean and India – particularly in assembly, testing and packaging activities – it could be good for upstream producers in Singapore to forge stronger links with them, said MAS.

Singapore can benefit from the growth potential in these emerging nodes by seeking a greater role in capacity investments to these economies, it added.

SSIA’s Ang said Singapore’s extensive network of free trade agreements is helpful in this regard, allowing small and medium enterprises “preferential access” to some of these markets.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.