Hiring sentiment in Singapore remains soft, but most sectors still looking to boost headcount: survey

44 per cent of employers say they will hire for the July-September period

HIRING sentiment in Singapore has weakened for the third consecutive quarter, although the good news is that most sectors have indicated that they still expect to see an increase in overall headcount.

This was one of the key findings of the latest employment outlook survey by recruiter ManpowerGroup Singapore, which was released on Tuesday (Jun 11).

Of the 525 employers polled, about 44 per cent said they plan to hire during the July to September period. Another 24 per cent anticipate a decrease in staffing levels, while 32 per cent do not expect any change.

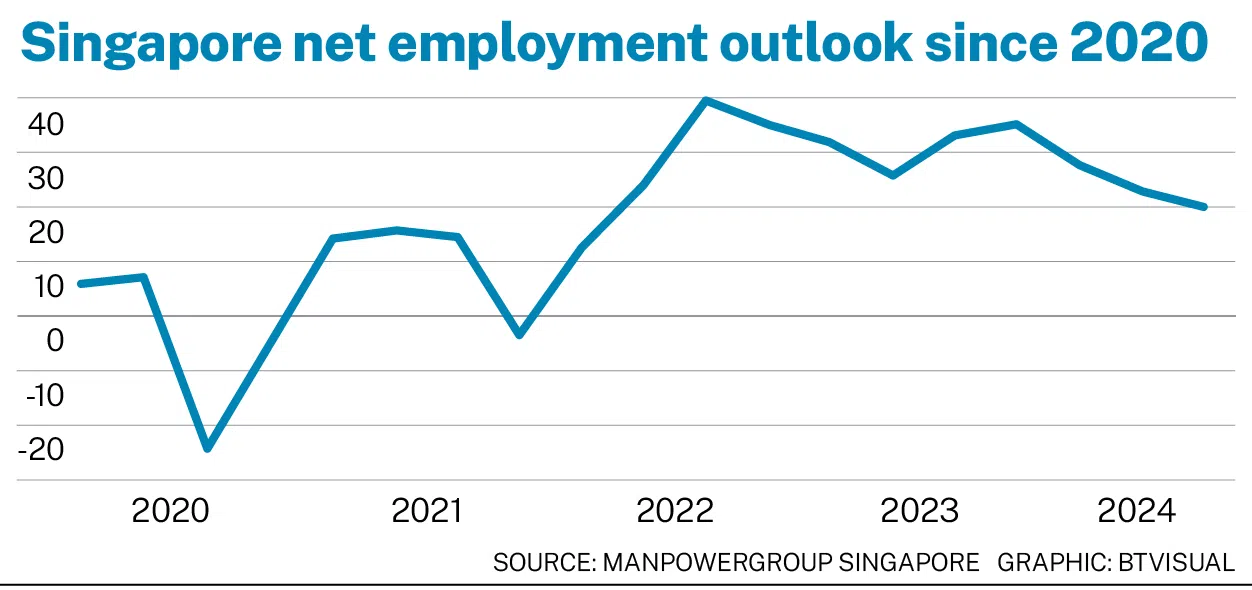

This takes the seasonally adjusted net employment outlook for Q3 to +20 per cent, which represents a fall of 4 per cent from the last quarter. This is lower than the global average seasonally adjusted net employment outlook of +22 per cent for the third quarter.

The net employment outlook, which is used as an indicator of labour market trends, is calculated by subtracting the percentage of employers who anticipate reductions in staffing levels from those who plan to hire.

A positive net employment outlook represents a higher percentage of employers who plan to hire than those who anticipate reductions.

The recruiter attributed the dip in employment outlook to weaker hiring sentiments from the previous quarter in six out of nine sectors, as companies looked to streamline their operations, cut costs, and fill the skills gap offshore.

A majority of organisations in each of the nine sectors surveyed reported a talent shortage.

Eight out of the nine sectors, however, maintained positive hiring outlooks for the third quarter of this year, with the transport, logistics, and automotive sector reporting the strongest employment outlook of +47 per cent for Q3.

The outlook for Singapore’s local transport, logistics, and automotive sector ranks second globally, behind only Ireland.

“Green initiatives driving domestic emission reduction are expected to boost job growth in Singapore’s transport, logistics and automotive sector,” Linda Teo, country manager of ManpowerGroup Singapore, said.

“With investments flowing into the transition to electric vehicles (EVs), companies are actively seeking skilled talent proficient in EV management and charging infrastructure navigation,” she added.

Singapore’s financials and real estate sector reported the largest change in hiring outlook, declining 30 percentage points from the previous quarter to a Q3 outlook of +15 per cent.

The communications services sector remains the weakest job market with an outlook of -33 per cent in the third quarter this year.

ManpowerGroup noted that 72 per cent of employers in the communications services sector are projected to increase their headcount, as more employers adopt machine learning and artificial intelligence.

More than half of the 525 companies surveyed (54 per cent) have already adopted artificial intelligence, an increase of 12 per cent year-on-year, ManpowerGroup Singapore said. Another 20 per cent expecting to do so in the next 12 months.

“In light of today’s talent shortage and rapid technological advancements, employers may find it beneficial to prioritise soft skills, particularly adaptability and learning agility, when making hiring decisions,” Teo noted.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.