How are CPF interest rates determined, and how have they trended?

SINCE it started in 1955, the Central Provident Fund (CPF) has been a staple in Singaporeans’ retirement planning.

The CPF Board pays different rates across the different CPF accounts: Ordinary (OA), Special (SA), MediSave (MA), and Retirement (RA) accounts.

This week, the government announced that it was extending the 4 per cent interest rate floors for the Special, MediSave and Retirement accounts for another year.

Here’s a look at how CPF interest rates work and have trended, and the reasons behind the changes:

How are CPF interest rates determined?

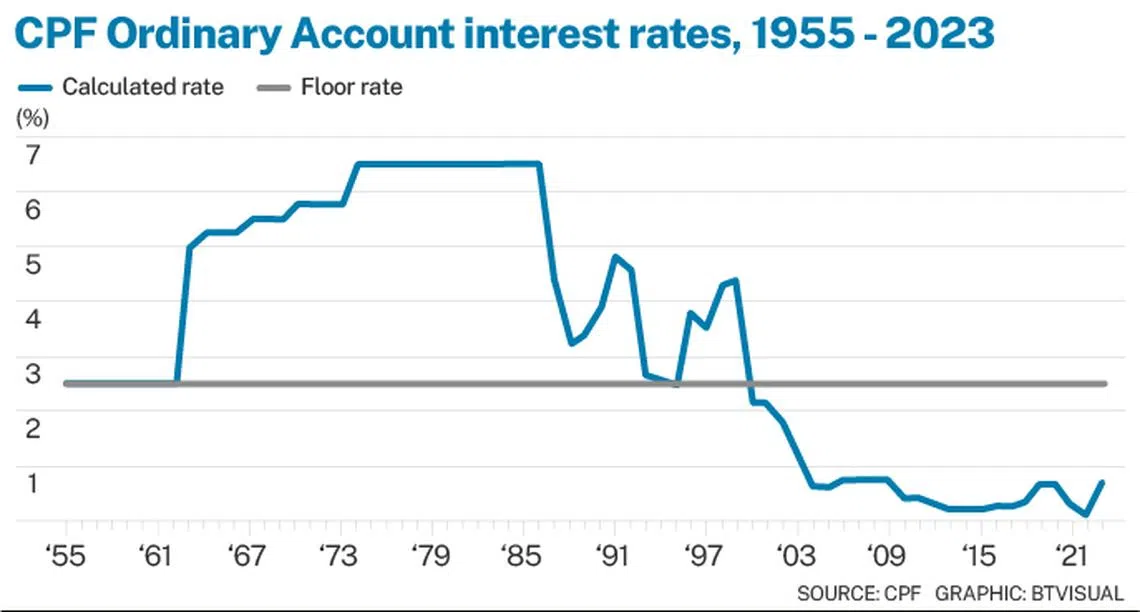

Ordinary accounts pay the higher of either the three-month average of major local banks’ deposit rates, or the legislated minimum rate (also known as an interest rate floor) of 2.5 per cent per annum.

The average bank deposit rate is an average with an 80 per cent weight for fixed deposits and a 20 per cent weight for a savings deposit. The current three-month average is 0.66 per cent, which means the floor rate still applies to the OA.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

CPF monies are invested in Special Singapore Government Securities. These are non-tradable bonds issued specifically to the CPF Board for the investment of CPF savings.

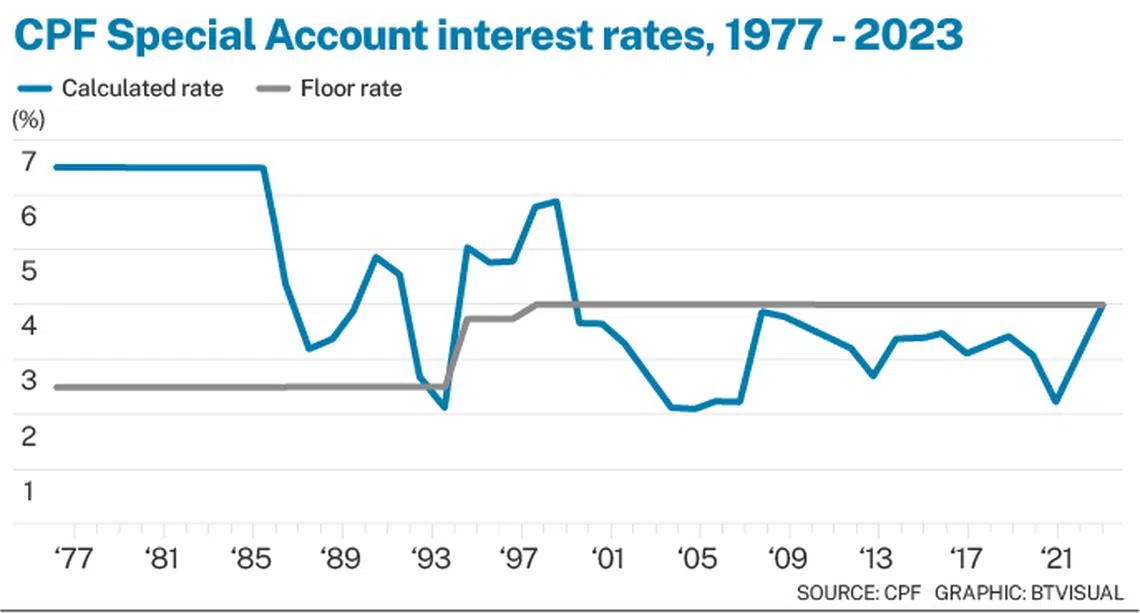

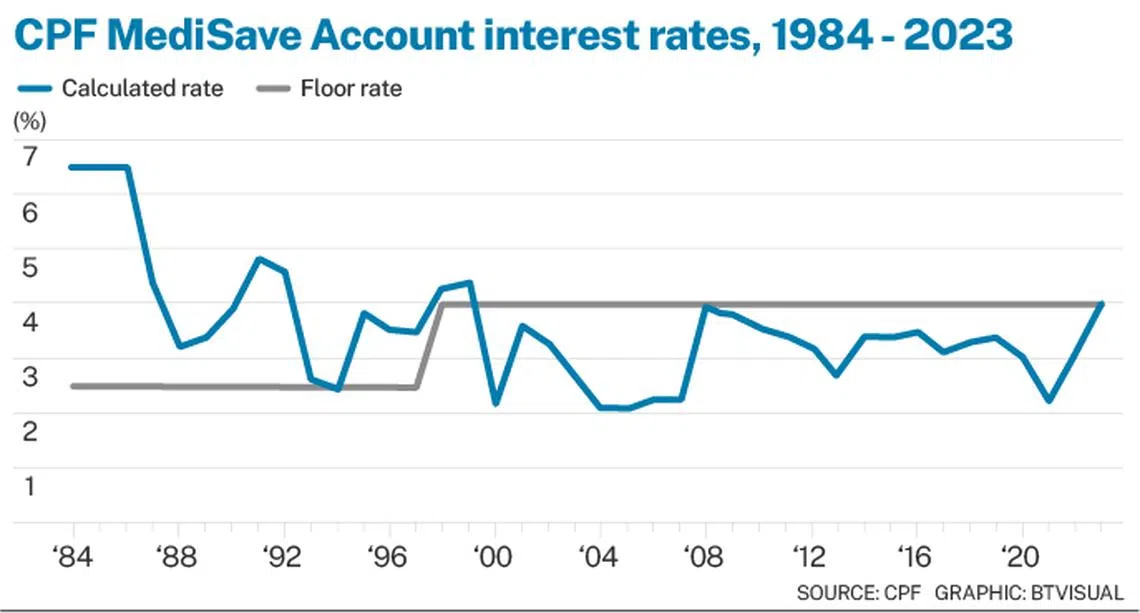

Special and MediSave accounts earn the 12-month average yield of 10-year Singapore Government Securities plus 1 per cent, or the interest rate floor of 4 per cent, whichever is higher. The former was 4.04 per cent for the period of August 2022 to July 2023.

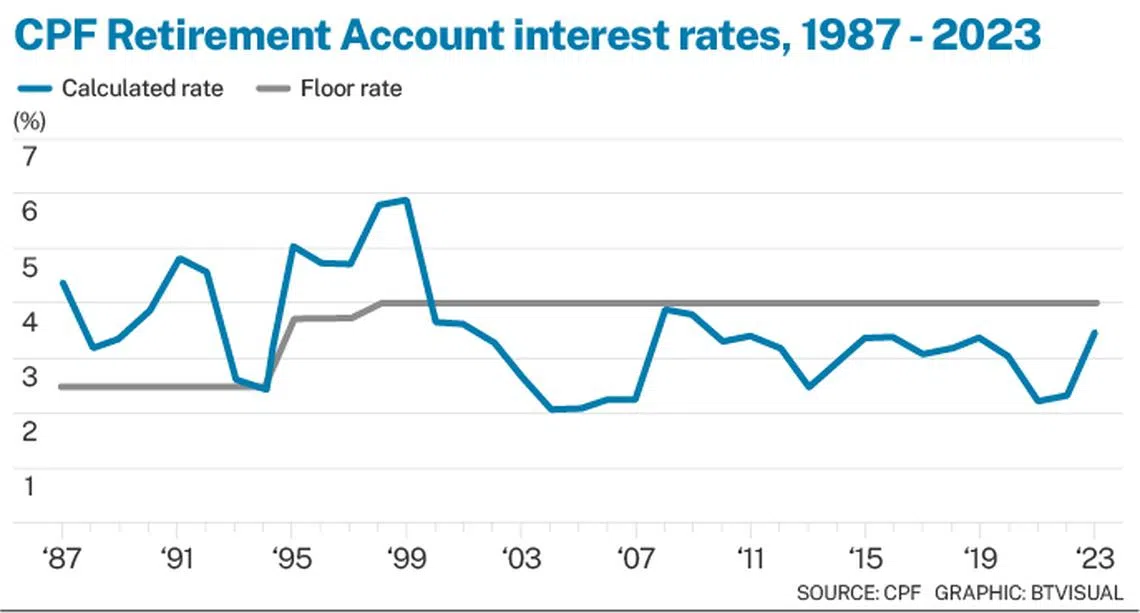

Retirement accounts earn an interest rate that is reviewed annually. For 2023, these accounts will earn 4 per cent.

SEE ALSO

How have CPF interest rates changed over the years?

The chart below shows the calculated rate (based on the formula above), and the floor rate set by the government.

The calculated rate was higher than the floor rate for three decades.

Why was the calculated rate higher at the time?

Between the 1960s and early 1980s, interest rates in most economies were high. Singapore, which was growing rapidly at the time, was no different.

In the past two decades, however, the world has entered a period of lower interest rates – partly a result of central banks’ moves to boost economic growth or support asset prices.

In Singapore, at least, there has also been a change in the way banks compete for deposits. Many high-interest savings accounts are not factored into CPF’s definition and calculation of average bank deposit rates.

The following graphs show the long-term interest trend for the SA, MA and RAs:

Special account:

MediSave account:

Retirement Account:

When did the government revise the interest rate floors?

The starting rate for all CPF account types was 2.5 per cent; but that for Special, MediSave and Retirement accounts was hiked progressively in the 1990s (in 1995 and 1998, specifically), until it reached the 4 per cent mark in 1998, where it has remained since.

Reasons such as global market conditions and exceptionally low interest rates have been cited in the past as reasons for these moves.

The government also took steps to provide additional interest to CPF members with lower balances on their accounts – for instance, adding 1 per cent in interest on the first S$60,000 of combined balances, and in 2015, adding another percentage point on the first S$30,000 in CPF balances for members aged 55 and up.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.