Inflation and its trajectory for Singapore

Jeanette Tan

What is inflation?

INFLATION is the rate of price changes over time for a constant basket of goods and services.

Like many countries, Singapore’s government measures both headline and core inflation. The former refers to the movement of the consumer price index (CPI), comprising items commonly purchased by most Singapore households.

In Singapore, core inflation – a subset of the full CPI – excludes private road transport and accommodation costs.

The Monetary Authority of Singapore (MAS) focuses on core inflation as a better measure of “underlying price pressures” in the economy. The central bank monitors this closely to uncover meaningful trends in the pricing of goods and services.

How does Singapore track the cost of living?

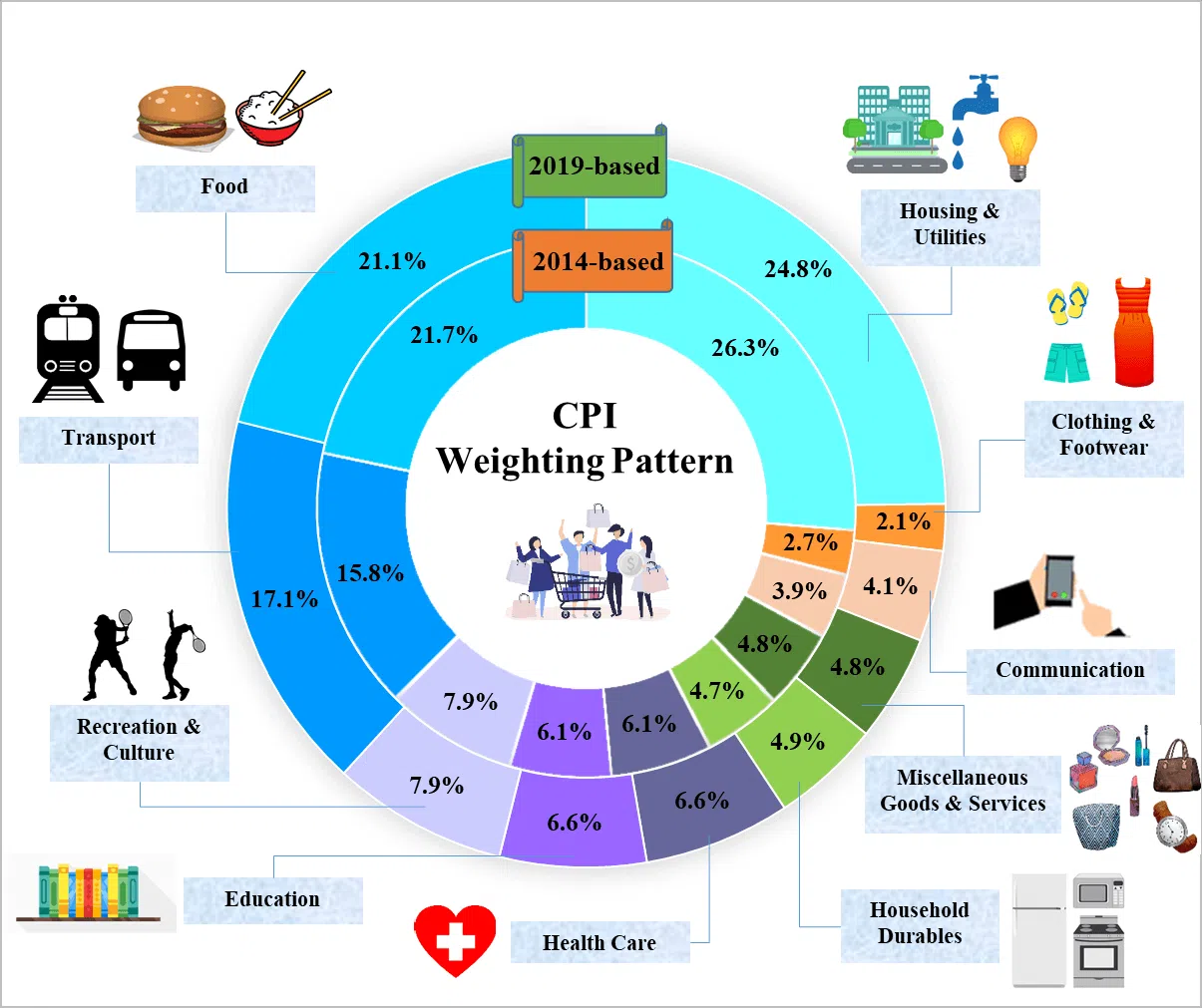

What goes into the CPI?

- Food

- Transport

- Housing and utilities

- Clothing and footwear

- Communication

- Household durables (like appliances)

- Education

- Recreation and culture, and

- Miscellaneous goods and services.

For the items in the CPI, Singapore’s department of statistics takes into account prices of around 6,800 brands and varieties from 4,200 outlets. Not all price changes have the same effect on the CPI – instead, weights are assigned to each category of items, according to how significant they are in an average household’s spending patterns.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

How has inflation trended in recent years?

The world has faced elevated inflation for some years, and Singapore has not been spared.

Post-pandemic, consumer goods prices trended up, as production lines and supply chains struggled to restore momentum from extended Covid-era shutdowns.

Another surge happened in 2022, led by soaring food and fuel prices after the Russian invasion of Ukraine that February. Many Western nations imposed trade sanctions on Russia, a major crude oil and agricultural producer. Russia’s blockades of Ukraine’s grain exports aggravated the situation, as Ukraine is a key wheat exporter.

SEE ALSO

Last year, many countries struggled with extra-tight labour markets, as the post-pandemic recovery meant higher labour demand but fewer workers were available. Wages went up, and companies passed on these additional costs.

Why are central banks trying to curb inflation?

High inflation means greater cost-of-living pressures. For businesses, unpredictable inflation makes it difficult to make informed longer-term business decisions.

There is also the fear of a wage-price spiral: when salaries do not keep up with rising prices, consumers find things more expensive and become anxious that prices will keep rising. They then demand higher pay – but this means higher business costs, which may be passed on in the form of higher consumer prices.

How has inflation trended in Singapore?

Singapore’s inflation rates trended up as the economy recovered from the worst of Covid-19. But from October 2021 through October 2022, the MAS tightened monetary policy five times, in a bid to rein in inflationary pressures.

Since late 2022, inflation has trended downward. Price pressures in several major areas have started to ease, thanks also to stabilisation and recovery in global food supply chains.

The MAS and Ministry of Trade and Industry (MTI) note that the prices of Singapore’s imported goods have continued to decline, even as global oil prices are on the rise. At home, however, labour costs are expected to keep rising, and be passed on to consumers.

Still, core inflation is expected to moderate further over the next few months, as imported costs stay low and labour market tightness eases.

Separately, Singapore is set to hike electricity and water tariffs, as well as public transport fares.

To help cushion these, Deputy Prime Minister Lawrence Wong announced on Thursday (Sep 28) an additional Cost of Living package of S$1.1 billion in cash handouts, conservancy and utility bill rebates, spending vouchers, and public transport vouchers for needier families.

It remains to be seen if these steps suffice, but economists BT spoke to expect core inflation to continue its moderating trajectory in the coming months.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.