Inflation to ease further in 2025 amid moderate external and domestic cost conditions: MAS

Risks to inflation have become more balanced, it says

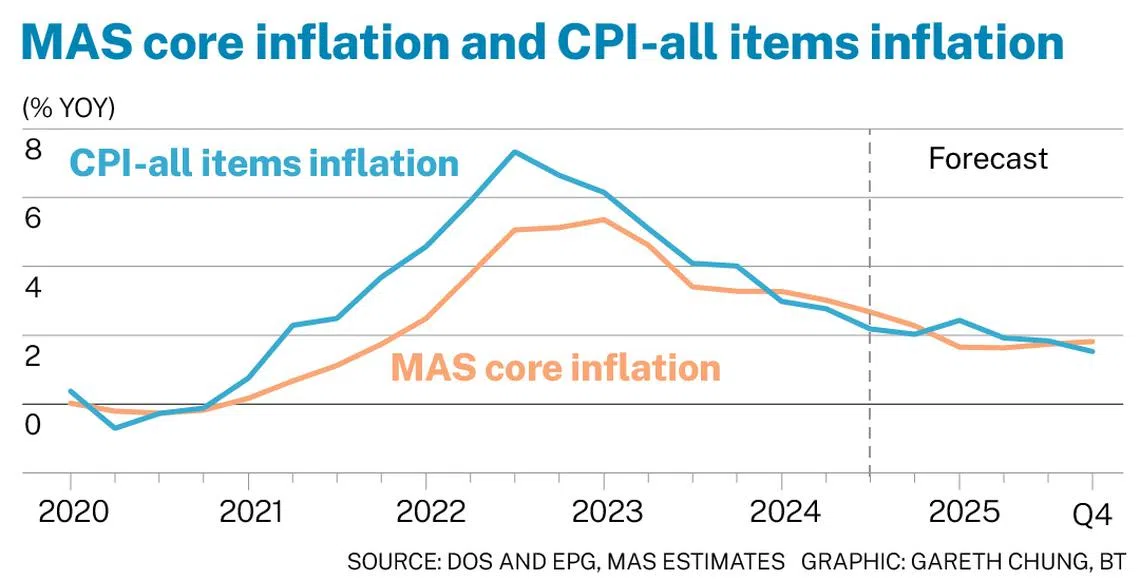

THE Monetary Authority of Singapore (MAS) on Monday (Oct 28) repeated its expectation for core and headline inflation to both average 1.5 to 2.5 per cent in 2025, “down significantly from their peaks seen over the last two years”.

“The disinflationary trend will be anchored by a broadly benign external cost environment and a slower pace of increase in domestic labour costs,” the central bank said in its half-yearly macroeconomic review. The prediction also partly reflects the dissipation of the effects of Goods and Services Tax hikes.

Amid inflation’s significant decline from its peak, and with demand and supply in factor and product markets broadly equilibrating, the risks to Singapore’s inflation outlook are now more balanced, it added.

Declining trend

In Q3, lower imported fuel and food costs, due in part to the appreciating Singapore dollar nominal effective exchange rate (S$NEER), as well as slowing unit labour cost increases, contributed to the fall in inflation.

“All in, the aggregate core price level has largely caught up with earlier accumulated cost increases and firms’ markups are estimated to have largely normalised,” the central bank said. “With the pass-through of prior cost increases to consumer prices diminishing as a driver of inflationary pressures, core inflation has moderated.”

For the remainder of 2024, the year-on-year declining trend “should remain generally intact”.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The dissipation of pent-up travel demand should limit the pickup in travel-related services prices, enhanced public healthcare subsidies will contribute to a step-down in essential services inflation; and crude oil prices which were lower in Q3 compared to the year-ago period will reduce electricity and gas inflation in Q4.

For the full year, MAS expects core inflation to average 2.5 to 3 per cent; and headline, around 2.5 per cent.

Further easing

Moderate external cost conditions, easing domestic cost conditions, as well as enhanced government measures to temper cost of living measures are expected to see inflation decline further in 2025.

“In the near term, subdued upstream cost pressures should continue to keep a lid on domestic inflation,” MAS said.

Increases in Singapore’s manufactured product and supply prices are unlikely to exert any significant upside pressure on consumer prices, with producer price inflation still weak in major goods-producing economies.

Global commodity prices are also projected to decline or remain broadly stable in 2025.

Global oil supply is expected to be supported by the anticipated unwinding of the Organization of the Petroleum Exporting Countries Plus’ production cuts from the end of this year. The US dollar has broadly depreciated, which should ease cost pressures on commodity importers globally.

Additionally, Singapore’s major trading partners’ headline inflation is forecast to broadly fall back to their pre-Covid norms in 2025.

“Against this baseline of a benign external cost environment, especially in the region, Singapore’s imported cost pressures are expected to stay moderate next year.”

It highlighted that domestic electricity and gas as well as food services inflation is forecast to slow further in 2025, while non-cooked food inflation is only expected to rise modestly. Services inflation associated with holiday expenses should also ease, with the full normalisation of the global tourism industry.

As for domestic conditions, unit labour costs are forecast to rise more slowly in the services sector next year. An increasingly large share of market-determined services prices has caught up with the cumulative increase in services unit labour cost, suggesting that services prices should broadly rise in line with the projected increase in unit labour cost in the future, the central bank said.

Additional subsidies for essential services announced by the government will have an impact on household prices.

“Inflation arising from changes in administered prices in the economy is expected to ease, after a period of strong price increases to catch up with accumulated cost hikes,” said the central bank.

MAS believes that, should inflation momentum remain close to historical norms, core inflation is likely to average around the mid-point of the forecast range for the year as a whole, at 2 per cent.

As for non-core components, private transport inflation is expected to pick up – on account of rising Certificate of Entitlement premiums – while accommodation inflation should continue to decline gradually, with demand for rental accommodation expected to remain relatively stable next year, having slowed this year from its 2023 pace.

More balanced

“Amid the significant decline in inflation from its peak and with demand and supply in factor and product markets broadly equilibrating, the risks to Singapore’s inflation outlook are now more balanced,” MAS said.

On the upside, stronger-than-anticipated demand for labour, as a result of economic outperformance, could keep services inflation elevated. An intensification of geopolitical tensions and commodity price shocks could also add to imported costs.

But a significant global economic downturn, including one induced by geopolitical tensions, could trigger an abrupt and generalised weakening in cost and price pressures, and cause domestic inflation to come in materially lower than expected.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.