Labour demand could ease further this year, after signs of cooling in Q2: MOM

Elysia Tan

SINGAPORE’S demand for labour will likely ease further in the rest of this year, with employment growth and job vacancies having moderated in the second quarter, going by figures in the Labour Market Report released by the Ministry of Manpower (MOM) on Thursday (Sep 14).

Resident employment shrank for the first time since Q2 2020, by 1,200 – but MOM attributed this to seasonal factors. “The contraction is unlikely to persist,” it said.

Non-resident employment rose by 25,500, nearly half of which was from construction.

As a result, total employment, excluding migrant domestic workers, expanded for the seventh straight quarter in Q2 2023; it was up 24,300 to 3.68 million – slower than Q1’s 33,000 rise.

OCBC chief economist Selena Ling said the contraction in resident employment was “industry-specific, rather than a general malaise”.

MOM said: “Robust increases in sectors such as community, social and personal services and financial and insurance services were offset by contractions in food and beverage services and retail trade, due to outflow from the cessation of seasonal hiring.”

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Ang Boon Heng, director of MOM’s manpower research and statistics department, said there is often a lot of hiring for temporary positions in the second half of the year for the Formula 1 Grand Prix and year-end festivities. This usually tapers in the first half of the following year.

Such activities should boost resident employment growth in Q3 and Q4 2023, but the increases will likely be lower than in the corresponding year-ago period, amid cooling labour demand and slower resident labour force growth.

Ling noted that China’s lacklustre re-opening and Singaporeans’ increased travel may have contributed to Q2’s cooldown: “Reality may have begun to weigh from the initial euphoria in Q1.”

Still, DBS economist Chua Han Teng said the contraction is “not concerning”, given seasonality and the expected rebound in H2.

Given the challenging external environment, the outlook for overall employment remains weak for outward-oriented sectors such as manufacturing, and finance and insurance, MOM said.

The ongoing recovery in the tourism sector is expected to support air transport and accommodation, along with consumer-facing sectors such as retail trade and food and beverage services.

Job vacancies declined for the fifth consecutive quarter to 87,900 in June, after peaking at 126,000 in March 2022.

Ang said that while this could signal that times were bad, it could also mean that demand was coming down to “a more reasonable level”, compared to when vacancies peaked and businesses faced manpower shortages. Vacancies remain elevated from the pre-Covid average of 50,000 to 60,000, and should continue to moderate, he added.

MOM said: “Growth sectors, including professional services, information and communications and financial services, made up more than a fifth of the overall available job vacancies in June 2023.”

With the fall, the ratio of job vacancies to unemployed persons dipped significantly for the second consecutive quarter to 1.94; this was the first time it has slipped below two since June 2021’s 1.6, noted an MOM spokesperson.

Hiring demand could also continue to soften, MOM noted. In June 2023, 58.2 per cent of companies polled said they plan to hire in the next three months, down from 64.8 per cent in March.

Retrenchments fell in Q2 to 3,200 from 3,820 in Q1 after rising for three quarters, mainly due to reorganisation or restructuring (69.9 per cent). They were largely driven by the information and communications sector – but the likelihood of residents retrenched from this sector finding new jobs remained high, relative to other industries.

Minister for Manpower Tan See Leng said reorganisation and restructuring often strengthens companies, “and net-net, there’s still a shortage in that field”.

OCBC’s Ling said the incidence of retrenchment of resident workers aged over 60 was more concerning, with the unemployment rate among this group having jumped from the previous quarter. These seniors “may find it more challenging to find re-employment if the job vacancies continue to ease”, she said.

Maybank’s regional co-head of macro research Chua Hak Bin expects retrenchments to fall slightly in the coming quarters, with the worst of the tech layoffs likely in the first half of the year.

But National Trades Union Congress assistant secretary-general Patrick Tay said he expects retrenchments will exceed 10,000 this year, mirroring pre-pandemic figures, despite Q2’s decline.

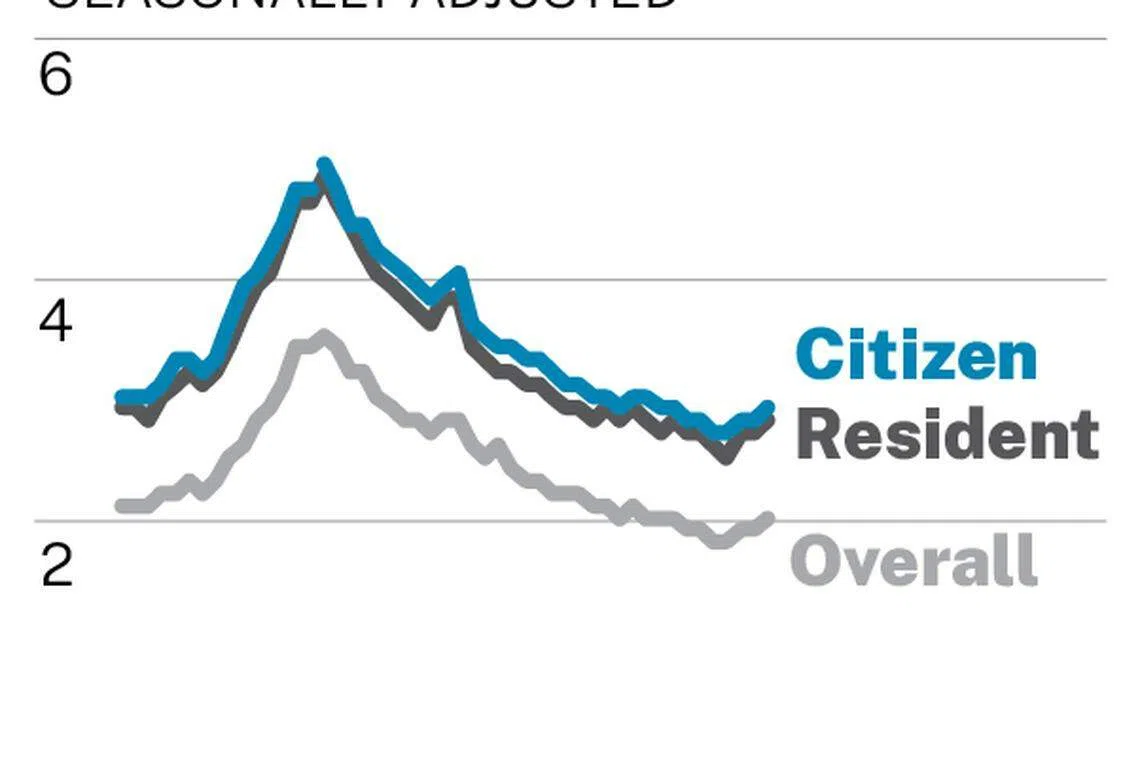

In July, unemployment rates registered a slight uptick, at 2 per cent overall – 2.8 per cent for residents and 2.9 per cent for citizens.

DBS’ Chua said he expects any uptick to be “modest and contained”, as the economy remains in expansion mode despite this year’s “below-trend” economic growth.

Maybank’s Dr Chua agreed: “The economy is turning the corner, with tentative signs that manufacturing, trade and exports are on the mend.”

Resident long-term unemployment rate remained low in June 2023 at 0.5 per cent. It was slightly higher for mature workers – 0.8 per cent for those aged 50 to 59, up from 0.7 per cent in the previous quarter; it was stable at 0.7 per cent for those 60 and above, but below pre-Covid figures, at 1 per cent and 0.8 per cent respectively.

During his Thursday visit to marine-engineering services provider Dyna-Mac Engineering Services, Dr Tan highlighted business transformation support programmes such as Workforce Singapore’s Career Conversion Programme for the marine and offshore energy sector.

Launched in April 2023, the programme provides funding support for reskilling employees and redesigning roles, to prepare them for the green transition, as well as digitalisation and automation. More than 25 companies are on board the programme, which is expected to benefit up to 400 employees.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.