Mainstream car COE premium climbs 3.9%, but large car category slides 7.1%

The focus on Category A comes as brands strive for sales in the last bidding round of 2025

[SINGAPORE] There were mixed results for Certificates of Entitlement (COEs) in the final round of bidding for 2025, as both buyers and dealers focused on the mainstream category.

“The demand for Category A was naturally stronger this round as there are more models in the category, especially EVs,” said Jason Lim, the managing director of Eurokars Auto, a dealer for BMW.

“The fact that it is the final bidding round of the year also means all dealers would have been pushing aggressively to secure sales and registrations that will tally into their 2025 performance figures,” he added.

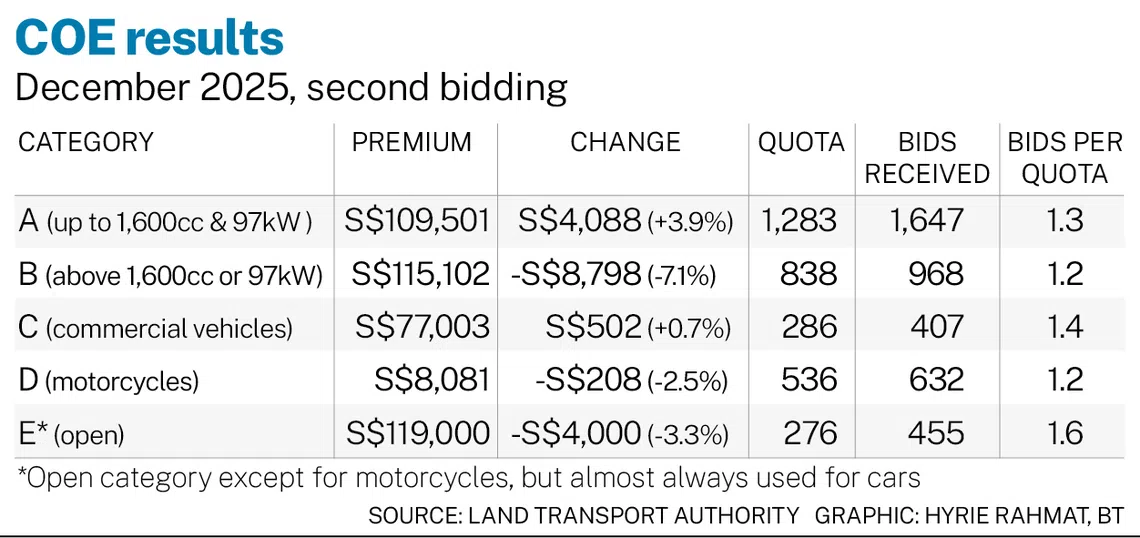

Category A rose 3.9 per cent or S$4,088 to S$109,501.

The category applies to cars that have engines of up to 1,600 cubic centimetres (cc) in capacity or with up to 97 kilowatts (kW) of power, or for electric vehicles (EVs) with up to 110 kW of power.

The premium for Category B fell 7.1 per cent or S$8,798 to S$115,002.

Category B is for larger, more powerful cars with engines of more than 1,600 cc or 97 kW in capacity, or for EVs with more than 110 kW of power.

Prices for Category C, applicable to commercial vehicles and buses, increased 0.7 per cent or S$502 to S$77,003.

Prices for Category D, used for motorcycles, decreased 2.5 per cent or S$208 to S$8,081.

Category E, the open category which can be used to register any type of motor vehicle except motorcycles, fell 3.3 per cent or S$4,000 to S$119,000.

A not-so-quiet place

Industry observers said buying activity has been concentrated on Category A in the past fortnight.

The rise in that category was also driven by EVs. China brands, which have dominated the EV market here, have been introducing numerous models to the category in 2025, including BYD’s low-cost sedan Seal 6 and Zeekr’s 7X sport utility vehicle.

Anthony Teo, managing director of BYD distributor and dealer Vantage Automotive, said the brand has been collecting “good orders” in December.

Its current sales efforts include a COE rebate and S$100,000 lucky draw open to those who buy a BYD car between Dec 4, 2025, and Jan 6, 2026. The brand has an ambitious goal to sell 10,000 cars in Singapore this year.

Traditionally, dealers attempt to bolster sales in the final quarter of the year by introducing more promotions and sales offers. Some dealers also receive monetary bonuses – which may number in the millions – from their principals for hitting sales targets.

In fact, Category A demand was such that its premium was higher than Category B’s for a brief period, before bidding closed.

“We saw the phenomenon where Category A’s premium was momentarily higher than Category B’s during bidding, which is quite rare,” said Nicholas Wong, CEO of authorised Honda dealer Kah Motor.

“That’s because there are many, high-demand models crowded into this category.”

This was supported in the past two weeks by those brands running aggressive sales promotions to bolster their sales, said observers.

Said the sales manager of a European car brand: “If you look at most of the Chinese brands, the majority of them focus on Category A because that’s where your mainstream numbers are. Also, after the recent drop, we see the market focus strongly on Category A, too.”

In December’s first round of bidding, the category’s premium dropped to S$105,413, its lowest level since August. It had climbed to a new record of S$128,105 in October, after an announcement in September that EV incentives would be reduced beginning in 2026.

Volatility in Category B has also driven buyer caution, said the manager, which could account for the dip this round.

After dropping to a relative low of S$115,001 in November’s first round, Category B spiked 12.9 per cent to S$129,890 in November’s second round, but still remained relatively high at S$123,900 in December’s first round.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.