Majority of affluent Singaporeans fear their wealth won’t last beyond next generation: poll

About 75% also worry their heirs are not financially equipped to manage inherited assets

[SINGAPORE] The majority of high-net-worth (HNW) Singapore respondents fear their wealth will not last beyond their children’s generation, a new survey found.

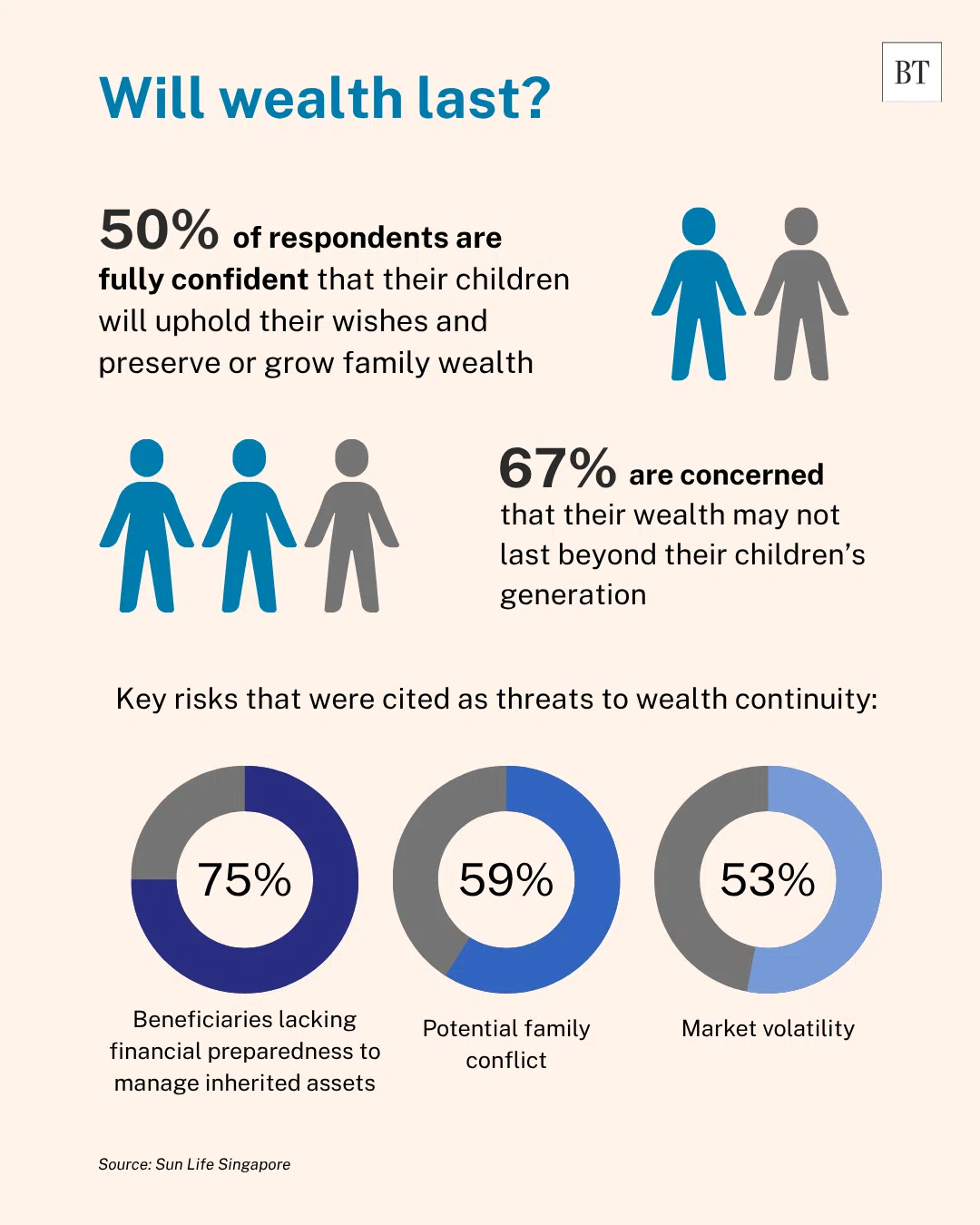

Two thirds – or 67 per cent – indicated this concern, while 75 per cent worry their heirs are not financially equipped to manage inherited assets, according to the poll.

While HNW individuals in Singapore have high aspirations for legacy planning, many harbour concerns that their legacies may not stand the tests of time and transition, according to global financial services firm Sun Life, which carried out the poll.

Other issues include conflict over their assets, with 59 per cent indicating so, and 53 per cent fearing market volatility affecting the valuation of their assets.

“This uncertainty extends to personal and cultural legacy. Just half (50 per cent) of Singapore HNW respondents are confident their children will uphold their wishes around wealth transfer, preserve assets, and continue to grow them for generations to come,” the report said.

The poll surveyed more than 3,000 respondents across Singapore, Hong Kong, Indonesia, Malaysia, the Philippines and Vietnam. In Singapore, the study included a “focused” sample of 316 HNW individuals, defined as those with US$1 million or more in investible assets, said Sun Life.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Asia set for largest intergenerational wealth transfer

In the coming decade, Asia will experience the largest intergenerational wealth transfer in its history, according to the report.

“With an estimated US$5.8 trillion set to be passed on from the first generation of wealth creators to the next by 2030, this raises profound questions about how families across the region should prepare,” said the report, citing McKinsey data.

In Singapore, legacy planning is shaped by a highly developed financial environment and HNW families who approach wealth transfer with “discipline and intention”.

“The city-state’s entrepreneurial culture also influences how families plan for continuity,” the report said, adding that family enterprises remain “at the heart” of Singapore’s wealth landscape.

“Many family business owners have formal succession plans in place, yet face a new challenge: Younger generations who may be reluctant to take over, driven by different career aspirations or a desire for independence,” it added.

More than half (52 per cent) have fully developed succession plans. Meanwhile, a quarter have partial plans, 11 per cent are still working on such plans, and the rest (11 per cent) are thinking of doing so in the future.

The poll showed that legacy planning here is not only about what is transferred, but also about how that wealth is expected to work for future generations.

Some 61 per cent emphasise the importance of growing and preserving wealth so it can be passed on sustainably to future generations, it showed.

“Taken together, these expectations show that Singapore’s affluent families are looking to define what their legacy means as well as shape how it should function,” said Sun Life.

Most of the planning centre on financial accounts (72 per cent), real estate (67 per cent) and life insurance proceeds (57 per cent), primarily through whole life and term life policies.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.