Singapore Budget 2023 in 90 seconds

The key announcements made in this year’s Budget speech, summarised.

Jeanette Tan

FINANCE and Deputy Prime Minister Lawrence Wong has delivered his 2023 Budget Day speech in Parliament – an expansionary one with Valentine’s Day “bouquets” for those hardest hit by inflation; seniors; platform workers; and parents, while also taking some surprise moves in car and property taxation.

Here are the major announcements:

1) Higher stamp duties for higher-value property

Stamp duties for higher value residential and non-residential properties will be raised further, affecting properties valued at above S$1.5 million. Some 15 per cent of residential properties are expected to be affected by this change.

60 per cent of non-residential properties will also be affected by this hike – those valued at S$1 million and up will be taxed in tiered amounts.

These changes kick in from midnight tonight.

2) Support for inflation, cost of living

More money will be handed out to Singaporeans and companies to help them cope with persistent inflation.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Individuals who have been on the government’s permanent GST voucher scheme (with assessable income of under S$34,000 and owning a maximum of one property with an annual value of under S$21,000) will receive more money this and next year.

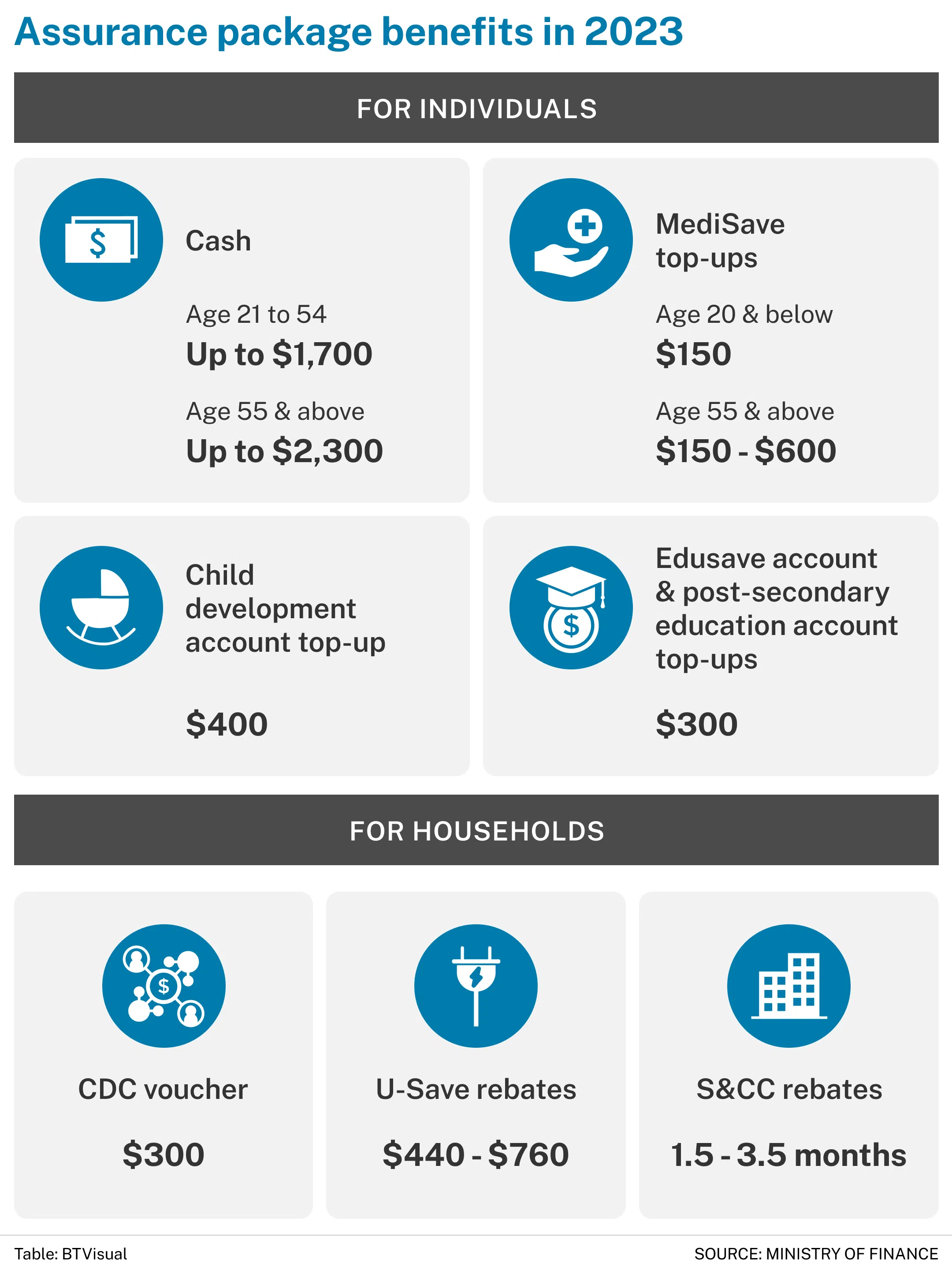

The rest of you aren’t left out – the government is giving more help each year through 2027 to everyone through the Assurance Package, depending on how much you earn, how much your home is worth and how many you have.

Top ups will also be made to MediSave, Child Development, Edusave and Post-Secondary Education accounts this year, apart from CDC vouchers, U-Save and service and conservancy rebates.

For firms, two schemes will get one-year extensions till Mar 31, 2024: the enhanced Enterprise Financing Scheme and the Energy Efficiency Grant.

3) Increase in monthly income ceiling for CPF contributions

To keep pace with rising salaries, this will be upped from S$6,000 to S$8,000. This ceiling was last raised in 2016, and will be phased over four years starting this year.

This will, however, also result in increases in costs for employers, as well as a larger sum set aside on the part of affected employees.

4) Encouraging innovation

The government is doing a big top up to the National Productivity Fund, which supports productivity enhancements, education and training initiatives for firms. This will also be expanded to support investment promotion.

It’s also introducing a new Enterprise Innovation Scheme, which provides for tax allowances and deductions for research and development, intellectual property registrations and rights, training expenditure, and projects carried out with polytechnics and ITEs.

It’s setting aside another S$1 billion to help local companies build capabilities and set them up for growth to the next level. For small and medium-sized enterprises, it’s also pumping money into a fund that invests in promising firms and also push for more private investments.

5) Increases in corporate taxation

A Domestic Top up Tax will be implemented for large multinational enterprise groups based here from 2025, as part of our rolling out of the Global Anti-Base Erosion rules, so the global minimum effective tax rate for them becomes 15 per cent.

6) Measures to support parenthood

Measures were introduced to support the urgent housing needs of parents with children buying their first homes, in the area of ballots for Build-to-Order flats and higher grants for resale flat purchases.

The government will also be boosting the baby bonus and Child Development Account top up amounts. Fathers can look forward to four weeks’ paternity leave instead of the current two, provided their employers opt in, and unpaid infant care leave will also be doubled.

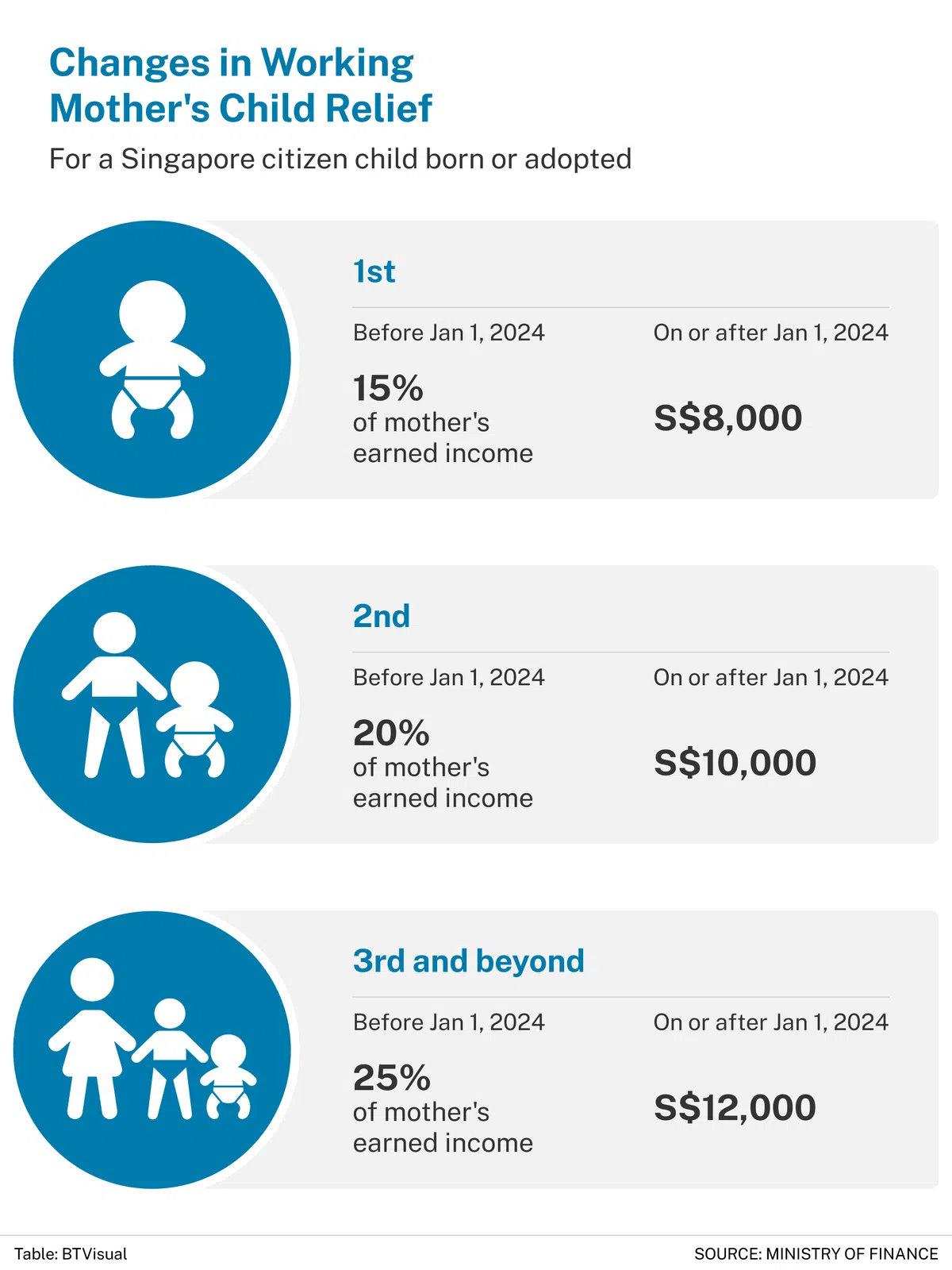

Lower- to middle-income working mothers will also benefit from changes to the Working Mother’s Child Relief scheme, which will be made more progressive. The foreign domestic worker levy tax relief will lapse from 2025.

7) Better income protection for platform workers

Platform workers can look forward to better protection for their livelihoods, with the government moving to align CPF contributions with those of employees and employers over the coming five years. Workers below 30 years old will have to make increased contributions, and platform companies will have to pay CPF contributions too.

A transition support scheme will also offset platform workers’ increased CPF contributions in the first four of these years if they earn S$2,500 or less per month.

8) Support for seniors and lower income Singaporeans

The government will work to harmonise its broad swathe of programmes supporting lower-income families, top up its ComCare fund and also scale up an initiative that supports children born to lower-income families.

For seniors, schemes that encourage companies to keep those who want to continue working in their employ, as well as to offer part-time and flexi-work arrangements for them, will be extended till 2025.

Top ups will also be sent to the ElderCare Fund and MediFund.

9) Higher taxes on luxury cars and tobacco

Tiered higher additional registration fees will be levied on cars with an open market value of more than S$40,000.

Excise duty on tobacco products will be increased by 15 per cent.

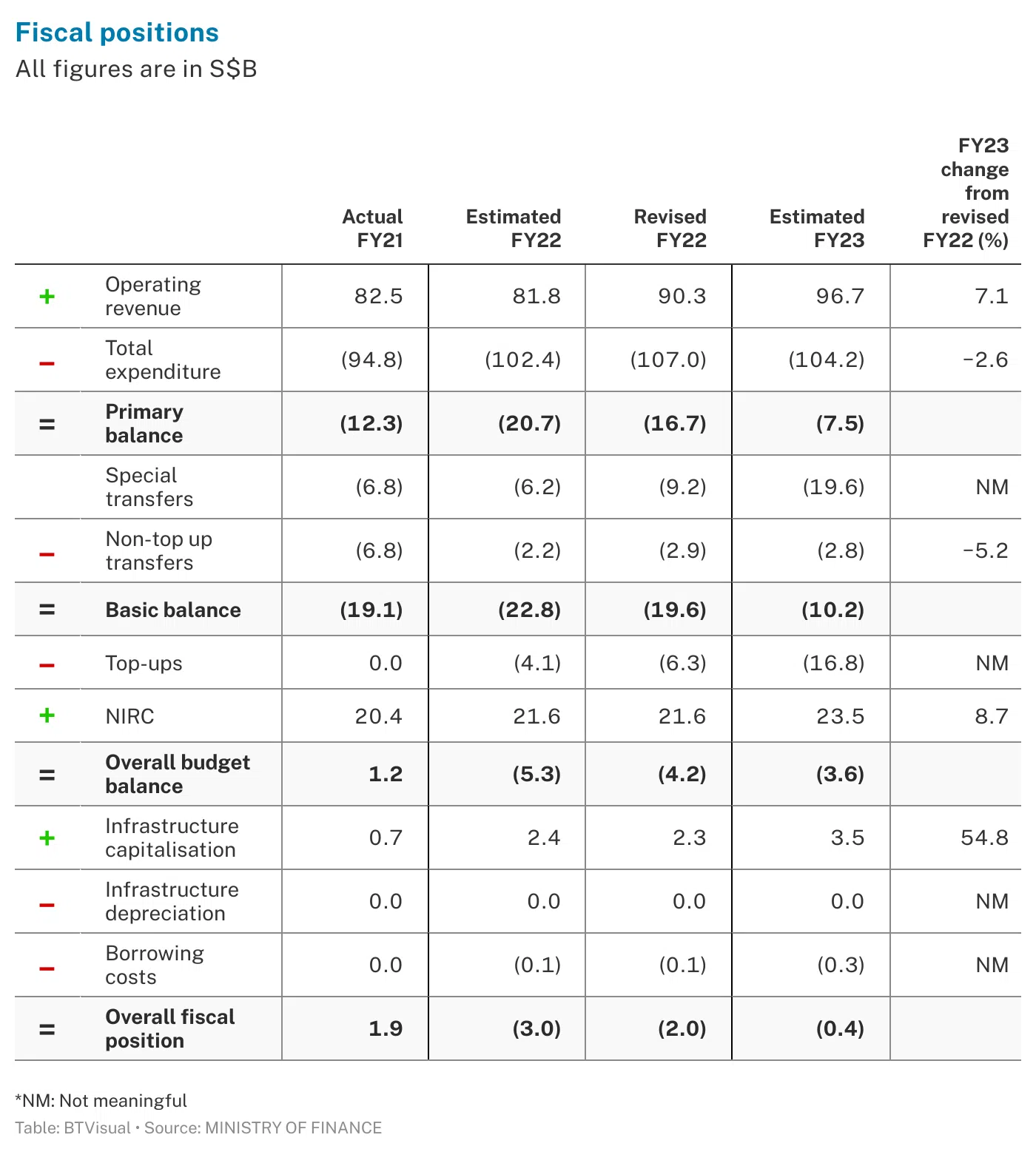

All in, the total government expenditure for Financial Year 2023 is S$123.7 billion (or 18.2 per cent of GDP), comprising ministry expenditure, special transfers and top-ups to endowment and trust funds.

Copyright SPH Media. All rights reserved.