Singapore’s core, headline inflation both rise to higher-than-expected 1.2% in October

MAS and MTI maintain their outlooks

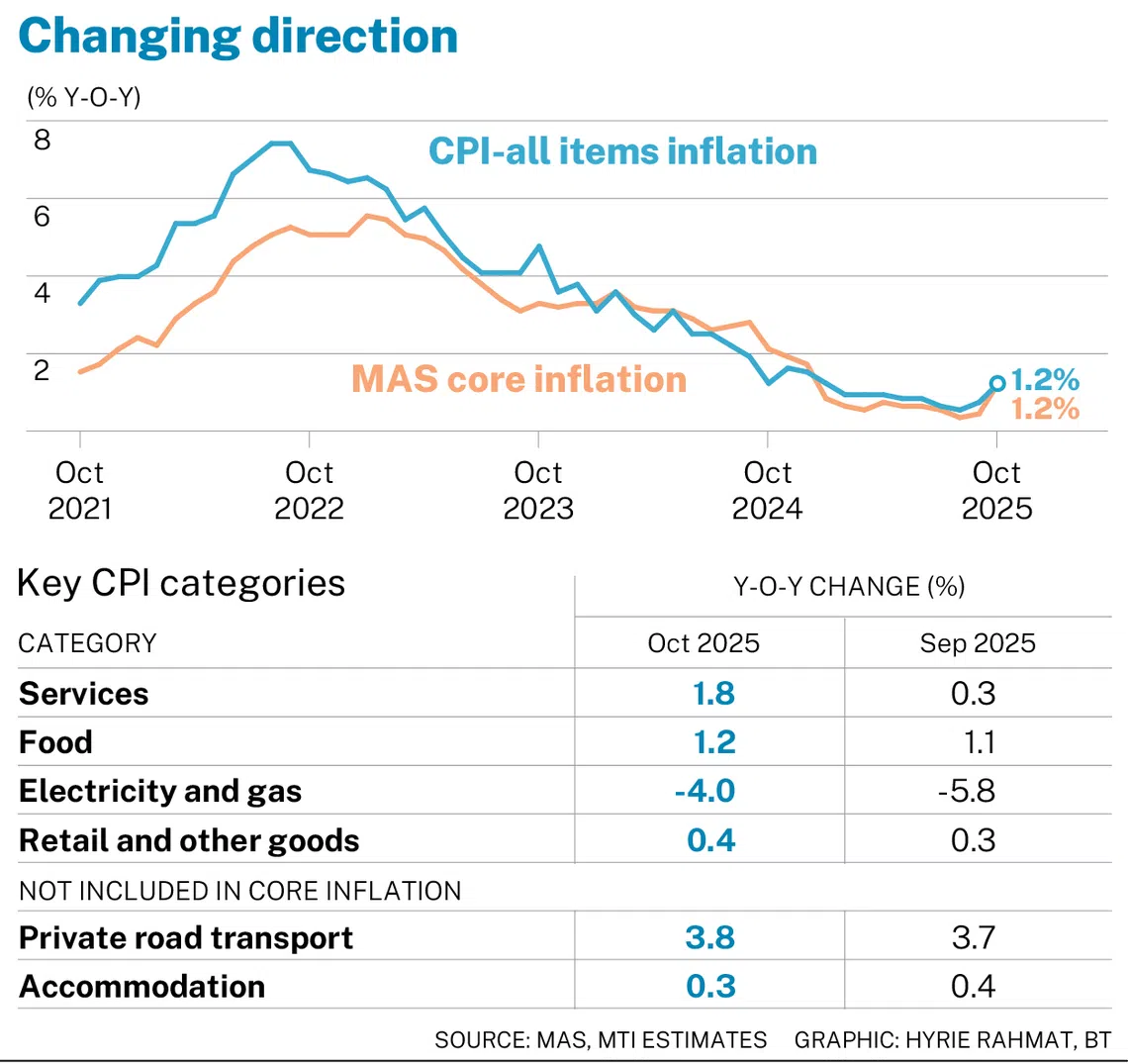

[SINGAPORE] Both core and headline inflation rose to 1.2 per cent in October, the Monetary Authority of Singapore (MAS) and Ministry of Trade and Industry (MTI) said on Monday (Nov 24). The latest figures were higher than what private-sector economists expected.

But the authorities maintained their full-year forecasts – 0.5 per cent for core inflation, and 0.5 to 1 per cent for headline inflation – even as they continued to note the uncertain outlook.

Barclays, on the other hand, raised its 2025 full-year core inflation projection slightly, to 0.7 per cent, from 0.6 per cent.

Core inflation, which excludes accommodation and private transport, was 1.2 per cent in October, up from 0.4 per cent in September, and above economists’ median forecast of 0.7 per cent in a Bloomberg poll. MAS and MTI attributed the rise in core inflation to higher inflation in services, food, and retail and other goods.

Brian Tan, head of non-China EM Asia Economics Research at Barclays, said he is “not inclined to conclude that demand-pull pressures are surging”.

After stripping uncooked food, energy (electricity and gas), and travel from core inflation to get a “supercore inflation” measure, and further excluding “various components that might have been affected by government subsidies”, Barclays found that inflation increased only slightly to 0.6 per cent year on year in October, against September’s 0.5 per cent.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Headline inflation, at 1.2 per cent in October, was also higher than September’s 0.7 per cent – and above Bloomberg’s consensus forecast of 0.9 per cent. The higher headline inflation was due to a larger increase in private-tranport prices, alongside higher core inflation, MAS and MTI said.

DBS senior economist Chua Han Teng noted that core inflation marked its highest rate since December 2024; and headline inflation, January 2025.

On a month-on-month basis, the core consumer price index (CPI) grew 0.5 per cent, while the all-items CPI was unchanged.

For 2026, the authorities expect both core and headline inflation to average 0.5 to 1.5 per cent.

The wording of their outlook statement was nearly identical to that of the previous month.

Uncertain outlook

The Republic’s imported costs should continue to decline – albeit at a slower pace – in the months ahead, they said. They noted that global crude oil prices in particular are expected to fall more gradually next year compared with 2025, while regional inflation “should pick up modestly after their weak outturns this year”.

Domestically, “administrative factors” that are temporarily dampening inflation are expected to continue tapering over the coming quarters, MAS and MTI added. They expect unit labour costs to begin to increase as productivity growth normalises, and for private consumption demand to remain steady.

But uncertainties remain. The authorities believe that supply shocks, including those due to geopolitics, could abruptly lift imported costs.

A sharper-than-expected weakening in global demand could also keep core inflation lower for longer.

“Another significant decline in global oil prices could also temporarily tamp down the pace of price increases,” they added.

Economists agreed that MAS is unlikely to change its monetary policy stance, at least in 2026.

Though he flagged that near-term risks are tilted towards easing, Tan’s base case is still for MAS to stick to the status quo till 2027.

“The optically higher core CPI figure further reduces any pressure on the MAS to ease due to low inflation,” said Tan. He believes that such pressure was low anyway, considering MAS’ focus on economic growth.

“And on that front, we suspect policymakers remain cautious despite recent positive surprises.”

He said MAS “needs to be convinced that the output gap is set to sink into significantly negative territory” before it further reduces the slope of the Singapore dollar nominal effective exchange rate policy band to zero. This is unlikely if the export cooldown proves to be relatively manageable, as is now expected.

Chua said the Q3 bottoming of inflation was in line with MAS’ expectations and coincided with stronger-than-expected economic growth, which supported the central bank’s decision to maintain its monetary policy stance in October. The current settings “appear consistent with a narrower 0 per cent output gap and higher core inflation of 0.5 to 1.5 per cent in 2026”, he added.

He expects MAS to “keep the powder dry in 2026”, maintaining its three monetary policy parameters and “safeguarding flexibility in an uncertain global environment”.

Key CPI categories

In October, there was higher inflation in most CPI categories.

Services inflation reached 1.8 per cent, up from September’s 0.3 per cent, due to a faster pace of increase in health insurance costs, as well as a rise in healthcare services costs and holiday expenses.

“The MAS noted in its October 2025 Macroeconomic Review that the sizeable disinflationary impact of healthcare subsidies introduced in October last year will drop out from year-on-year calculations,” Chua pointed out.

He also noted that travel-related services price changes turned positive. This was partly due to low base effects, he said, adding that administrative price changes for green transition, such as the new sustainable fuel levy on airfares, could support travel-related inflation in 2026.

Food inflation edged higher to 1.2 per cent, compared with 1.1 per cent in the preceding month. This was on the back of a faster increase in non-cooked food prices.

Retail and other goods prices increased to 0.4 per cent in October, marginally higher than 0.3 per cent in September. This was on account of a rise in the prices of clothing and footwear, as well as personal effects.

Private-transport inflation ticked up to 3.8 per cent from 3.7 per cent before, due to a steeper increase in car prices.

Accommodation inflation, on the other hand, eased to 0.3 per cent from 0.4 per cent previously, as a result of smaller increases in housing rents.

Electricity and gas prices fell by 4 per cent, less steeply than 5.8 per cent in September, due to a smaller decline in electricity prices.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.