Singapore’s factory output growth down to 1.2% in October, misses expectations

This is lower than the 2.6 per cent expansion private-sector economists were expecting

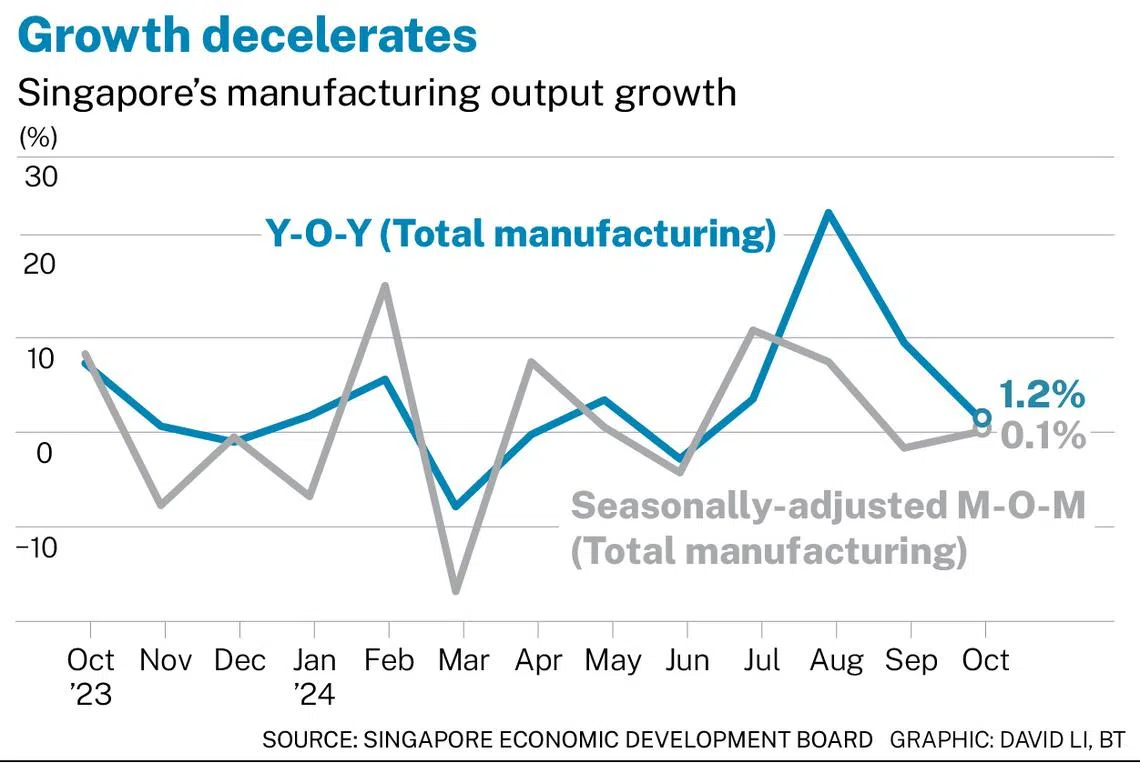

SINGAPORE’S factory output rose 1.2 per cent year on year (yoy) in October, a far more modest increase than in the previous month’s surprise jump, data from the Economic Development Board (EDB) showed on Tuesday (Nov 26).

This was also lower than the forecast given by private-sector economists polled by Bloomberg, who predicted a 2.6 per cent expansion.

Excluding the typically volatile biomedical sector, last month’s industrial production grew just 0.4 per cent yoy, easing from September’s revised 3.6 per cent growth.

The month’s worse-than-expected performance was dragged by the biomedical manufacturing cluster, which clocked a much reduced 7.8 per cent growth, compared to the 62.3 per cent jump in September.

Within the cluster, pharmaceutical output decelerated sharply to clock 10.5 per cent growth, from a 143.9 per cent rise the previous month.

For the rest of 2024 and into the next year, growth momentum in trade-related sectors – including manufacturing – should be sustained, supported by the ongoing upturn in the electronics cycle, said UOB associate economist Jester Koh.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Output in the linchpin electronics cluster edged up 4.3 per cent, accelerating from the previous month’s 0.9 per cent increase.

All electronic segments recorded output growth on the back of improved orders, said EDB, with the computer peripherals and data storage segment clocking the biggest increase at 22.9 per cent.

There could also be “some front-loading of exports and attendant ramp up in production ahead of (Donald) Trump’s proposed tariffs on US imports”, added Koh.

SEE ALSO

Earlier on Tuesday, US president-elect Trump announced that he plans to slap a 25 per cent tariff on all imported goods from Mexico and Canada into the US. He also wants to impose an additional 10 per cent tariff on all Chinese goods.

Against this backdrop, Singapore’s manufacturing outlook remains cloudy in 2025, said UOB’s Koh, and downside risks could emanate from further protectionist measures under Trump.

Other downside risks include elevated geopolitical tensions, a possible peak in the electronics cycle, and uncertainty over the pace of monetary easing by major central banks.

Despite October’s slowdown, last month still marked the fourth straight month of output growth and “remained better than the declines observed in some months of the first half of 2024”, noted DBS economist Chua Han Teng.

“We expect still-resilient external demand and favourable base effects to support Singapore’s manufacturing expansion during the final months of 2024,” he added.

Cluster performance

Transport engineering grew 10.9 per cent, a turnaround from September’s 0.6 per cent contraction.

The remaining segments clocked yoy declines in production last month:

- Chemicals (-2.2 per cent)

- Precision engineering (-15.9 per cent)

- General manufacturing (-0.6 per cent)

On a seasonally adjusted monthly basis, October’s manufacturing output nudged up just 0.1 per cent, reversing from the previous month’s 1.5 per cent decline.

Excluding biomedical manufacturing, factory output fell 1.9 per cent, contracting at a slower pace than September’s 9.2 per cent fall.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.