Singapore firms could grow revenue by S$12.3 billion from EnterpriseSG support in 2025, down from 2024

10,000 skilled jobs are also expected to be created through transformative projects undertaken by 2,400 companies last year

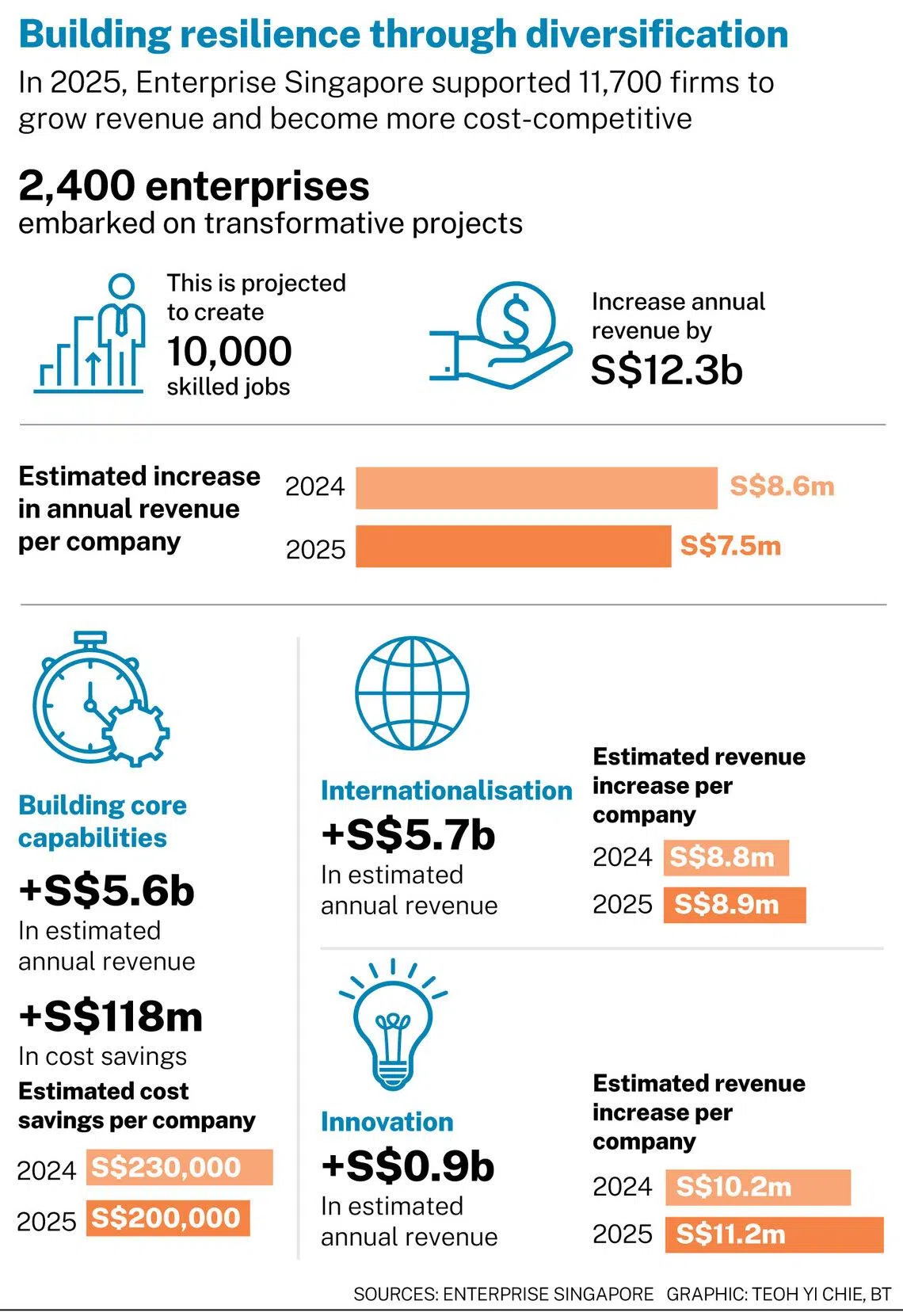

[SINGAPORE] Amid a volatile macroeconomic environment in 2025 fraught with trade tensions and disruptions, Singapore companies are expected to grow their annual revenue by S$12.3 billion and create 10,000 skilled jobs through projects supported by Enterprise Singapore (EnterpriseSG).

These forecasts are lower than 2024’s figures – when projected revenue stood at S$14.5 billion and jobs growth at 12,300 – but are “not surprising” given the gloomier global outlook, said chairman Lee Chuan Teck at EnterpriseSG’s annual media briefing on Wednesday (Jan 28).

He pointed out that 2025 was a “very turbulent” year, with the government bracing itself “for the worst”, following the announcement of US President Donald Trump’s Liberation Day tariffs.

Yet, “things did not turn out as bad” overall, Lee said, noting that global growth slowed less than anticipated and that Singapore’s economy stayed resilient with gross domestic product growth of 4.8 per cent.

He attributed this to two key factors: the delay of US tariffs, which eventually proved lower for “many countries” after negotiations; and a surge in artificial intelligence (AI) investments, which boosted global growth and electronic exports for Singapore.

In 2025, EnterpriseSG supported 11,700 enterprises to grow their revenue and strengthen cost competitiveness – slightly above 2024’s figure of 11,500.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

This included 2,400 companies – more than the previous year’s 2,300 – that embarked on transformative projects, contributing to projected revenue growth of S$12.3 billion and the creation of 10,000 skilled jobs.

Transformative projects are larger-scale projects focused on business transformation, the development and implementation of new business strategies to deepen market presence or the creation of new products to expand revenue streams.

Rather than putting things off due to the “volatile and uncertain” environment, Lee said that companies forged ahead with their transformation and growth plans.

Notably, projects companies embarked on were focused on building resilience through diversification.

“(For) several months after April, many companies adopted a wait-and-see mode. But surprisingly, many leaped back into action soon after.”

But he noted that the scale of projects in 2025 have shrunk overall, as smaller companies were careful about embarking on initiatives that require large investments and capital expenditures.

Projects undertaken in 2025 translated to an average of S$7.5 million in additional revenue per company, down from S$8.6 million in 2024.

2025’s scorecard

In terms of internationalisation, EnterpriseSG supported companies in 2025 to diversify their market presence and build supply-chain resilience.

This is especially for those affected by global tariffs, with the statutory board helping them to expand their operations to alternative markets such as Europe.

Lee highlighted that EnterpriseSG assisted companies to enter 76 new markets in 2025, “the most varied” footprint in the past five years.

Firms explored new opportunities in far-flung markets such as Angola and Fiji, be it for early-stage business development activities or to cultivate new strategic partners.

On the whole, these internationalisation projects are expected to raise companies’ annual revenue by S$5.7 billion, translating to an increase of S$8.9 million in annual revenue per company – on a par with 2024’s estimates.

For innovation, EnterpriseSG helped companies develop new products and solutions as a way to diversify their revenue streams and increase business competitiveness.

These moves are projected to boost their annual revenue by about S$900 million, translating to an increase of S$11.2 million in annual revenue per company.

As for building core capabilities to become more cost-efficient, companies that embarked on such projects with EnterpriseSG’s support estimate an increase of S$5.6 billion in annual revenue, and a reduction of annual costs by S$118 million.

Among those that implemented cost-competitiveness projects – such as automation and process redesign – each expect to reduce their annual costs by S$200,000 on average.

These forecasts represent a decline from 2024, with projects in that year expected to boost annual revenue by S$8.2 billion and result in cost savings of S$230,000 per company.

Lee said that many capability-building projects in 2025 were software-related, which cost less and, in turn, reap fewer gains.

Meanwhile, companies are also requesting more guidance in navigating the challenging trade and tariff environment and how to strengthen their business, said Lee.

To that end, EnterpriseSG has deepened its advisory services by setting up the Centre for the Future of Trade and Investment in partnership with the Singapore Business Federation.

Business advisers at its SME (small and medium-sized enterprise) Centres were also equipped with new skills to better advise companies on their business journeys. In 2025, the statutory board supported almost 30,000 companies through its SME Centres.

Focus for 2026

For 2026, Lee cautioned that the outlook “remains precarious”.

“The global trading environment has not stabilised. New risks loom in the horizon, including geopolitical conflicts and growth headwinds like high global debts,” he said.

He added that tariffs will continue to be a looming concern “for a long time”, with sectoral tariffs on semiconductors and pharmaceuticals to affect Singapore and the risk of trade diversion as a knock-on effect from tariffs.

In light of the uncertain external economic environment, EnterpriseSG will deepen efforts to help Singapore enterprises build resilience and seek new growth opportunities in 2026.

The statutory board hopes to see a “similar number” of companies undertaking transformative projects this year, said Lee.

But he does not expect revenue growth and job creation to reach the extent of the “rosy” figures seen in 2024, which saw a “wave of enthusiasm” from companies in the aftermath of the Covid-19 pandemic.

For the year ahead, EnterpriseSG will first strengthen support to help Singapore companies internationalise, through venturing into new markets and navigating the evolving business and tariff landscape.

It will deepen its overseas footprint by operating new overseas centres and work with trade associations and chambers (TACs) to provide in-market support for businesses. This year, two more centres will be set up in the US and maybe more in other regions “as the need arises”, said Lee.

Second, EnterpriseSG will help companies across sectors use AI to transform their business and uplift efficiencies, while working with industry partners to develop transformative AI solutions to address industry needs.

Third, it will reach out to more enterprises through its new digital platform, myEnterprise. It will also help TACs strengthen their governance and build new capabilities in areas such as talent management and technology, so they can scale and better support businesses.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.