From $354m to $382b: S’pore holding company grows as an active global investor

An ‘unplanned experiment’, it was entrusted with an eclectic mix of companies in 1974. Investing across generations, its portfolio now spans sectors and continents

AT age 33, she took whatever work she could find, from repairing gunny sacks used to transport rice to cleaning the offices on Pulau Bukom, an offshore petrochemicals site.

“Jobs were hard to find at that time,” says Madam Lim Kah Eng in a mix of Mandarin and Teochew. The 90-year-old, who retired in her 60s, adds: “We had to support our family so we couldn’t be picky.”

The year was 1967. Singapore had just issued its first notes and coins.

The Beatles released its album Sgt Pepper’s Lonely Hearts Club Band and Hong Kong actress Nancy Sit was at the Metropole Cinema (now home to Fairfield Methodist Church) promoting her latest films.

Singapore had only two years earlier separated from Malaysia; the Republic was taking baby steps towards nationhood when it was rocked by news of the British military’s impending withdrawal.

About 20 per cent of Singapore’s economic activity was attributed to the British forces and related industries then. An estimated 30,000 jobs would be lost.

“It was hard,” acknowledges the sprightly matriarch, who has five children, nine grandchildren and four great-grandchildren, “but there was no use worrying. We just did our best day by day and kept moving forward.”

Madam Lim’s can-do spirit was forged by necessity, characterised by resilience and a commitment to provide for the next generation.

Her tenacity, enterprise and energy personifies Temasek’s growth: Birthed by a generation fighting for survival, it now nurtures a legacy for generations to come.

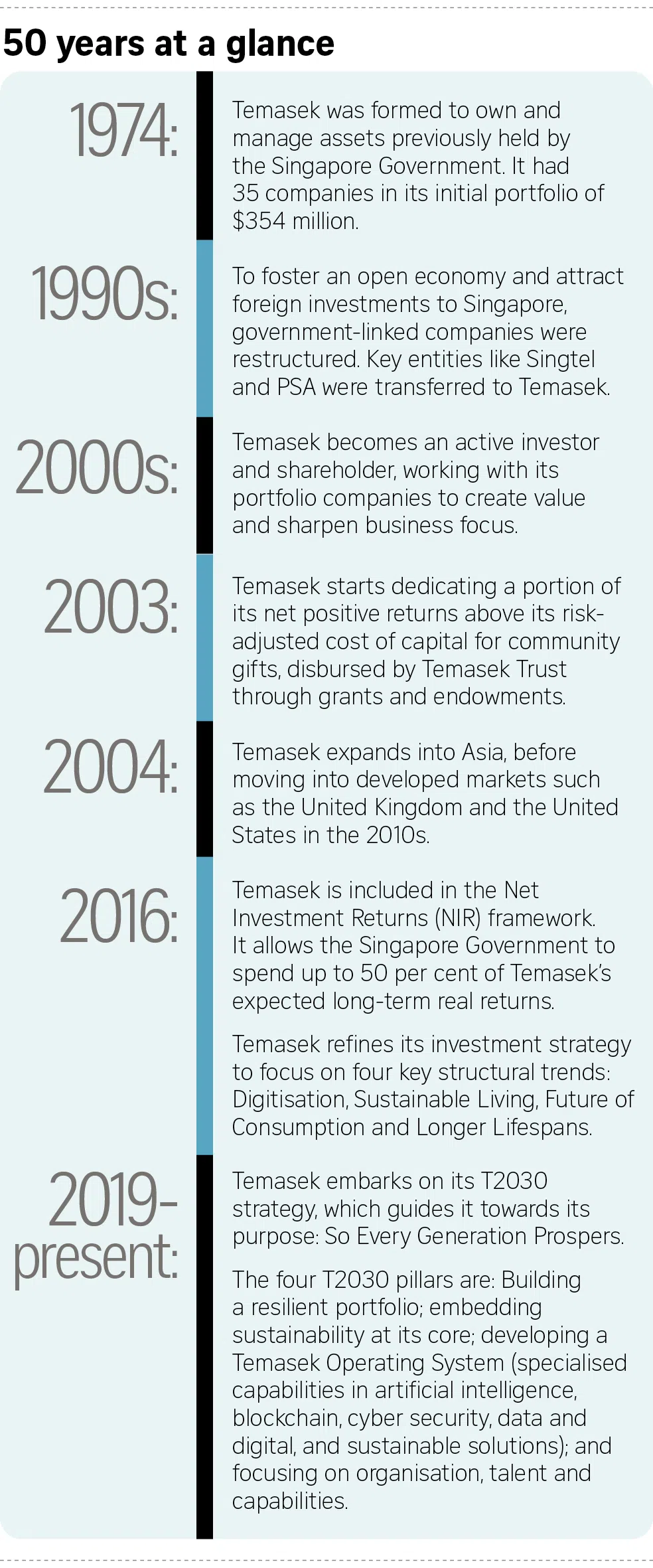

Temasek, which marks its 50-year milestone this year, was formed to own and manage assets previously held by the Singapore Government, which could then focus on its core role of policy-making and legislation. Temasek’s initial portfolio was valued at $354 million.

“Up until the 1990s, Temasek functioned mainly as a holding company and commercial shareholder,” explains Mr Dilhan Pillay, CEO of Temasek, “that saw to the industrialisation, expansion, and globalisation of our portfolio companies, which grew in tandem with Singapore’s economy.”

“Our portfolio companies were growing from strength to strength, but Temasek itself was a passive investment holding company at that time,” he explains.

Even when Temasek invested, it was mainly in funds or to support its companies, such as in their expansion plans or investing alongside them in overseas ventures or joint ventures.

Sharpening its role

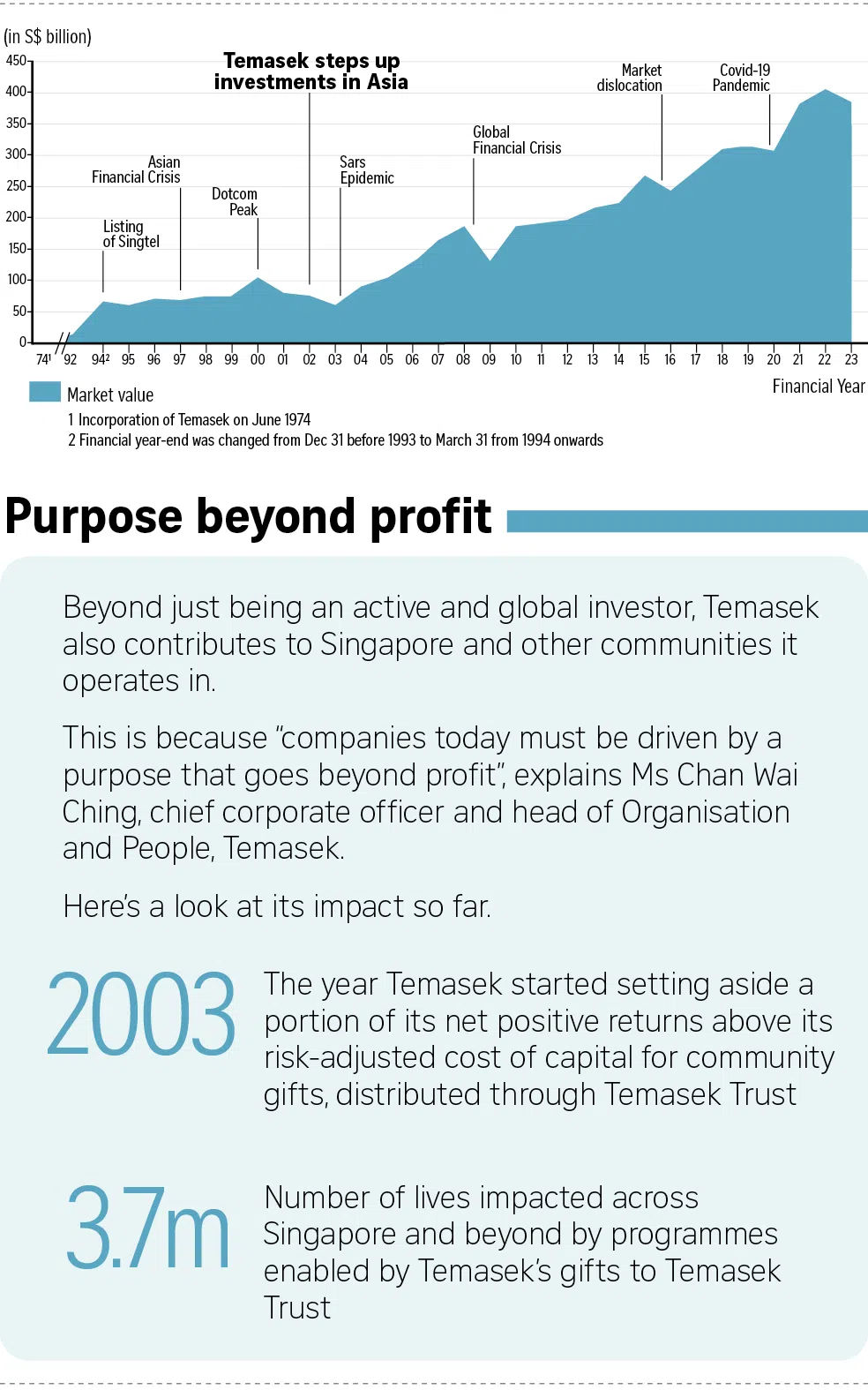

Today, Temasek is no longer a passive holding company; it has a $382 billion portfolio, with a 20-year total shareholder return of 9 per cent as at 31 March 2023. How did it evolve?

A key shift happened in 2000. Port and terminal operator PSA was gearing up to go public then.

But Temasek, its shareholder, felt that the company needed to prioritise restructuring its portfolio instead.

“The market conditions were not ideal, and we felt that PSA needed to implement radical changes,” explains Ms Juliet Teo, head of Temasek’s Portfolio Development Group and head of the Singapore Market.

“We recognised the need to engage our portfolio companies closely to see where we could create value.”

PSA had accumulated a large and varied portfolio of assets by 2000, including a cruise centre, cable car operations, real estate holdings and even exhibition centres, on top of its core port operating assets.

The biggest of these peripheral businesses was real estate holdings, says Ms Teo, comprising offices, flatted factories (multi-storey industrial buildings with multiple tenants) and logistics-related “distriparks”.

These were carved out into real estate company Mapletree.

By focusing on its core competency, PSA could expand globally and “improve its performance dramatically”, says Ms Teo. “Even today, we continue to actively engage the board on its strategic growth plans.”

PSA International’s portfolio currently encompasses over 60 deep-sea, rail and inland terminals. These are located across more than 170 locations in 45 countries.

It has 55,000 employees globally, of which 12,000 are in Singapore.

Navigating complexity

Temasek’s transformation helped to set the stage for the company to take a more hands-on approach, as it ventured overseas in the early 2000s.

Its presence has grown to 13 offices across nine countries today.

As a global investor, navigating complexity – from Sars in 2003 and the Global Financial Crisis in 2008 to the ongoing Covid-19 pandemic – is par for the course.

The landscape is likely to remain complex and uncertain, notes Mr Pillay, with worldwide challenges including technological disruptions, environmental risks, geopolitical tensions, and changing economic conditions.

How does Temasek plan to move forward?

The answer lies in its T2030 strategy – a 10-year roadmap that guides Temasek’s decision-making, strategic planning and talent development, towards its purpose: So Every Generation Prospers.

The strategy is a culmination of the lessons learnt throughout Temasek’s history, applied against the backdrop of today’s complexities.

“One lesson we’ve learnt and continue to learn is how to balance risk in our portfolio,” says Mr Pillay. “Today, our portfolio comprises resilient and dynamic components to ensure sustainable returns while being able to invest in areas with potential for high growth.”

“One lesson we’ve learnt and continue to learn is how to balance risk in our portfolio. Today, our portfolio comprises resilient and dynamic components to ensure sustainable returns while being able to invest in areas with potential for high growth.”

Mr Dilhan Pillay, CEO of Temasek

Its T2030 strategy also highlights the value of collaboration. “As we grow in size and capabilities, we recognise that we don’t have all the skill sets necessary for our objectives,” says Mr Pillay.

“We need to be a globally networked organisation, augmenting our capabilities with the skill sets of our ecosystem partners,” he adds. These partnerships enable Temasek to identify opportunities and develop solutions to address challenges in the complex global environment.

Looking ahead, Mr Pillay affirmed Temasek’s commitment to “doing well, doing right, and doing good, always with tomorrow in mind”.

“As a long-term investor rooted in Singapore, we will navigate these changes proactively to ensure resilient, sustainable returns for generations to come,” says Mr Pillay.

Temasek can, at 50, look back at how it has successfully overcome crisis after crisis to reach its current position.

So, too, can Madam Lim look back with pride at the legacy she has built. Seeing her five children, nine grandchildren and four great-grandchildren flourish is her greatest reward, she says.

“All the hard work that I went through,” she says, “I did it for my family.”

This was produced in partnership with Temasek.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.