Fraudsters target businesses as well: Here’s how DBS helps educate its corporate customers on how to stay safe in the face of AI-powered scams

As corporate scams grow more sophisticated, and scammers masterfully exploit the human psyche and thrive on uneven defences, multi-layered defences and vigilance are crucial for businesses to stay ahead

Millions of people are using generative artificial intelligence (GenAI) apps like ChatGPT to work faster and get better results. So are scammers, who are now churning out perfectly written e-mails and realistic deepfakes to target business owners or employees who have payment or procurement functions.

The scale of the threat is staggering. Between June and September 2025, the Singapore Police Force reported at least 384 government official impersonation scam cases, affecting both individual and corporate victims, with total losses amounting to at least $20.2 million.

In early 2024, CNN reported how a finance worker at a multinational company in Hong Kong was tricked into paying out US$25 million to scammers posing as the company’s chief financial officer and other staff. The worker attended a video call where the other attendees were deepfakes of his colleagues, and he was convinced enough to remit the funds to the scammers.

These are not isolated incidents – they are part of a global surge of AI-powered fraud. By 2027, 17 per cent of cyber attacks globally will involve the use of Gen AI, according to research firm Gartner. Scammers are combining their tech savvy with their knowledge of human psychology and cognitive biases to swindle millions from businesses.

Banks are witnessing the rise in business-targeted scams up close.

“As the use of GenAI becomes more prevalent, the speed at which scammers work exponentially increases,” says Aaron Chiew, group head of digital channels at DBS Bank’s institutional banking group.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

“In the past, it would take a team of scammers several hours to sift through Excel lists of potential victims, piecing together information from various sources. Today, GenAI helps them rapidly process vast datasets to identify all the potential targets with speed and scale.”

Prompting users to pause

Scams do not even need to be elaborate. Chiew says: “Recently, we’ve seen several cases of Business E-mail Compromise scams.”

Such scams often begin with a company receiving an e-mail seemingly from their regular supplier, asking for payment of recently purchased goods.

“The supplier would say that their bank account number has changed, so would you mind paying to this bank instead of the other bank?” he adds.

These scams are carefully targeted. Scammers identify and go after specific employees who have the authority to change payment details and process transactions – typically those in finance, procurement or account payable roles.

A key feature DBS has added to tackle scams like this is what Chiew calls “cognitive breaks” on their digital banking platform for businesses, DBS IDEAL.

“Whenever a user adds or edits a payee on DBS IDEAL, a warning pop up appears to remind the user to verify if the request is real,” he says. “We believe these cognitive breaks have prevented numerous scams as we’ve seen many payments get initiated but the client chose not to complete it.”

This is just one of several layers in DBS’ Scam Defence strategy to help businesses withstand the growing onslaught of cyber attacks.

Four pillars that protect

DBS pairs public education with threat detection on its platforms through four key pillars: Educate, Detect, Collaborate and Prevent.

The first pillar, Educate, focuses on driving awareness through public education campaigns and monthly newsletters on the latest scam types to customers. DBS also has a regularly updated Scam Defence hub for customers to learn about the latest scam typologies, and find official contact points to reach out for help and investigation if they suspect you have been targeted.

“Business owners have a big role to play in protecting their businesses and educating their employees,” says Chiew. “It only takes a single loophole or gap – and for scammers, finding and exploiting these gaps is a full-time job.”

The Detect pillar is where DBS uses pre-screening checks and anti-malware controls to spot anomalies early. Suspicious cases are escalated for human oversight, as human discernment remains a critical feature in the bank’s anti-scam efforts.

The Collaborate pillar involves sharing intelligence and aligning best practices across banks, regulators and industry partners.

Finally, the Prevent pillar comprises fraud monitoring, real-time alerts, cognitive breaks, safety switches and links to national databases to help stop suspicious transfers and bad actors.

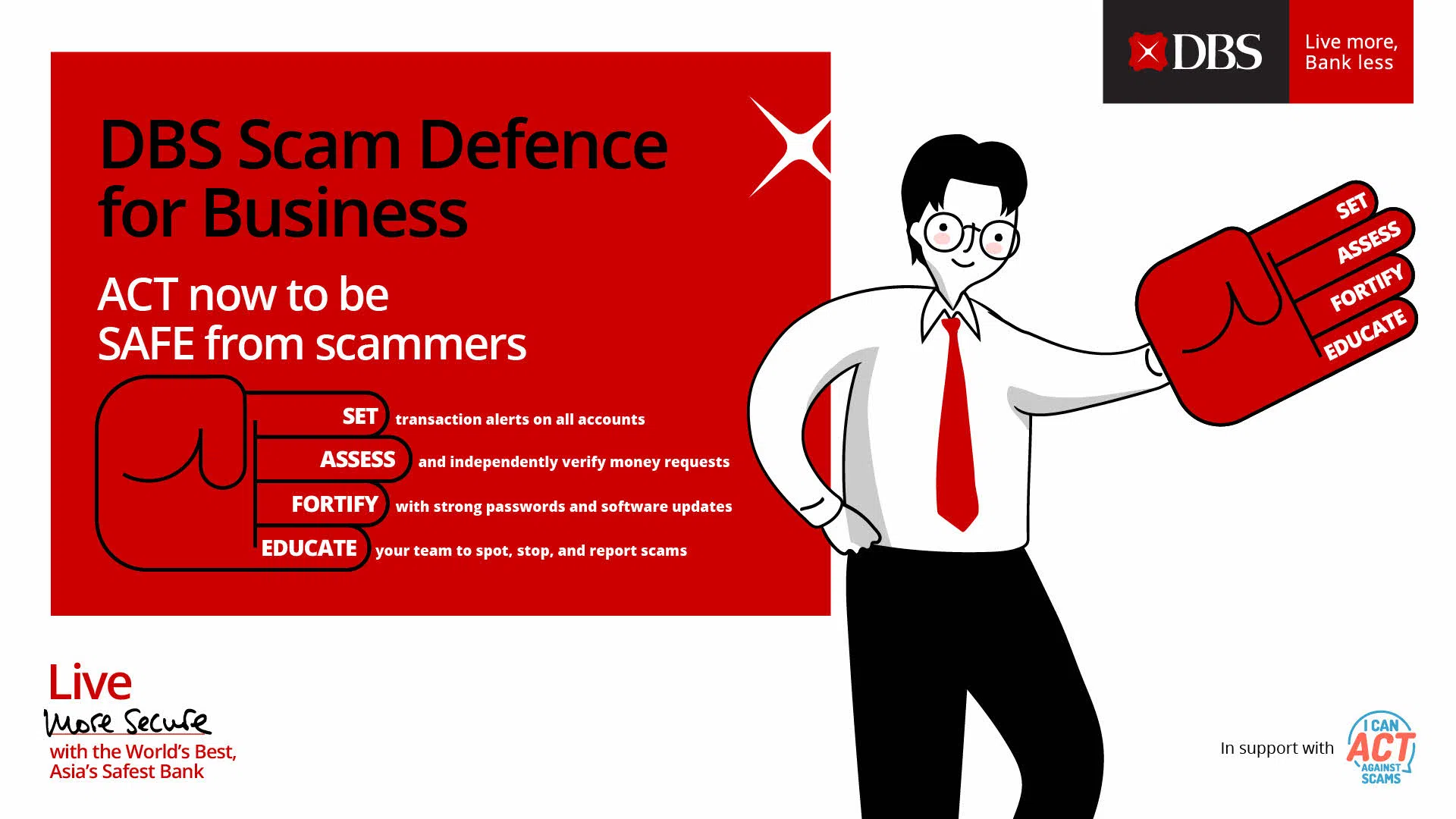

A simple checklist that business owners can review today is based on DBS’ S.A.F.E. approach:

- Set up transaction alerts to track account activity

- Assess and verify all financial or account-related requests

- Fortify with strong passwords and keep software updated

- Educate employees to recognise and report suspicious activity

Chiew asserts that deterring fraud demands more than just robust security protocols and constant vigilance from business owners and employees. It necessitates a keen awareness of inherent human cognitive biases and blind spots.

A prime example is authority bias, the innate human inclination to trust or comply with authority figures, which explains the recent rise in government official impersonation scams.

In the past year, small businesses have fallen victim to scammers pretending to be from prestigious schools or government organisations making large orders of food or services.

“Unfortunately, the lure of large orders is a strong one for small businesses who are trying to sustain their operations,” Chiew says.

“But if it’s too good to be true, it usually is worth double checking.”

Companies need to act now to start building awareness and discernment, because the scams will only get more sophisticated over time.

Chiew says: “With the advances in AI, it is possible in the foreseeable future that an avatar could realistically impersonate a real person.”

Only through continuous vigilance and a well-informed workforce can businesses build the resilience needed to remain secure , ahead of ever evolving cybersecurity and scam threats.

To better defend your business against scams, visit the DBS Scam Defence Hub.

Share with us your feedback on BT's products and services