Financing emerges as new cost challenge for SMEs: survey

SMEs now have to deal with higher interest rates, tightened access to credit and higher collateral

Singapore

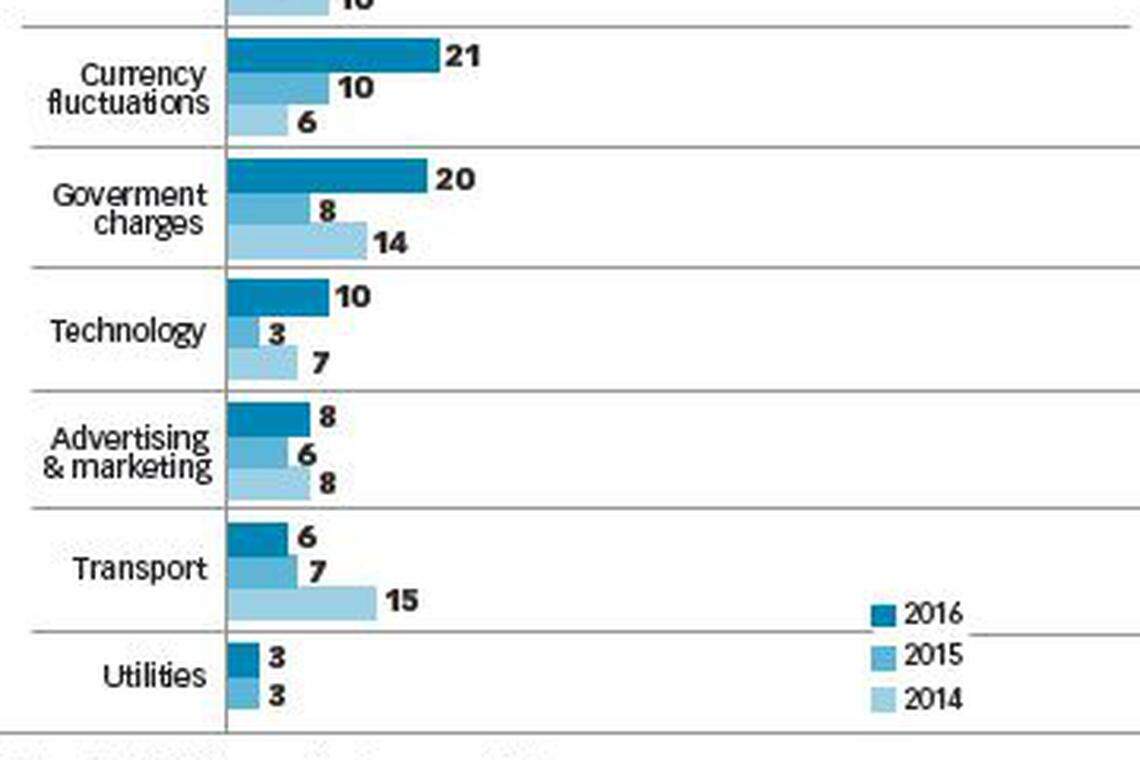

SMALL and medium-sized enterprises (SMEs) continue to face cost challenges on the usual three fronts - manpower, materials and rents - but a new one has cropped up, and it is the cost of financing.

The 2016 SME Development Survey carried out by DP Information Group found this to be now the fourth biggest cost issue among SMEs. Last year, it was named as an issue by 6 per cent of the survey sample; this year, it was 22 per cent.

SMEs still identified manpower costs as their top challenge, but while 75 per cent of the survey respondents cited this as an issue in 2015, only 72 per cent did so this year.

The percentage of SMEs with materials cost challenges also fell, from 37 per cent last year to 33 per cent this year; ditto for those naming rental cost as an issue, from 36 per cent in 2015 to 24 per cent this year.

The annual survey, now in its 14th year, polled 2,513 respondents from SMEs across all sectors.

Of the SMEs with financing issues, 46 per cent named higher bank interest rates as their biggest problem; 34 per cent said their suppliers were tightening credit access, 19 per cent said they had to provide more collateral to maintain their loans.

Lincoln Teo, chief operating officer of DP Info, said: "Banks and institutions have become more cautious about lending to SMEs, and this is reflected in a higher cost of funds."

He added that a lack of access to affordable financing can trap SMEs in a "downward spiral" - one where they are unable to grow without more funds, but they cannot get funds without more growth as well.

Across all sectors, more SMEs are looking to acquire financing in the next year; the retail and manufacturing sectors show the biggest jumps, up 13 per cent and 10 per cent respectively.

Supplementing working capital remains the biggest reason for seeking additional financing, at 46 per cent. This is followed by asset acquisition (23 per cent) and repayment of existing loans (21 per cent).

Bank loans remained the key financing facility that SMEs consider (66 per cent), followed by financing assisted through government funding schemes at 24 per cent.

In keeping with the times, new additions to this year's survey options on financing facilities included crowdfunding (2 per cent) and peer-to-peer lending (1 per cent). Mr Teo said that SMEs are not yet moving in the direction of these non-traditional financing sources, but he did not rule out this catching on down the road.

The survey found that, to cope with costs, SMEs are turning to raising productivity (42 per cent), sourcing for cheaper supplies or raw materials (19 per cent) and reducing of overheads (17 per cent).

One concern of note was that 7 per cent of SMEs said they will downsize their operations, up from 2 per cent in 2015 and 2014. Mr Teo said this does not necessarily mean that these SMEs are retrenching staff; they could instead be cutting down on physical branches, production lines or product offerings.

The DP Info survey also examined SMEs in terms of what they are doing on the skills-training front - a key priority of the Singapore government.

While 68 per cent of SMEs said they have invested in manpower development, 85 per cent of them said they were hindered in their efforts to upgrade their employees' skills. In particular, manufacturing firms faced the most obstacles at 90 per cent, and retail firms, the least, at 74 per cent.

Among those facing obstacles, about half have problems committing staff for skills training due to a lean workforce, followed by 38 per cent which said they have other priorities to focus on.

Mr Teo said: "The survey shows that implementing training and development strategies while keeping their employees focused on the business is a delicate balance, and one which SMEs will struggle with during the next few uncertain years." However, one bright spot found in the report was that 78 per cent of SMEs are receptive to engage professionals, managers, executives and technicians (PMETs) over the age of 40.

In response to the survey findings, Singapore Business Federation CEO Ho Meng Kit said that the results was no surprise, as SMEs here have been grappling with the economic slowdown.

One area of concern for him was in financing, but he points out that the success rate for bank financing applications remain high at 98 per cent, which he says is "reassuring". Mr Ho added: "We will be monitoring the situation closely to assess if current government-backed loans for SMEs are sufficient to support the SME sector, or whether more help is needed."

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

SMEs

Fintech KPay aims to triple Singapore merchant base, double local workforce

Singapore SMEs in contractionary mode for fifth straight quarter: OCBC

B2K’s second-generation leaders paw a new path in pet products

Finding a growth vector with digital solutions

Striking while the flat iron’s hot

From leasing steel plates to renting out buildings