Singapore business sentiment remains positive for Q3: SCCB survey

Lisa Kriwangko

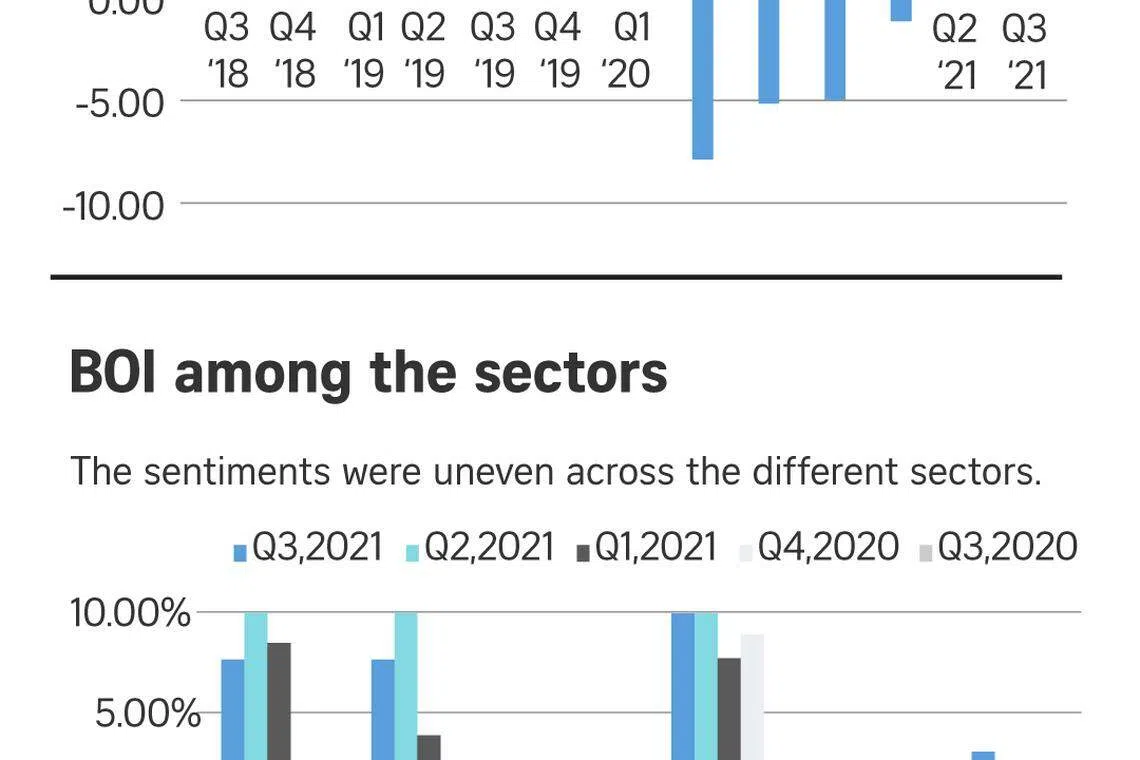

BUSINESS sentiment in Singapore has remained expansionary for the second consecutive quarter in Q3 2021.

On Monday, the Singapore Commercial Credit Bureau's (SCCB) latest overall quarterly Business Optimism Index (BOI) was at +4.07 percentage points for Q3 2021, up from +3.94 percentage points in the previous quarter, and -5.16 percentage points in Q3 2020.

That said, only three of the six of the studied indicators improved quarter on quarter, compared to all six in Q2 2021.

Business expectations for employment saw the most improvement, rising to +3.05 percentage points from its previous quarter's zero.

Selling price shifted up to +2.29 percentage points from its previous +1.53 percentage points, while inventory levels inched up to -6.11 percentage points from -7.64 in the quarter ago.

Meanwhile, new orders remained unchanged at +9.92 percentage points in Q3 2021, while both volumes of sales and net profit fell to +7.63 from the previous quarter's +9.92 percentage points.

However, the changes were not equal among the different sectors.

SCCB chief executive Audrey Chia noted that the recently tightened measures and border controls further dampened the already muted construction and transportation sectors, as well as moderated the customer-facing services sector.

With four of six indicators in the contractionary zone, the construction sector saw both volumes of sales and net profit sinking to -16.67 percentage points from -8.33 before.

Meanwhile, the transportation sector saw five of six indicators in negative territory, with new orders falling to -9.09 percentage points from zero percentage point, while inventory levels declined from +9.09 percentage points to zero percentage point. Its volume of sales, net profit and selling price remained at -18.18 per percentage points, while employment levels persisted at -9.09 percentage points.

The services sector slipped with two of six indicators in positive territory, compared to the three in Q2 2021. Both volume of sales and net profit dropped to +13.36 percentage points for Q3 2021 from +18.18 percentage points for Q2 2021.

On the other hand, the financial services and manufacturing sectors remained upbeat, with positive expectations on all fronts.

Similar to the previous quarter, the financial sector held on to its position as the most optimistic, with both volume of sales and net profit remaining expansionary at +36.36 percentage points in Q3 2021. Employment sentiment for the coming quarter also increased to +45.45 percentage points from its +36.36 percentage points in Q2 2021. (see amendment note)

Meanwhile, the manufacturing sector's volume of sales and net profit sentiment both rose to +10.71 percentage points from their previous +7.14 percentage points.

"Given the lingering uncertainties in the pandemic both locally and globally, we foresee the outlook to remain mixed and uneven across different sectors. Moving into Q3, firms will have to brace themselves for more downside risks ahead," said Ms Chia.

SCCB noted that the Ministry of Trade and Industry has maintained the gross domestic product growth forecast for 2021 to be between +4 per cent and +6 per cent.

The SCCB Business Optimism Index (BOI) is a measure of business confidence in the economy. Each quarter 200 business owners and senior executives representing major sectors across Singapore are asked if they expect increases, decreases or no changes in their upcoming quarterly sales, profits, employment, new orders, inventories and selling prices.

The index figures used in the survey represent the net percentage of survey respondents expecting higher performances compared with the same quarter of the previous year. The indices are calculated by subtracting the percentage of respondents expecting decreases from the percentage expecting increases, said SCCB in the Monday release.

Amendment note: An earlier version of this article misstated the employment sentiment in financial sectors to have increased to +45.5 percentage points from its previous +36.6, when in fact it reached +45.45 percentage points from its previous +36.36.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.