Fintech funding in South-east Asia falls 13% in Q1 amid economic slowdown: report

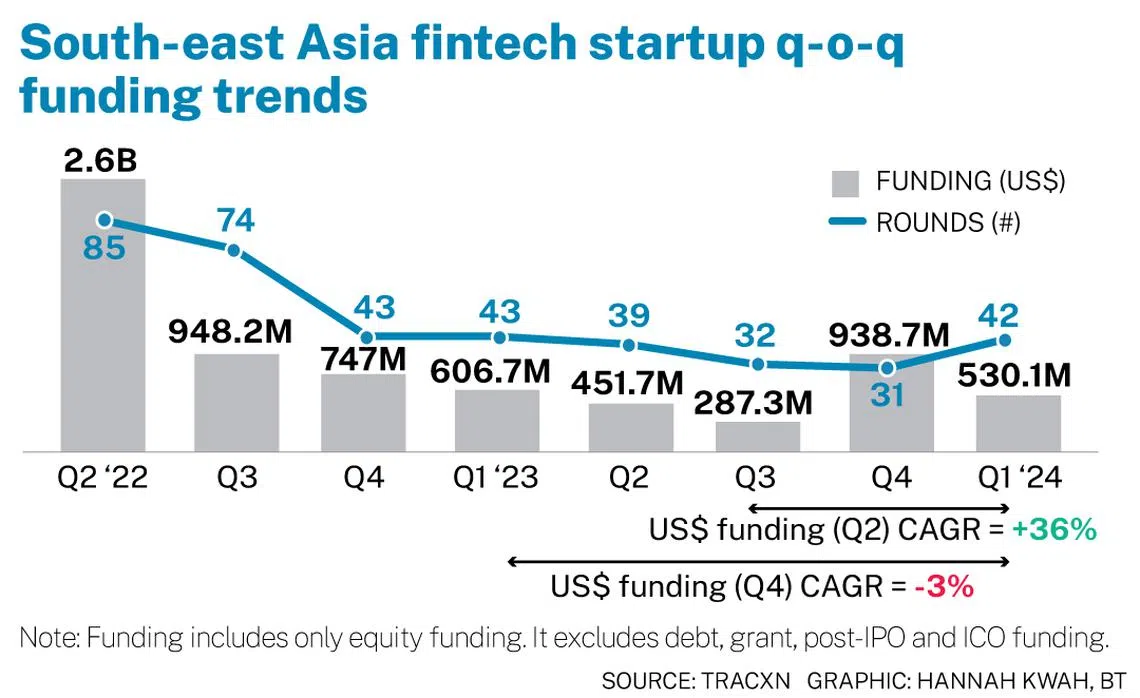

FINANCIAL technology startups in South-east Asia recorded a 13 per cent year-on-year decrease in total funding to US$530 million for the first quarter of 2024, a new report has found.

Data intelligence platform Tracxn said on Tuesday (Apr 16) that the drop was largely due to a 40 per cent decline in late-stage funding, which fell to US$270 million from US$447 million in Q1 last year.

Seed-stage investments were also down 59 per cent to US$19.4 million in Q1 2024, from US$47.4 million in the year-ago period.

However, there was an increase in early-stage investments, which more than doubled to US$240 million in Q1 2024, from US$112 million in the corresponding year-ago period.

Tracxn noted an overall downward trend in South-east Asia’s fintech startup funding since its highs of more than US$1 billion per quarter from Q2 2021 to Q2 2022. While funding grew in Q4 2023, there was a decrease again in Q1 2024.

The research platform attributed the overall decline to multiple factors including a slowdown in economic activity across industries, reduced consumer spending, and a shift in investor interest towards more sustainable and profitable businesses.

As for funding rounds, there was one round which raised more than US$100 million in Q1 2024, down from four rounds in the previous quarter and two rounds in Q1 2023.

Tracxn also noted that while the sector had no initial public offerings or new unicorns emerging in Q1 2024, the number of acquisitions doubled to 10 from five in the year-ago period.

Top-funded segments

Banking tech, alternative lending and cryptocurrency were the top-funded segments in South-east Asia’s fintech startup space in Q1 2024.

Companies in banking tech attracted US$180 million in investments in the period, up from US$5.5 million in Q1 2023. The cryptocurrency sector also had a 138 per cent increase in funding to US$91.9 million in Q1 2024.

Meanwhile, alternative lending had a 58 per cent year-on-year decrease to US$126 million in Q1 2024.

Fintech companies based in Singapore accounted for 70 per cent of total funding in the region, raising US$372 million. Jakarta, which raised US$103 million, came in second place, and Taguig in the Philippines placed third with US$32.1 million.

East Ventures, Y Combinator and 500 Global were the most active investors in South-east Asia to date, the report indicated.

As for seed-stage investments, Mirana, Bixin Ventures and Draper Dragon were in the lead. For early-stage investments, MassMutual Ventures, Nyca Partners and Illuminate Financial were the most active.

The top late-stage investor in Q1 2024 was MUFG Innovation Partners.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.