Singapore tech firms bag majority of S-E Asia funding for 9M 2025, at US$2.3 billion: report

But overall funding levels in South-east Asia have contracted year on year; the Philippines is a ‘bright spot’ in the region

[SINGAPORE] Singapore-based tech firms accounted for about 88.5 per cent of all funding by technology companies in South-east Asia in the first nine months of 2025, at US$2.3 billion, based on data from venture capital (VC) and startup research platform Tracxn.

This comes in the context of sharp declines in overall funding raised during the period – US$2.6 billion, down 7 per cent from the US$2.8 billion raised in the same period the year before. Total inflows were also down 58 per cent from 9M 2023.

The report on South-east Asia tech funding for 9M 2025 on Tuesday (Sep 30) also noted that one unicorn – Sygnum – was created during the period. This was half the number in the same period a year before, sliding to 9M 2023 levels.

The Singapore-based firm achieved unicorn status earlier this year in January, following three rounds of funding and eight investors prior to its unicorn round, The Business Times reported previously.

A total funding of US$110 million for the seed stage was recorded in 9M 2025, a dip of 72 per cent from US$386 million raised in the same period a year prior. Early-stage funding was at US$688 million in 9M 2025, down 55 per cent from US$1.5 billion raised in 9M 2024.

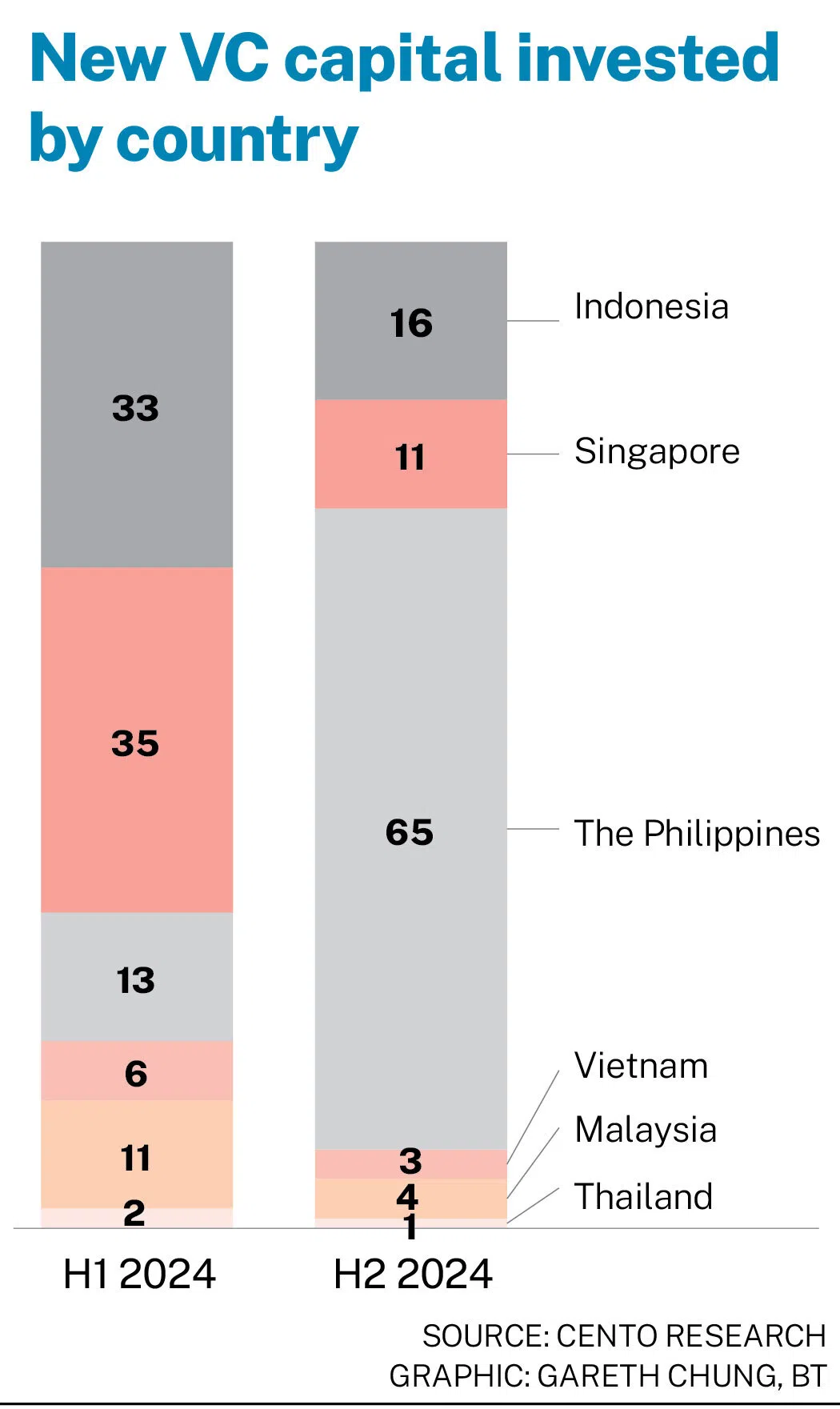

This pullback was as early as mid-2024, where Series A to early B deals were down 50 per cent from H1 2023, a Sep 19 report by VC firm Cento Ventures indicated.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The data also reflected that a “gradual slowdown” for Series B and C rounds continued in H1 2024 from the same period a year before, while Series C+ rounds stabilised.

For 9M 2025, a number of the top feeds were from data centre infrastructure at US$640 million in funding, payments at US$350 million, and artificial intelligence infrastructure at US$300 million, the Tracxn report said.

The top early-stage investor in the South-east Asian tech ecosystem for the period was Seeds Capital – the investment arm of Enterprise Singapore – followed by Integra Partners and Tin Men.

East Ventures, 500 Global and Singapore-based VC firm Wavemaker Partners were the overall all-time top investors in the ecosystem in 9M 2025.

Support from late-stage funding rounds

Late-stage deals, however, have provided “resilience” during this period of slowdown within the South-east Asian funding space, Tracxn said. Such funding witnessed a total of US$1.8 billion in 9M 2025, up 112 per cent from US$831 million raised in 9M 2024.

There were six funding rounds above US$100 million in 9M 2025, double that in 9M 2024.

Companies that managed to raise more than US$100 million included Singapore-headquartered digital infrastructure company Digital Edge, with US$640 million in a Series D round; and fintech company Airwallex, with US$300 million in a Series F round. (* see amendment note below)

The report by Tracxn also noted that a major part of these over-US$100 million funding rounds came from enterprise infrastructure and enterprise applications, and fintech.

The enterprise infrastructure sector saw total funding of US$951 million in 9M 2025, up 32 per cent from the US$719 million raised in the same period a year before. The enterprise infrastructure sector experienced a total funding of US$857 million in 9M 2025 – a 621 per cent surge from the US$121 million raised in 9M 2024.

The fintech sector also had substantial amount of total funding – US$839 million in 9M 2025. However, this figure is down 39 per cent from the US$1.4 billion raised in the same period a year ago.

The total number of funding rounds in South-east Asia for 9M 2025 stood at 168, down 62 per cent from 443 in the concurrent period a year before.

Philippines as a “key investment destination” in SEA; Indonesia possibly outpaced

Research from Cento Ventures indicated that the Philippines has displayed promise to re-emerge as a key investment destination in the region.

The VC firm’s report said that the country has “come under scrutiny” as the “New Indonesia”, with waning competition from its neighbour.

It had an over 6 per cent rise in Series A median pre-money valuation of US$25 million in 2024, from US$23 million in 2023, having benefited from capital flowing out of Indonesia and the boom in digital financial services.

As for its Series B median pre-money valuation by country, the Philippines more than doubled in 2024 to US$65 million from US$32 million in the year prior.

What has assisted this is also Indonesia’s middle-class economics casting doubt on the sustainability of consumer-led theses, especially after failed initial public offerings (IPO) of consumer companies of late.

Data from Tracxn noted that for 9M 2025, there were 12 IPOs of tech companies in the region, up 71 per cent from the seven recorded in 9M 2024.

Companies that went public included Singapore-based software-as-a-service provider Info-Tech Systems and Malaysia food and beverage manufacturer A K Koh during the period.

New VC capital invested by the Philippines stood at 65 per cent of South-east Asian countries in H2 2024, while that of Indonesia trailed behind at 16 per cent, with Singapore at 11 per cent.

A specific field of the Philippines’ up-and-coming growth story is in the digital banking space, where the competition has reportedly shifted away from Indonesia and Singapore to the Philippines. This comes on the back of companies from the Philippines such as Salmon, UNO Digital Bank, Mynt and PayMaya securing substantial capital in 2024.

Indonesia has received less than its “fair share” of investment in the regional digital economy since H2 2023, as funds previously raised for “consumer story” ventures shift away from tech towards mid-cap private-equity style investments, such as food and beverage chains.

Even amid a market slowdown, Indonesia’s valuations have remained stable due to increased bridge financing and venture debt rounds that helped companies avoid downrounds, the report by Cento Ventures said.

Both Indonesia and the Philippines continue to be strong contenders and “proven profitability at scale” in the digital lending space, said the analysts.

* Amendment note: An earlier version of this story stated that the value of Airwallex’s Series F round was US$150 million, when it should be US$300 million. This included the US$150 million which was in secondary share transfers.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.