Employee stock option plans gain traction among founders despite lack of understanding: study

More startups are offering Esops to all staff, not just senior management

EMPLOYEE stock option plans (Esops) have gained popularity among founders, with 78 per cent of the 160 startups polled offering such plans to employees in 2024, up from 59 per cent in 2021.

The 2024 study done by Saison Capital, the corporate venture arm of Japan’s Credit Saison, angel investment network XA Network and equity management platform Carta also found that more startups are offering Esops to all employees and not just senior management. Now, one in three startups offers such plans to all employees, up from one in four in 2021.

Nine out of 10 founders now explain such plans to employees during the interview or at the point of the job offer, compared with 7.5 out of 10 founders in 2021. Median Esop pool sizes have also grown from 9 per cent in 2021 to 12.6 per cent in 2024.

Looi Qin En, partner at Saison Capital, said: “At the end of the day, working in a startup (as an employee) is often riskier and more intense. Thus, employees should be recognised, and Esops are one of the most effective mechanisms to align interests between the startup and its employees.”

The reasons for offering the plans have also changed since 2021, with a growing focus on cost savings. Now, 40 per cent of founders implement Esops to save costs in 2024, compared with 28 per cent in 2021.

Founders listed building culture and ownership as the biggest reason for such plans in 2024, followed by talent retention.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

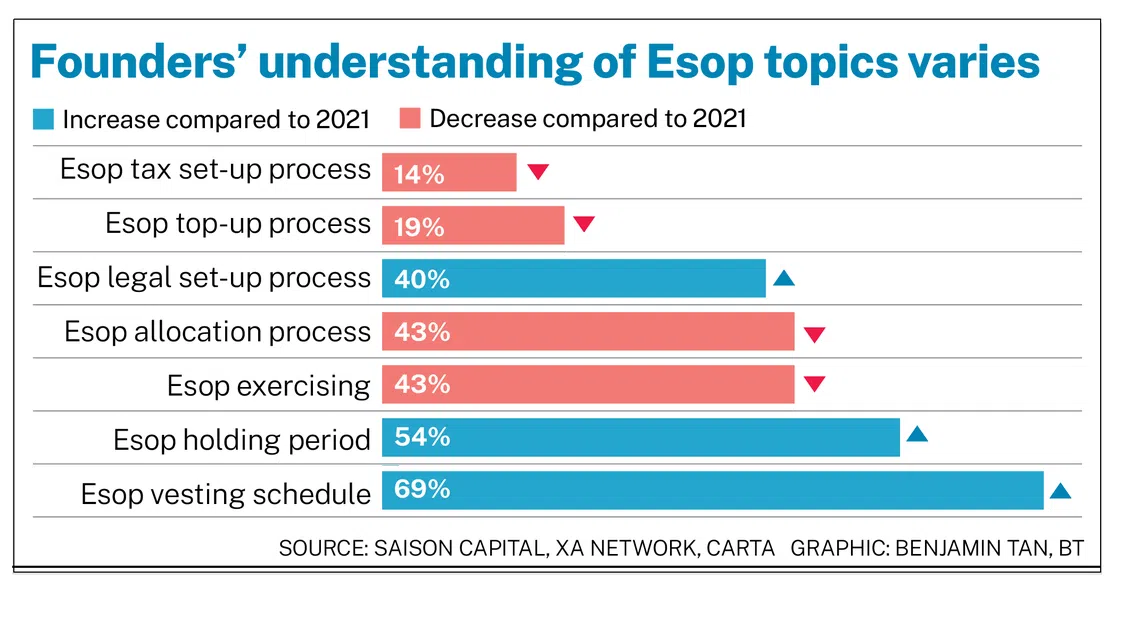

However, there is a lack of understanding Esops beyond the basics among founders. Less than 30 per cent of them have a deep grasp of these plans, similar to 2021. The tax set-up process for Esops was the biggest topic in which founders lacked understanding; just 14 per cent said they understood.

This lack of understanding on Esops’ deeper topics is concerning, said Looi, as founders are the ones explaining the plans to employees.

For instance, departing employees may need to have enough cash to exercise their options within six months of departure, or risk losing the options. Many employees may not be aware of this requirement, and it is on the founders to explain it, he said.

SEE ALSO

“It is important for founders to first understand the intricacies and risks of Esops, before they can comprehensively explain this to employees,” he added.

The bulk of startups without an Esop are planning to implement one; a quarter said they have no plans to do so. The top three reasons for not having such a plan are:

- Lack of sufficient information on Esops;

- The majority of employees do not want it;

- Uncertainty about how to set it up.

However, the top concern among these same companies is talent retention without an Esop in place. This is in contrast to how employees view these plans.

Employees are also prioritising such plans, with 72 per cent considering it a priority when considering a new job. The reputation of a company’s investors and current valuation are what 85 per cent of employees consider when evaluating the plans in the job application process.

About 49 per cent of employees value such plans as much as a cash bonus. This is despite low initial grants, with 76 per cent of employees getting less than 30 per cent of their base salary as Esops at the time of joining the company.

Looi said: “The writing on the wall is clear – Esops are here to stay, and educating, embracing and embedding Esops as an important compact between the company and its employees must have its due attention.”

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.