Falling exit values in Asean push venture funds towards early-stage deals: Preqin

EARLY-STAGE venture capital (VC) deals are growing in size in Asean, as dry powder grows but exit conditions weaken, said a report by private markets data tracker Preqin.

The average deal size for seed has increased 112 per cent between end-2019 and end-October 2023, Preqin said in its 2023 territory guide for private equity (PE) and VC in Asean (*See amendment note).

The average deal size for Series A rounds has increased 31 per cent over that same period; that for Series B is up 87 per cent; and for Series C the number is 53 per cent.

For Series D and later, the average deal size is down 50 per cent.

“Given valuation concerns and poor exit conditions, investors prefer early-stage over late-stage deals,” Preqin said.

Chua Joo Hock, managing partner at Vertex Ventures South-east Asia & India, said VC activity has dipped compared with previous years when money was “cheap”, but still remains quite high.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

“We now see more serious founders and better quality deals at the early stage,” Chua said.

VCs reaped gains from several large exits in 2021 and 2022 – including the US$40 billion merger of on-demand ride and delivery services platform Grab with a Nasdaq-listed special purpose acquisition company, and the US$1.5 billion initial public offering of e-commerce company Bukalapak.

Higher interest rates and inflation, however, mean investors are more demanding. Valuations are falling and exits are tougher to execute.

SEE ALSO

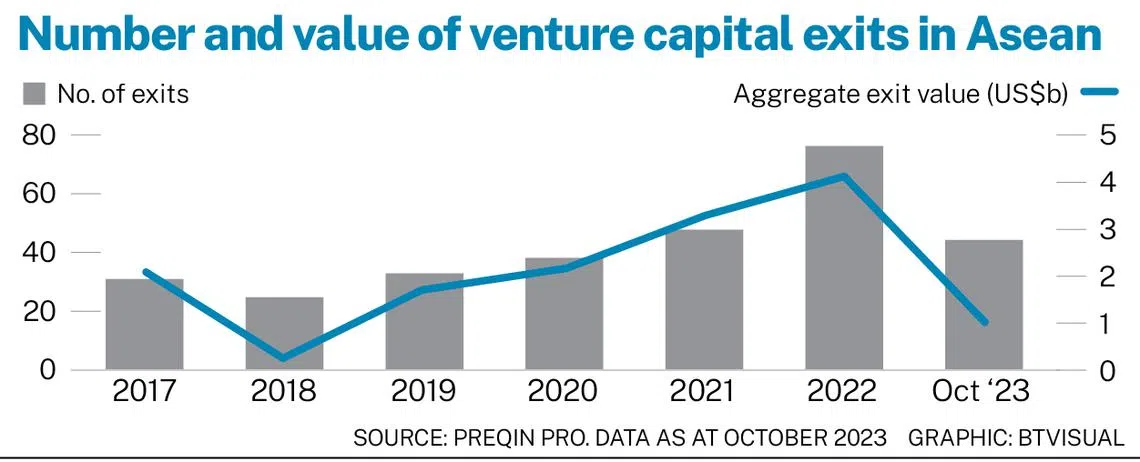

The total exit value of US$1.03 billion for the year to October is a quarter of the US$4.1 billion recorded for 2022.

The average exit value has fallen as well. There have been 44 exits for the year to October, versus 76 in 2022. This works out to an average exit value of US$22.7 million this year, down from USS$51.5 million in 2022.

Gary Khoeng, partner at Vertex Ventures South-east Asia and India, said South-east Asia also has limited exit options because its capital markets are not sufficiently mature.

At the same time, he noted “promising improvements” in the region, with “policies to facilitate exits through domestic listings”.

“We are hopeful for rapid improvements in the coming decade,” he added.

Exit values are falling for PE funds, too. For the year to October, Preqin recorded 16 exits at a total value of US$1.9 billion.

Aggregate exit value had peaked at US$5.8 billion in 2021, when there were 18 exits. Last year, total exit value fell to US$2.6 billion and the number of exits fell to 15.

The average exit values work out to US$112.5 million for the year to October, US$173.3 million for 2022 and US$322.2 million for 2021.

There is still money to be invested, though, particularly among VCs.

VC dry powder hit a record US$7.4 billion at end-March 2023, up 25 per cent quarter on quarter.

Assets under management were also at a record US$27.3 billion.

One sign of that interest: Vertex Holdings in April closed its fifth South-east Asia and India fund, an early-stage fund, at US$541 million.

That close made it the fourth-largest Asean-focused fund in the last four years, and the fifth-largest in a decade.

*Amendment note: The average changes in sizes for VC deals have been edited to reflect an amendment in Preqin’s report.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.