GetGo drives revenues at a cost as bottom line turns red

WHEN Singapore-based GetGo raised almost US$15 million in 2023, its CEO and co-founder Ting Feng Toh set a lofty goal: help the city-state realise “a significant part” of its Green Plan 2030 via serving a million households by that year.

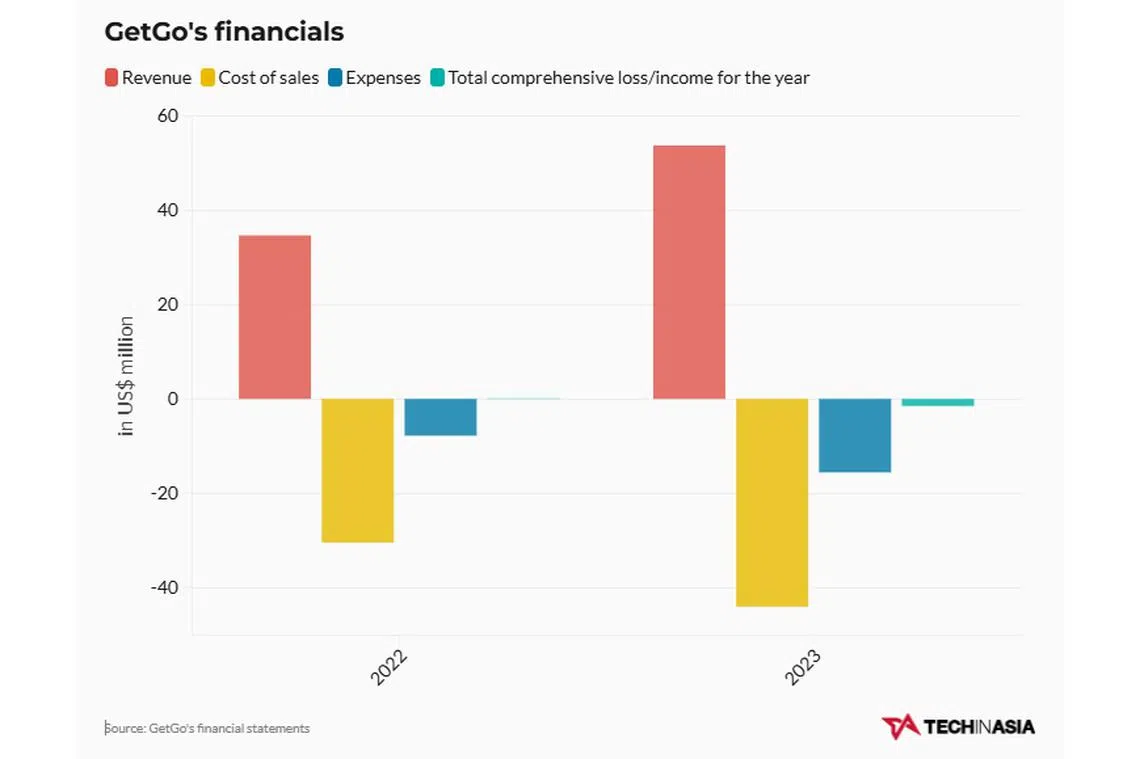

To that end, GetGo boosted its fleet by adding electric vehicles. This plan initially appeared to have benefited the company’s top line, with its revenue growing 55 per cent year on year in 2023.

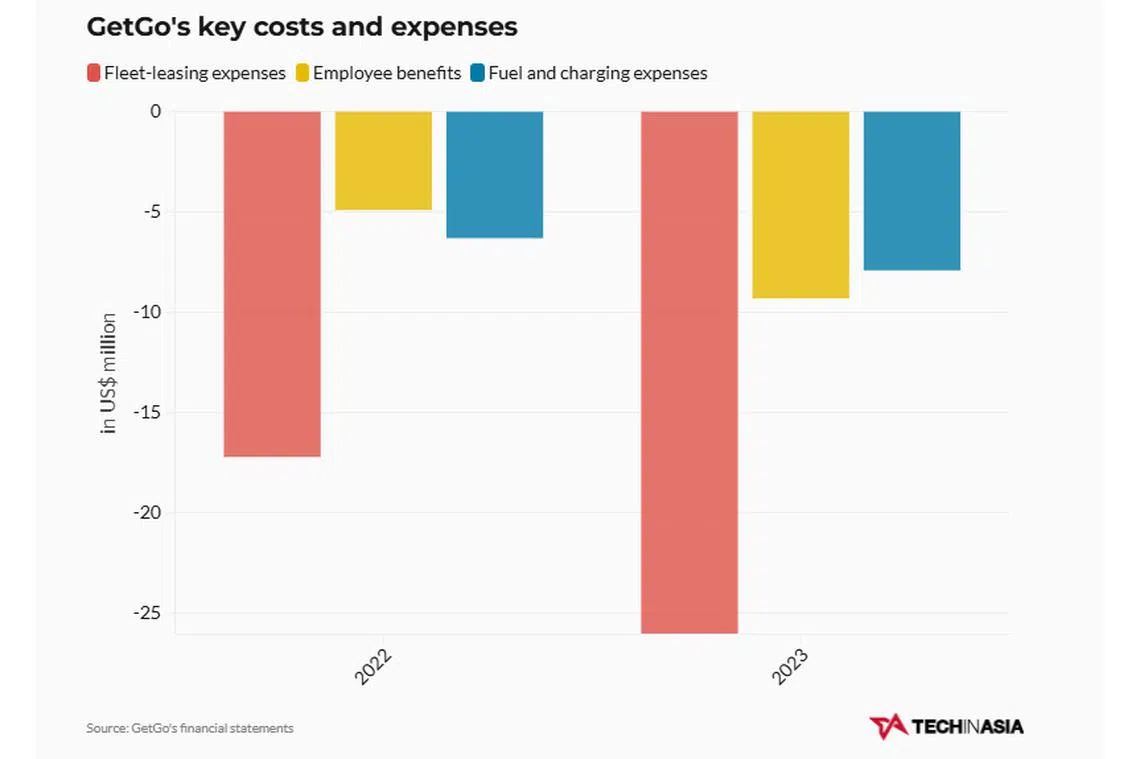

However, costs have gone up. After making a small profit in 2022, GetGo turned loss-making the following year as its employee benefits and fleet-leasing expenses nearly doubled, according to its audited financial statement for 2023.

But with continued growth and improvements in operational efficiency, Toh says that it expects to hit profitability this year.

Convenience is key

Founded in 2021, GetGo emerged as one of the major tech-enabled players in Singapore’s car-sharing space. It claims to be the largest platform that does not require users to pay deposits or membership fees.

Instead, the company operates on a pay-per-use model that lets users rent cars by the hour or day. This service is mostly offered through GetGo’s app, with rates starting at around US$2 and varying based on factors like duration and distance.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Convenience is key for services like GetGo’s, Toh observes. The company had grown its fleet to 3,000 from 2,100 vehicles during its 2023 funding round, increasing accessibility for its 400,000 registered users.

“Today, there’s a GetGo vehicle within five minutes’ walking distance from most users’ homes,” Toh says.

EVs are a key part of this expansion. At the time of its US$15 million round, the company said it would be adding more EVs to build a fleet of 10,000 electrified cars in total.

But for now, it would seem that GetGo still has its work cut out. Toh says only 10 per cent of its fleet are EVs, making it difficult for the company to support Green Plan 2030, which covers Singapore’s long-term goal of net zero emissions.

Nevertheless, the company coupled this expansion with efforts to push brand awareness and community engagement last year, allowing GetGo to bump up its current monthly bookings from 150,000 to 180,000 as of February 2023.

These combined initiatives were the main drivers of GetGo’s revenue growth in 2023, according to Toh.

Charge depleting

The company, however, also logged its first year of loss in 2023. This was mostly because GetGo’s administrative expenses went up twice year on year to US$15.3 million.

Toh says this comes after a year of “significant investment” for GetGo, doubling down on the company’s data and technical architecture capabilities as well as partner integrations.

“We grew our technology team and expanded our capabilities and integrations in order to deliver a best-in-class user experience powered by a new tech stack,” he adds.

As for integrations, the company in 2023 struck a deal with Charge+, a Singapore-based EV charging solution provider focused on South-east Asia. The agreement helps ensure that EVs on GetGo’s platform are fully charged upon rental bookings and that users have access to more power stations.

These collaborations gave GetGo users access to more than 4,000 charging lots islandwide, Toh says. As of August this year, there were about 13,800 registered EV charging points in Singapore.

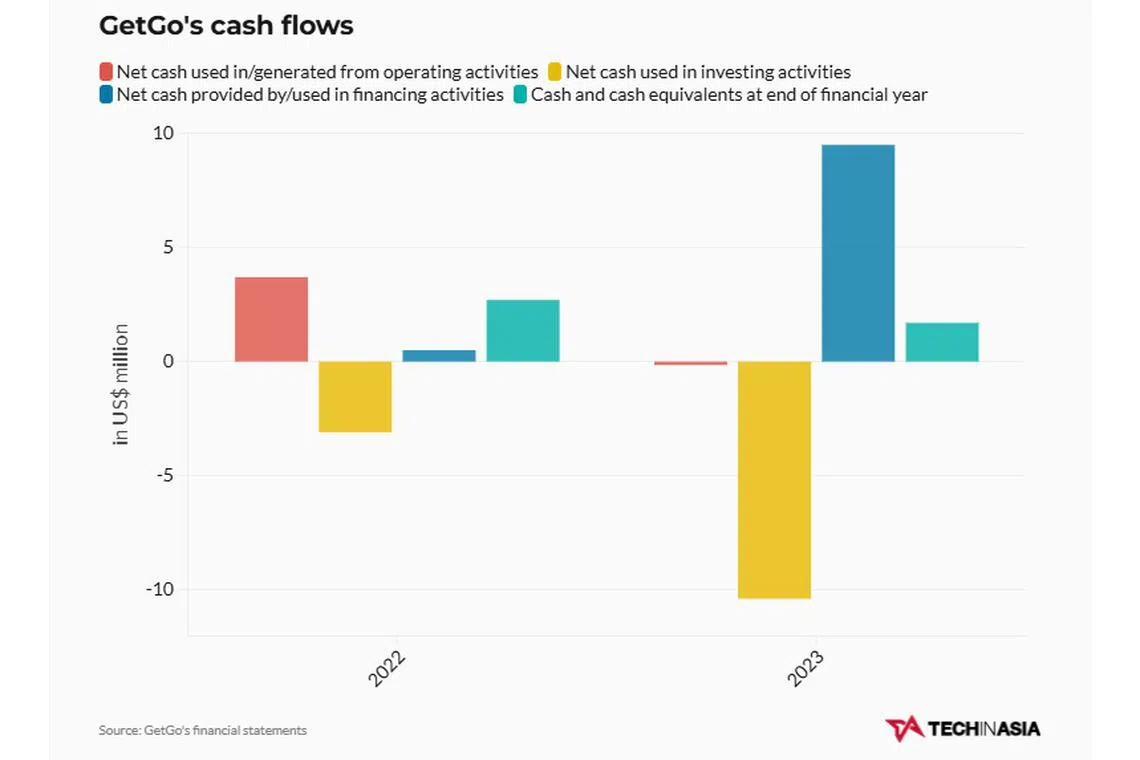

While the upsides are clear, the company’s achievements came at a significant cost. For instance, GetGo’s net cash used in investing activities more than tripled between 2022 and 2023.

Along with cash generated from operating activities going negative, this resulted in its cash and cash equivalents dropping by 36 per cent to US$1.7 million at the end of 2023.

Full speed ahead

But for GetGo, these expansion efforts are worth it.

“In 2024, we continued to improve our service offerings and features to empower our users for a wider range of their mobility needs,” says Toh.

GetGo is currently integrated with four EV charging operators in Singapore. Its most recent deal was in January 2024, when it partnered with SP Mobility, which also offers direct current charging points that allow for faster top-ups.

Toh says that right now, GetGo is the most convenient and affordable way for Singaporeans to drive EVs without coughing up the cash to own one. Looking ahead, the founder expects the EV segment to keep expanding as adoption continues to grow.

In addition to EVs, GetGo also launched new vehicle categories to broaden its offerings in the city-state. These include Select, which lets users rent vehicles with no GetGo decals or branding on the sides.

The company also teamed up with public transport company SBS Transit to provide commuters with first and last-mile connectivity options.

GetGo plans to build upon these initiatives in 2025. “Users can also look forward to new initiatives that will allow them further access to a reliable carsharing experience of great convenience and flexibility,” Toh shares.

The company still has the cash to push ahead with its plans. In June, GetGo received US$5 million from its US$15 million round last year. The money is “earmarked for future strategic investments,” he says. TECH IN ASIA

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.