Meet three Singapore tech firms that have reimagined their digital capabilities to tackle real-world problems

Trakomatic and Handshakes use AI to help retailers understand shoppers' insights and optimise the search for corporate data respectively, while V-Key's authentication system enables safer banking

In an age of rapid digitalisation, the race to build game-changing technologies is more competitive than ever. To stay ahead, tech firms must continuously innovate and improve on their offerings.

One way for companies to distinguish themselves is to proactively uncover and understand industry problems so they can create better solutions, tap new business opportunities and gain a wider customer base.

Trakomatic, V-Key and Handshakes are some local firms that have found success in Singapore and abroad by taking this approach.

They also developed their capabilities by working closely with Digital Industry Singapore (DISG), a joint office of the Economic Development Board, Enterprise Singapore, and Infocomm Media Development Authority, which supports the growth of the technology sector.

Here is a look at how these three companies' innovations have transformed processes for various sectors, changing the way digital marketing, digital authentication and due diligence checks are done.

Empowering better retail decisions with AI

The moment visitors enter Funan mall, an artificial intelligence (AI) system determines their demographic profile, such as age and gender, using image recognition software.

This data allows the mall's operator to personalise advertisements to visitors. For instance, a digital billboard can detect when a lady shopper is standing in front of it and display an advertisement that she might be drawn to, such as an ongoing promotion by a cosmetics store.

If she subsequently visits the store, she will be counted by the AI system as a visitor who responded positively to the advertisement and enable the mall to quantify the effectiveness of the promotional campaign.

Cameras placed throughout the public and open areas of the mall also enable the operator to monitor crowds and track footfall.

This is made possible by Trakomatic's products that allow operators of physical spaces like malls to derive insights from reports, graphs and heat maps generated using metrics like crowd density, visitor movements and engagement time. To protect shoppers' privacy, the data collected is anonymised and encrypted, and is not linked to specific identities.

Mr Shaun Kwan, Trakomatic's co-founder and chief operation officer, founded the company in 2013 with two business partners.

"Our innovation aimed to address the challenges and the gaps that we saw in the retail industry," says Mr Kwan.

"With our system, the operators will be able to understand whether a new campaign or strategy is working. They will be able to set and track KPIs like footfall targets and repeat visitorship while optimising resource allocation, store layouts and displays."

Mr Kwan had observed that many malls previously deployed staff to manually count the number of shoppers, which incurred significant manpower costs.

Malls were also facing competition from e-commerce retailers, as they were "not aware of the demographic profiles of their visitors and target customers" and were unable to precisely measure the effectiveness of their sales campaigns, Mr Kwan adds.

Today, Trakomatic continues to innovate and improve its offerings. A focus on innovation has helped the company diversify its tech offerings and expand further into South-east Asia.

The company recently shared its plans for future upgrades to its visitor tracking and analytics capabilities with DISG, which supported the company in scoping out a product development project with an aim to commercialise its new innovations.

Beyond the retail sector, the company's AI solutions are being used by universities, healthcare institutions, libraries, tourist attractions and event organisers.

Constant innovation to keep hackers and scammers at bay

Singaporeans are among the most prolific users of mobile banking, but not many know about the key role that tech companies like V-Key play in the finance sector.

This is not surprising as V-Key's patented security and authentication systems are seamlessly built into mobile banking apps, such as those by UOB, as well as Philippine digital bank Tonik Bank.

These systems are crucial for generating one-time passwords (OTPs), authentication codes and alerts, ensuring people can do their banking online in a secure manner.

"We selected V-Key because of its history with major banks around the region, where its solutions were well validated and tested," says Tonik CEO and founder Greg Krasnov.

"V-Key's technology is protected by a global patent and has been proven to deliver the trust factor and security to customers, which is among the most important issues for our potential customers in the Philippines."

The core technology which forms the basis for V-Key's products was designed by its chief executive and co-founder Joseph Gan.

"What we set out to do when we started V-Key in 2011 was to build a mobile security solution that would be as secure as the hardware smart card chips that we used to have in our ATM cards, credit cards or hardware authentication tokens," says Mr Gan.

As the threats posed by hackers and scammers grew in sophistication, V-Key saw the need to work closely with its clients to refine its cryptographic algorithms.

Further innovation has allowed V-Key's platform to detect and block spoofed transaction requests that do not originate from banks' official apps, thwarting the attempts of hackers and scammers.

Mobile banking alerts are now also designed to include details about the device used to make a transaction and the country where the banking request originated, so users can spot and report suspicious transactions more quickly.

Over the years, V-Key has successfully established a foothold in the South-east Asian market. It continues to develop new innovations, with its core research and development (R&D) efforts anchored in Singapore.

The company has its sights set on further expansion farther afield and has received support facilitated by DISG to venture into new global markets like China, the United States, Canada and Panama. DISG has also introduced V-Key to regional companies in the real estate and telecoms space, to explore potential deals for its security solutions.

Mr Gan says DISG has been instrumental in helping V-Key establish itself as a credible security solutions provider. Being accredited by IMDA also helped the company win new clients and assure them that their systems and data are handled properly.

Constant innovation also helps V-Key to serve all its clients better, he adds.

"We have a lot of ongoing R&D to deal with the threats our clients are facing, and we do incorporate this into our product with each iteration. When we deploy a new security upgrade, it benefits all our clients, not just the client it was developed for." says Mr Gan.

Helping corporations make swift and better-informed business decisions

For companies embarking on a new business venture, conducting background checks on potential partners is a must. However, this is a complex process that may involve searching for information from multiple sources.

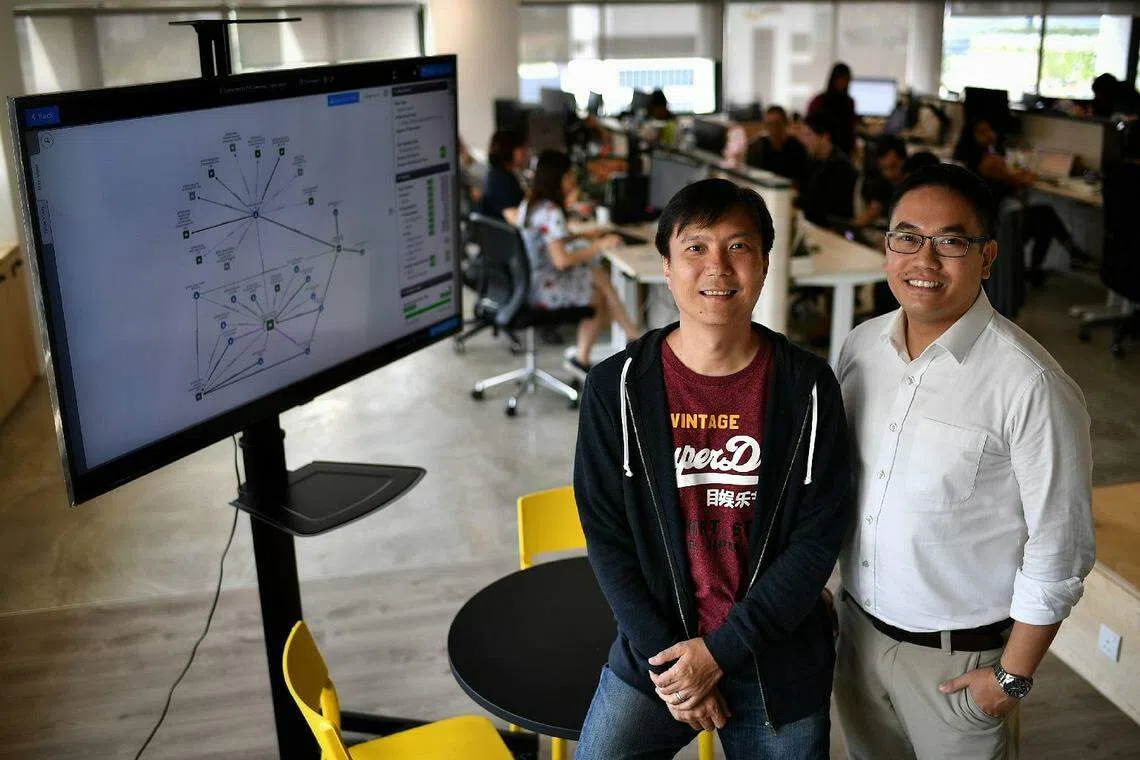

To simplify this process, in 2011, Handshakes founded a platform that acts as a search engine for companies to gather corporate information about other enterprises.

Mr Charles Poon, co-founder and chief products officer at Handshakes, says the traditional means of research, which involved identifying credible sources as a first step, was "very inefficient". He says the Handshakes platform can reduce the time needed to conduct such checks from months to minutes.

Besides business data from Singapore's Accounting and Corporate Regulatory Authority, Handshakes also supplies corporate data from overseas markets, from partners such as S&P Global, as well as non-corporate data such as news archives from SPH Media and Nikkei.

It can also showcase relationship maps linking individuals and entities in a visual manner, providing quick insights on potential conflicts of interest and compliance risks.

The company's investments in AI and other technological advancements have allowed it to capture new business opportunities.

While Handshakes started out primarily serving capital market players like law firms, financial advisories, banks and regulators, it has since expanded it to the broader corporate landscape as well as educational institutions and the public sector.

Handshakes' R&D efforts in Singapore have been supported by DISG, which worked closely with the company to understand its product development priorities that can capture global market opportunities. This included the deepening of their AI, data analytics and other technical capabilities.

DISG also facilitated introductions to potential investors and partners, which could help launch the company's products into new markets such as the US and Europe.

"DISG has been partnering our local technology companies on their growth journeys in many different ways - supporting their R&D and product innovation efforts, facilitating introductions to technology and business partners, and charting out possible market access and expansion opportunities," says DISG director Samantha Su.

"We are encouraged that Singapore technology firms like Trakomatic, V-Key and Handshakes are pushing the boundaries of innovation to be ahead of their competitors. We will continue to work with them and other similar Singapore technology firms to build capabilities as they scale further locally and internationally."

Digital Industry Singapore (DISG) is a joint office of the the Economic Development Board, Enterprise Singapore, and Infocomm Media Development Authority, established to support the growth of the technology sector in Singapore.

Learn more about DISG here.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.