Verify once, use everywhere: How one regtech firm is making identity checks faster for customers and businesses

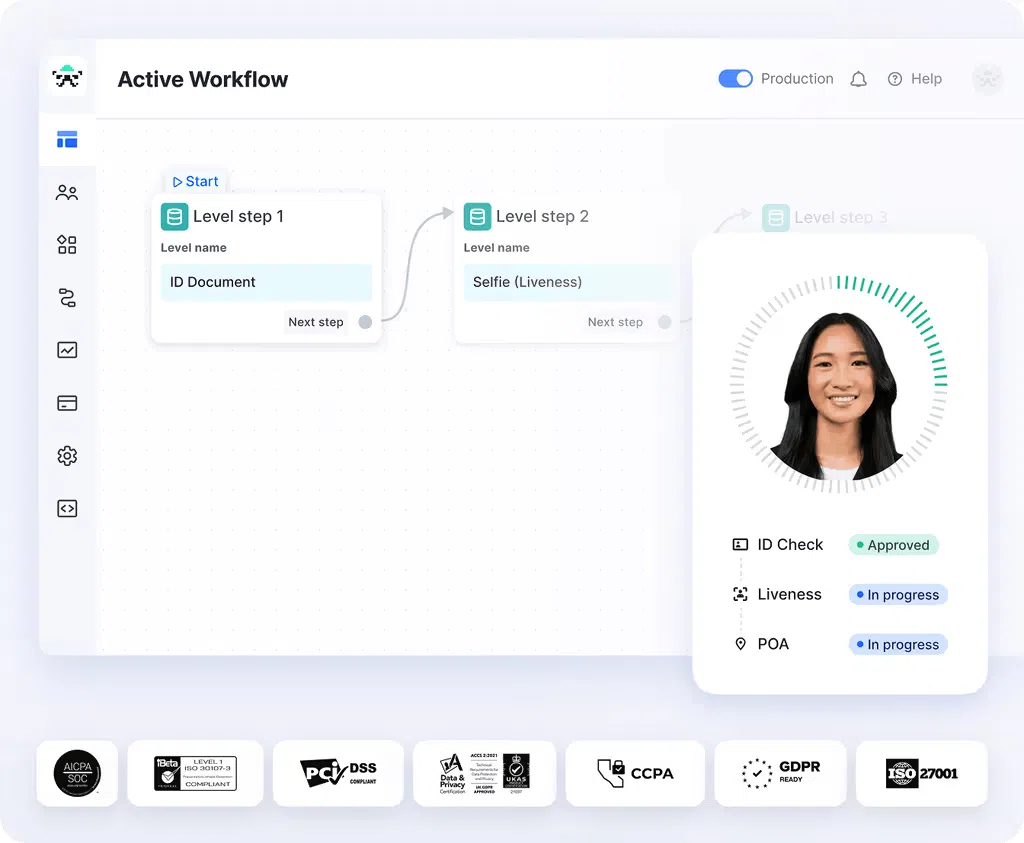

Global verification and anti-fraud solutions provider Sumsub allows users to store and reuse personal data for multiple verifications securely, and can also be integrated with Singpass

SOME start-up co-founders may take a while to build synergy. Others are just born with it – literally.

That is the case with Sumsub, a global verification and anti-fraud solutions provider. It was founded in 2015 by brothers Andrew, Jacob and Peter Sever – with the latter two being twins – alongside a fourth co-founder, Vyacheslav Zholudev.

Andrew, the firm’s chief executive officer, shares that just because they are siblings does not mean they always agree on everything. But he also says that being open to contrasting perspectives has only made the company stronger.

“We’ve had our fair share of difficult discussions, but it’s also helped us undergo a positive metamorphosis,” Andrew explains. “It’s always good to have people with different angles and mindsets coming together.”

Building a scalable foundation through innovation

One of the key moments that inspired Sumsub’s creation was when Jacob, the firm’s current chief innovation officer, tried to sign up for a particular online service. However, his twin brother Peter, Sumsub’s chief strategy officer, had already registered with the same service.

Andrew recalls: “The system thought that they were the same people just because they’re twins.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

“We realised early on that know-your-customer (KYC) systems need to account for this to avoid digital exclusion, and so we wanted to build a solution to help firms onboard as many users as possible while avoiding fraud and staying compliant.”

Externally, the brothers also had several friends in fintech who constantly complained to them about how slow and inefficient onboarding and compliance procedures were.

The co-founders had limited knowledge about compliance, though.

Jacob admits: “We didn’t even know what KYC stood for.”

Yet, they leveraged their expertise in computer graphics and digital image processing to develop digital solutions that automated many aspects of the KYC process, offering efficient alternatives.

With that, Sumsub was born.

“By the time we launched our first product in 2017, the digital market was taking off and everyone was going online,” says Jacob. “It was perfect timing with a bit of luck – a lot of new financial services were looking for super scalable, efficient and reliable KYC tools.”

This huge influx of customers was a good thing, but then a new challenge arose: meeting the demand.

Andrew shares: “So many customers wanted to implement our product instantly.”

Jacob adds that in many cases, developer teams would even leave the implementation of KYC tools to the last minute.

To meet those quick turnaround times, Zholudev, the firm’s chief technology officer, stepped up.

Peter shares how Slava, what Zholudev is affectionately called by the brothers, reviewed Sumsub’s tech stack at the time and immediately said it was not tenable.

“He rebuilt everything in just one month using Java,” Peter recalls. “Typically, coding with Java requires a lot of human resources, and everyone told us it was impossible. Slava just said, ‘You’ll see,’ and did it.”

The move proved extremely fortuitous for other reasons.

According to Peter, using Java allowed the firm to both meet demand back then and subsequently scale up in a cost-efficient manner.

Expanding into complex, fast-growing markets

Besides its strong technical foundation, Sumsub’s rapid expansion was also underpinned by a somewhat bold strategy: targeting complex, emerging markets.

Andrew shares that many of the firm’s competitors typically focused on the Europe and US markets because they were more familiar with the documents, languages and processes there.

Sumsub, on the other hand, was not afraid to handle the unfamiliar, character-based languages seen in the Asia Pacific.

Peter adds: “The important thing is to be trend-setters and not wait for new developments to tell us what to do next.”

He then brings up the firm’s non-documentation verification solution, which connects with and gets information directly from government databases.

It delivers 100 per cent regulatory-compliant, document-free identity verification in more than 30 jurisdictions worldwide, enabling frictionless access to digital services for over three billion people.

Sumsub keeps upgrading this solution as well, even launching the integration services with Singpass most recently.

Jacob shares: “Singaporean businesses can now onboard users in a very efficient and secure way.”

This focus on efficiency led the team to build out more features, eventually creating a one-platform solution that supports the verification process along the whole user journey – from identity and business verification to ongoing transaction and event monitoring, which adapts to evolving risks, market demands and regulatory requirements.

One of the features includes the Reusable Digital Identity product suite comprising Reusable KYC and Sumsub ID.

Both functions allow users to securely store and reuse their verified documents for multiple verifications across more than 4,000 Sumsub client platforms, and companies in the Sumsub ecosystem can also share applicants’ data upon receiving their consent.

This, in turn, provides businesses with higher pass rates, fewer drop-offs and stronger compliance. There are now millions of Sumsub ID clients in its ecosystem, according to the co-founders.

Interestingly, the company has also taken the rise of artificial intelligence (AI) – generative or otherwise – into account in its strategy. It is always exploring how the latest tech can improve its solutions.

“AI has been part of Sumsub since day one,” Jacob says, pointing out that machine learning powered much of the firm’s initial tech.

Sumsub has had a team dedicated to AI fraud prevention since 2022. This foundation is important, as there has been a 158 per cent year-on-year growth in deepfake fraud in 2025 in Singapore, and the Asia Pacific has experienced three-digit deepfake growth for the third year in a row.

Multi-layered protection is more critical than ever, and Sumsub’s one-platform solution approach offers just that, combining document verification, biometrics, device fingerprinting and behavioural signals at different touchpoints.

Finally, the co-founders hired a strong legal team and data protection officers early on because Sumsub’s solutions would usually have to be vetted by compliance teams.

This allows the firm to present itself not only as a tech startup but as one specialising in regulatory technology – or regtech – solutions, reassuring potential customers.

“We helped customers connect the dots between technical capabilities and legal compliance, giving them the best of both worlds,” Andrew says.

Strengthening the future of fraud prevention

Sumsub has come a long way since those early, scrappy days from a decade ago.

Today, it employs around 1,000 people spread across eight offices in 70 countries, including Singapore, its headquarters in the Asia Pacific. It has also achieved an annual run rate of 162 million euros (S$244.7 million) recently, according to Andrew.

With the Singpass development, its research collaboration agreement with Nanyang Technological University to combat deepfake fraud, as well as its recent What the Fraud Summit held in Singapore, Sumsub sees the Asia Pacific as a key market.

It is also committed to building an expert community to fight fraud in the region.

Leading such a huge company is not easy, but Andrew says it is important that they allow themselves to make mistakes.

“If you’re too much of a perfectionist, you’ll never take the next step,” he explains. “As co-founders, we need to take responsibility and not just blame each other.”

And while they are focused on many big-picture questions – like managing the future of the company and bringing in new ideas – retaining this start-up founder mentality is still good for a significant reason.

“We didn’t start Sumsub to be recognised – we did it because we’re obsessed with solving this problem of fraud and digital exclusion,” says Andrew. “Ultimately, we want to create a better, safer world for everyone.”

Sumsub is a leader in global verification that enables fraud-free, scalable compliance with its adaptive, no-code solution. Stay ahead of the latest fraud developments by downloading its Identity Fraud Report 2025-2026.

This article was first published in Tech in Asia.

Share with us your feedback on BT's products and services