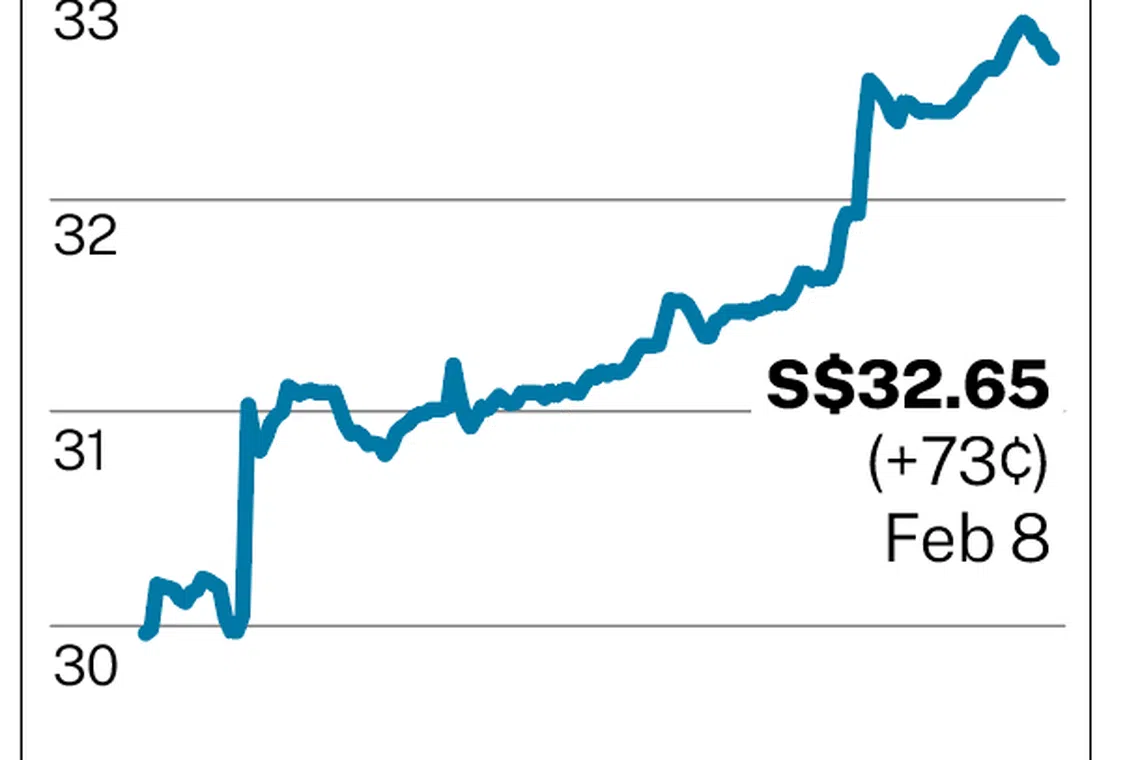

Hot stock: UOB shares hit all-time high of S$32.86

UOB U11 spiked on Tuesday (Feb 8) to stand out among its peers as the largest share price gainer of the day.

At 4.10 pm, the counter rose as much as S$0.94 or 2.9 per cent to S$32.86 - an all-time high for the bank - with 5.1 million shares changing hands.

There were 5 married deals in total, according to ShareInvestor data.

UOB eventually ended the day at S$32.65, up S$0.73 or 2.29 per cent with some 6.44 million shares changing hands when the market closed on Tuesday.

As for its fellow local banks, DBS was up 0.27 per cent or S$0.10 at S$36.58, while OCBC was up 1.31 per cent or S$0.17 at S$13.13.

UOB's share price has been on a steady upward trend since it first announced on Jan 14 that it will be acquiring Citigroup's consumer banking assets in Indonesia, Malaysia, Thailand and Vietnam for almost S$5 billion, almost doubling its existing retail base in the 4 markets to 5.3 million from 2.9 million.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Several brokerages had reacted positively to the deal, with many increasing their target prices for the bank and reiterating their "buy" calls. They cited reasons including the acquisition being earnings accretive, enhancing the bank's longer-term growth prospects, and accelerating and improving the bank's regional strategy.

More recently, the bank faced an hours-long disruption of its mobile app TMRW on Feb 4-5, resulting in some customers being unable to log in or make fund transfers. The bank has ruled out a cyberattack or breach as the cause, and is currently probing the issue.

Meanwhile, fellow local bank DBS was ordered on Monday by the Monetary Authority of Singapore to set aside S$930 million in additional regulatory capital to guard against operational risks, following a 2-day disruption from Nov 23-25 to its digital banking services in November 2021, which DBS reported was due to a problem with its access control services.

All 3 banks will also be releasing their results in the coming weeks. DBS will start next week with its full-year financial year 2021 results on Feb 14, followed by UOB's FY2021 earnings on Feb 16. OCBC will post its FY2021 results on Feb 23.

READ MORE:

- Hot stock: UOB up 1.4% after Citi consumer business acquisition

- UOB injects 2b yuan in China subsidiary

- Brokers' take: Analysts largely positive on UOB's purchase of Citi assets

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.