Singapore's S$520b market looks past recession risk

[SINGAPORE] Investors are sanguine about Singapore's stock market even as the nation faces the risk of a technical recession, as a positive outlook for dividends and earnings overshadows threats from the US-China trade spat.

Singapore's trade-reliant economy unexpectedly contracted by 3.4 per cent in the June quarter from the previous three months, reflecting sluggish global trade and electronics cycles. Following the data release, the International Monetary Fund on Monday cut Singapore's 2019 growth forecast to 2 per cent from 2.3 per cent.

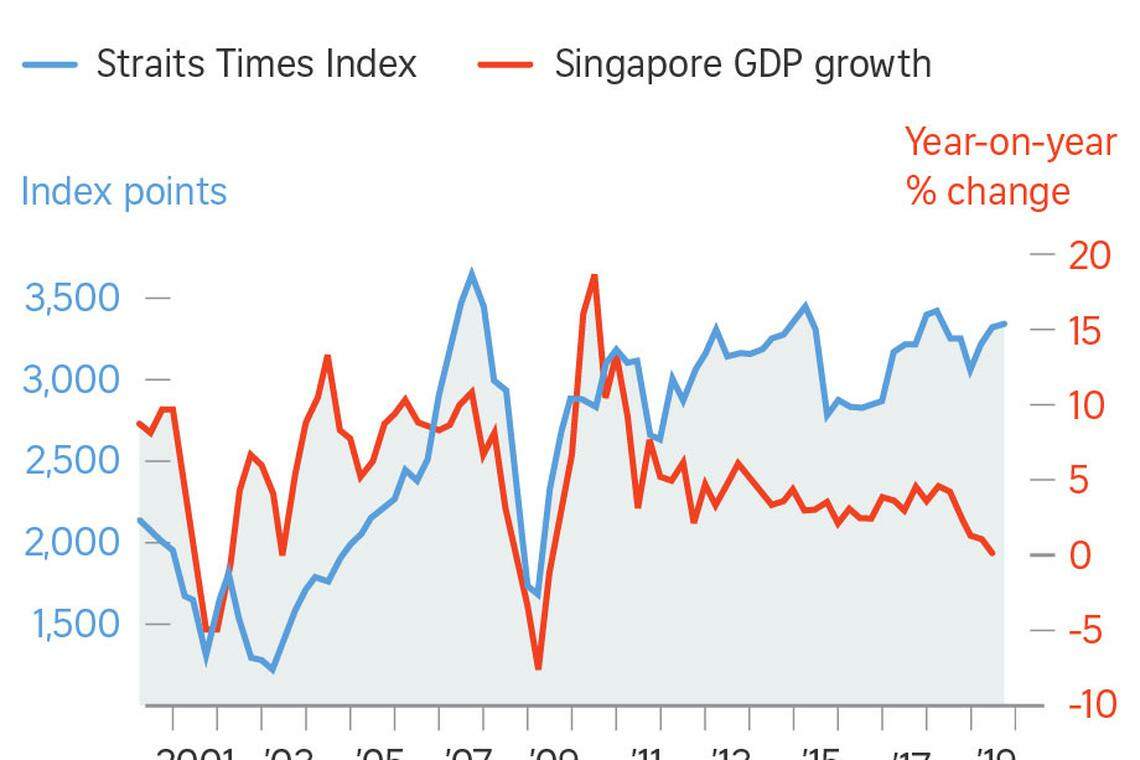

The benchmark Straits Times Index, on the other hand, has surged 9.3 per cent this year. The gauge is among the best performers in South-east Asia and is expected to rise further. The reason behind such optimism is more than half of the 30-member gauge generate 50 per cent or more of their revenues outside the city-state, hence are less influenced by the domestic economy, data compiled by Bloomberg show.

While the economy is important, "with more companies deriving a bigger percentage of their earnings from outside of Singapore, the impact on the stock market is now less acute than two to three decades ago," said Carmen Lee, head of investment research at Oversea-Chinese Banking Corp. "The stock market is decoupled from the economy because many of the companies on the stock market are more defensive."

A major producer of electronics and semiconductors, Singapore's trade value is more than double its US$364 billion economy. Amid trade tensions, not only did the economy contract unexpectedly on a quarter-on-quarter basis, exports slumped dramatically in June, making it the second-worst month since the global financial crisis.

"The stock market and domestic economy are two different animals, and have been for some time now," said Daryl Liew, head of portfolio management at Reyl & Cie in Singapore. "Most Singapore-listed companies such as the banks and Singapore Telecommunications are pan-Asian plays."

HIGHER RETURNS

What's more, cash is king for equity investors in Singapore, who expect the market to cough up a dividend yield of 4 per cent amid low valuations this year, compared with 2.9 per cent on the MSCI Asia Pacific Index. The benchmark is trading at a price-to-earnings multiple of 12.8 times on one-year forward earnings, lower than its 10-year average of 13.5, according to data compiled by Bloomberg.

"Singapore is one of the few markets in Asia to be trading below its mean historical price-to-earnings ratio yet paying out one of the highest yields," said Kum Soek Ching, head of Southeast Asia research at Credit Suisse Group AG's private banking unit.

POSITIVE PROFIT OUTLOOK

And while earnings estimates fell at the start of the year, they have risen from their lows in February. Looking ahead, corporate profits are expected to grow by 4 per cent for 2019 compared to 21 per cent decline in the previous year, based on data compiled by Bloomberg.

"Focus going forward remains on the outcome of US-China trade negotiations," said DBS Bank's analyst Yeo Kee Yan. Singapore's equity gauge may rise to 3,450, implying 2.6 per cent gain from Thursday's close, as the world's biggest economies work toward a deal, he said.

BLOOMBERG

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Capital Markets & Currencies

Singapore stocks end lower after US market wobbles ahead of CPI data; STI down 0.2%

LSEG reports in-line first quarter as Microsoft partnership progresses

Japan brokerage Daiwa’s Q4 profit more than doubles as markets recover

South Korea readies new system to detect illegal short-selling

Asia: Markets mixed as global rally stalls, eyes on yen

Singapore shares retreat at Thursday’s open; STI down 1.1%