Five tech companies charging ahead this results season

Lisa Kriwangko

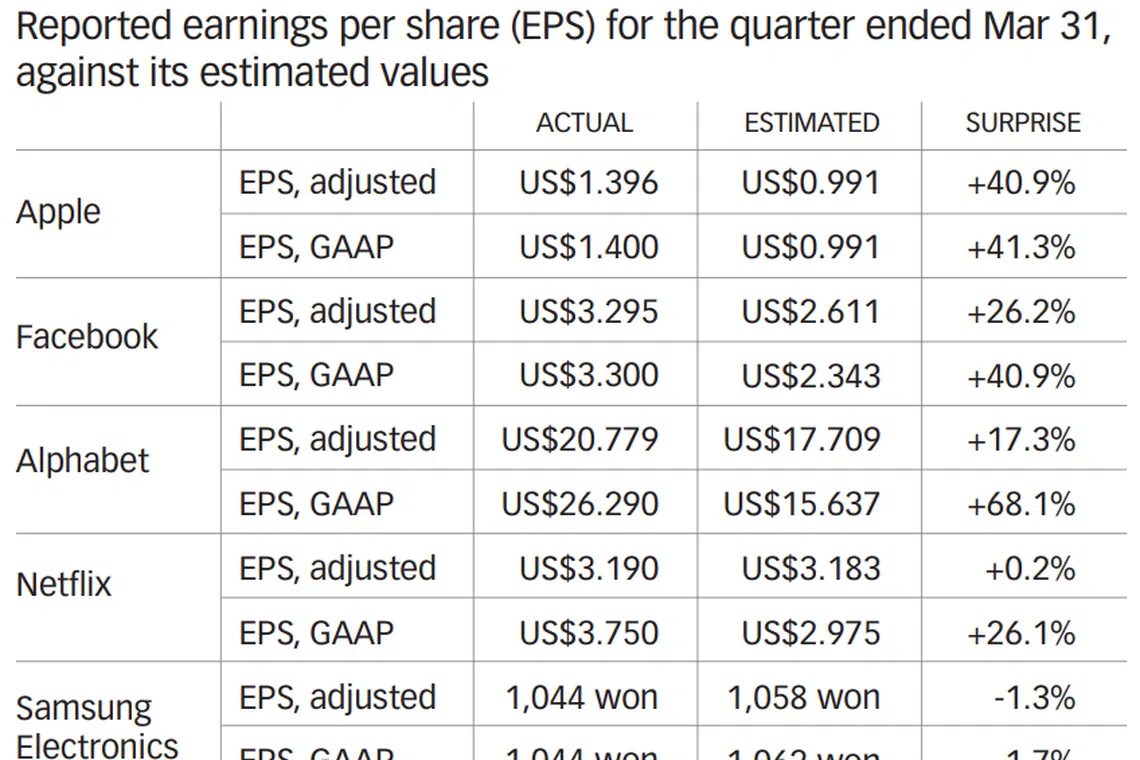

THE tech-heavy Nasdaq set new records on Monday's close as investors anticipate a busy week of earnings. The excitement seems not to be in vain, as notable names in the industry have posted strong revenue and profit growth, some more than others.

Here are five noteworthy reports so far:

Apple

The California giant's profit more than doubled for the past quarter to US$23.63 billion amid robust growth from pandemic-hit consumers, Apple reported on Wednesday.

Its revenue was up 54 per cent from the previous year to reach a record US$89.58 billion for its second fiscal quarter. Some US$47 billion came from iPhone sales alone, which rose 65 per cent year on year (y-o-y) on strong demand for new iPhone 12 models and 5G capabilities.

Apple shares leapt more than 3 per cent in after-hours trade on the stronger-than-anticipated earnings.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The world's largest social media network reported on Wednesday that its profit for the recently ended quarter nearly doubled y-o-y to US$9.5 billion on sharp gains in digital advertising, as the pandemic kept people glued to the Internet.

Ad revenue rose some 46 per cent to US$25.4 billion from the same quarter a year earlier. This was driven by a 30 per cent increase in price and a 12 per cent gain in the number of ads, according to Facebook.

The earnings trounced market expectations, causing shares to jump nearly 5 per cent in after-market trades.

Alphabet

Google's parent company saw a total revenue of US$55.31 billion for Q1, up 34 per cent y-o-y, pummeling Wall Street estimates.

Despite suffering a slump in commercial queries for things like flights and hotels, the search engine contributed the most to Alphabet's revenue at US$31.88 billion, up 30.1 per cent from the previous year, Alphabet announced on Tuesday.

YouTube ad revenue grew 48.7 per cent to US$6.01 billion as people were stuck at home looking to relieve boredom by watching videos online, while earnings from Google's cloud-computing business rose 45.7 per cent to US$4.05 billion on a spike in demand for Internet-based services from remote workers.

The company also unveiled a US$50 billion share buyback, sending the stock up as much as 5.5 per cent to an intraday record high of US$2,416.98 on Wednesday.

Netflix

The industry pioneer saw a 24 per cent y-o-y revenue increase to reach US$7.16 billion for Q1 2021. Its operating profit and margin reached all-time highs of US$1.96 billion with a margin of 27.4 per cent.

Netflix also ended the quarter with four million new paid memberships, bringing the total to 208 million. This is up 14 per cent y-o-y but below its guidance forecast of 210 million.

According to Netflix, the paid-membership growth slowed due to the big Covid-19 pull forward in 2020. The pandemic also brought about production delays which thinned its content slate in the first half of 2021.

"We continue to anticipate a strong second half with the return of new seasons of some of our biggest hits and an exciting film lineup. In the short term, there is some uncertainty from Covid-19; in the long term, the rise of streaming to replace linear TV around the world is the clear trend in entertainment," the streaming service provider said in its earnings report on April 20.

Samsung Electronics

The South Korea-based multinational company on Wednesday posted a net profit of 7.14 trillion won (S$8.54 billion) for the quarter ended March 31, up 46.3 per cent yoy. Samsung's revenue climbed 18 per cent to 65.4 trillion won, led by sales of its flagship Galaxy S21 smartphone series and supported by continued stay-at-home demand for its television set and home appliance business.

However, its semiconductor business saw an earnings decline quarter on quarter (q-o-q), despite solid memory shipments, mainly due to a production disruption at its Texas plant and a downward trend in prices.

The company also saw a q-o-q decline in mobile earnings and expects the trend to continue in Q2 2021 due to chip shortages and weak seasonality.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.