🖋️ Buying life insurance? Know what you’re signing

Straight to your inbox. Money, career and life hacks to help young adults stay ahead.

[SINGAPORE] If you’ve ever bought life insurance, you’d know first-hand the volume of documents involved. Between the fine print and legal jargon, it’s tempting to just skim through the material and sign.

But understanding the policy you’re buying is crucial. Miss something important, and you could end up paying for features you don’t need – or worse, discover too late that you’re not covered when it matters most.

This is especially important if you’re buying policies directly, without an insurance agent to explain the details.

Even if you have an agent, it’s still a good idea to read through the documents yourself. Make sure what’s in writing matches what you’ve been told and that the policy actually suits your needs.

“Policies may look very similar on the surface. You really have to read deep into the documents to understand what it covers for and when it is payable,” Tan Chuan How, chief agency officer at Income Insurance, tells thrive in a video interview.

So, here’s a quick guide to making sense of your insurance documents.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

📃 What’s in the documents?

The documents you receive will depend on the type of policy, but here are the ones you’ll typically come across:

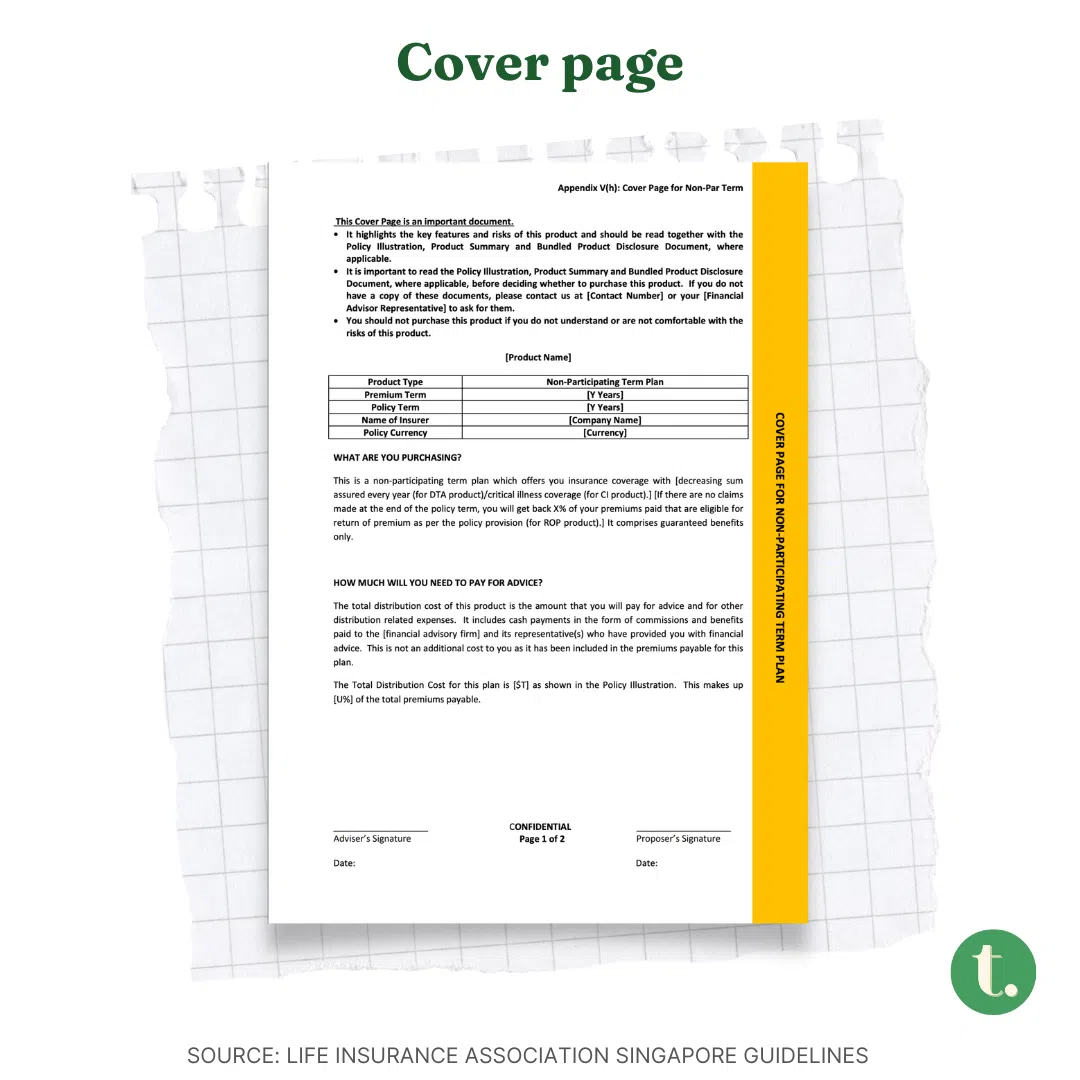

📔 Cover page: A summary of the key features, risks and charges of the policy that’s typically two to four pages long.

It’ll also state how much you’re paying for advice and distribution (including your agent’s commission) and explain what happens if you surrender the policy early.

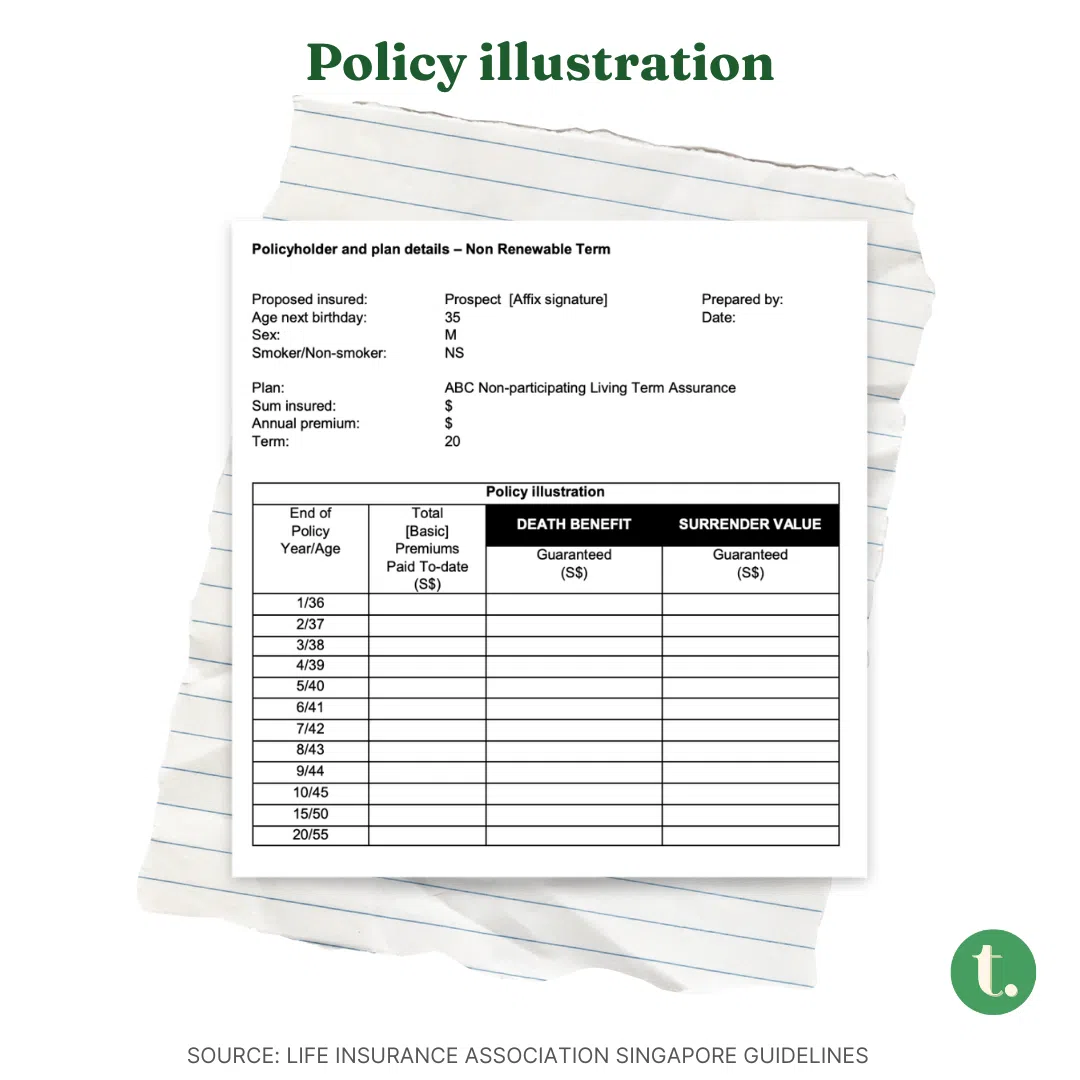

📊 Policy illustration: This is where you’ll find numbers and tables showing your premiums and benefits over time.

Understand how your premiums are structured. Are they fixed, or do they increase over time?

If your policy has a savings or investment feature, you’ll see how the policy’s cash value might grow.

💡 Take note: Some figures are guaranteed, while others are non-guaranteed and based on projected investment returns (like 4 per cent or 8 per cent). These are for illustration only – actual returns can differ.

📋 Product summary: Here, you’ll find more details of the features of your policy, including what you’re covered (and not covered) for. It’ll also tell you, for example, whether the premium rates for your policy are guaranteed or subject to adjustments.

For critical illness plans, you should pay attention to the list of illnesses covered. Some plans cover just the big three – cancer, heart attack and stroke – while others cover as many as 50.

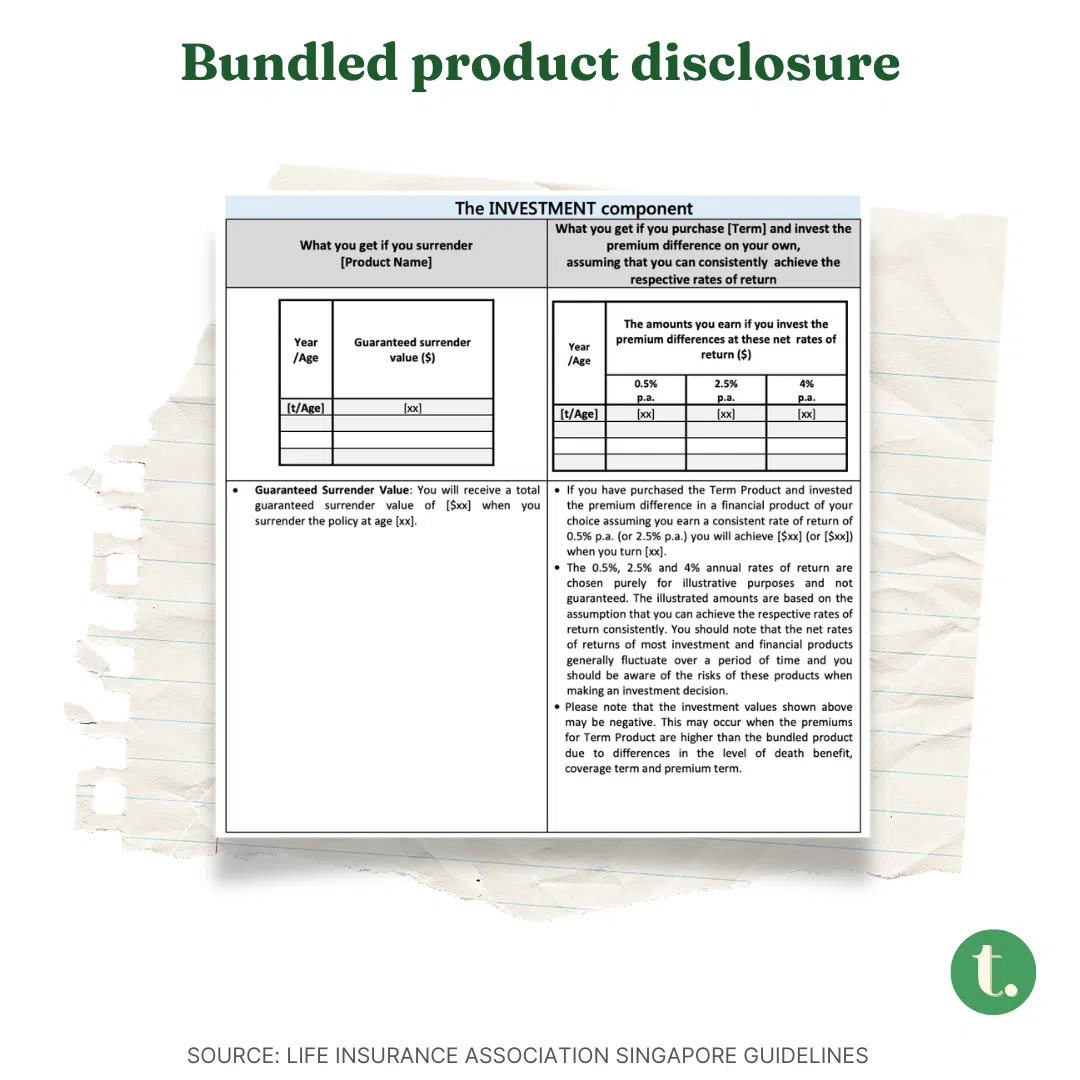

🎁 Bundled product disclosure: If you’re buying hybrid plans such as whole life plans (that combine protection with savings or investments), you’ll see this.

It helps you compare whether you might be better off buying a cheaper term policy (protection-only plans) and investing the remaining cash on your own. Or as the popular saying goes, “buy term and invest the rest”.

The document usually includes tables comparing the surrender value of your plan versus investing the cash left over from buying a term plan at a hypothetical 0.5 per cent, 2.5 per cent or 4 per cent rate of return.

🔎 What to look out for

It may take some time to get yourself familiar with the gist of the features and coverage of the policy you’re planning to buy.

Income’s Tan says insurance buyers should consider three things when reading through the document before their purchase.

First, whether the policy suits your needs. Can you afford the premiums? Is the length of the policy and the features of the policy something you’re looking for?

Second, look out for the exclusions so that you won’t be caught off guard when the insurance company rejects a claim that you thought you were covered for. Common ones include pre-existing conditions and self-inflicted injuries.

Thirdly, are the charges fair? As mentioned earlier, the documents lay out the fees that your insurance agent and the company charge, though these fees are already included in the premiums that you’re being quoted for.

In the case of policies with an investment component, look out for the fees associated with buying, selling and switching the underlying investment funds, as well as fees for surrendering your policy early.

If you have any doubts, clarify them with your insurance agent or get a second opinion from another adviser.

In any case, life insurance policies in Singapore come with a 14-day free-look period after receiving your policy. If you change your mind and cancel during this period, the insurance company will refund your premiums.

But don’t leave it to the last minute – read through everything carefully. After all, insurance is meant to give you peace of mind, not unpleasant surprises.

TL;DR

- Knowing what you’re signing is crucial because policies can look similar on the surface

- Key documents to check include: the cover page, policy illustration, product summary and bundled product disclosures

- Look out for whether the policy suits your needs and budget, its exclusions list, and the fairness of fees and charges baked into your premiums

- Remember, you have a 14-day free-look period to back out if needed

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.