Gold is booming. Here’s what Gen Z investors should know

Straight to your inbox. Money, career and life hacks to help young adults stay ahead.

[SINGAPORE] What’s up with gold?

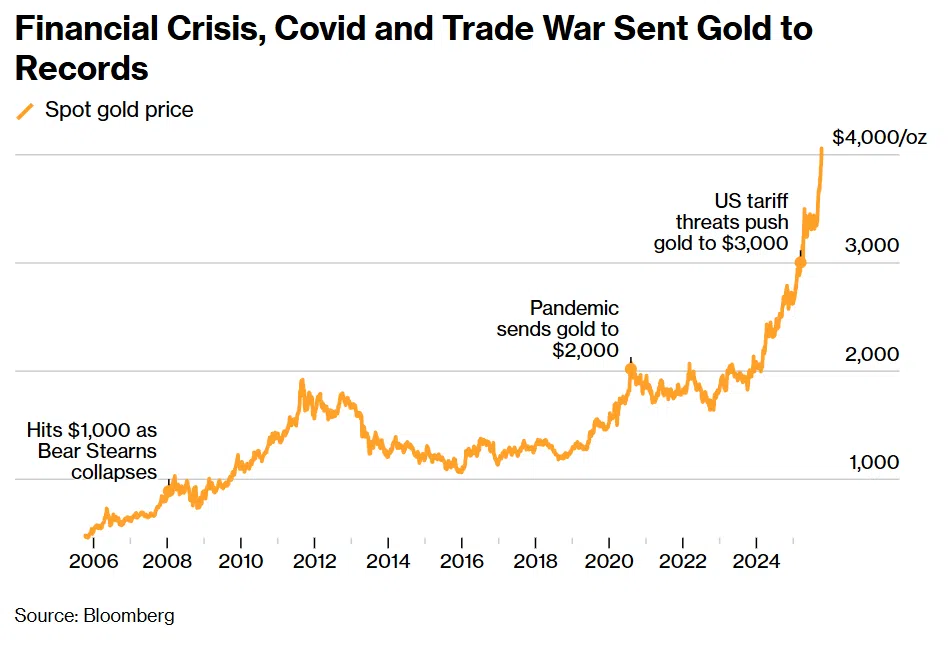

After rising 27 per cent last year, gold has climbed another 54 per cent this year, breaking US$4,000 an ounce and outpacing both global stocks and Bitcoin.

That’s surprising for an asset many people once saw as boring or outdated. So what’s driving this sudden shine and should you still consider it?

📈 Why gold has risen

Several factors are pushing gold higher at the same time.

The latest push came from the US government shutdown, the first in almost seven years. It has made investors more worried about America’s finances and the strength of the US dollar, which remains the world’s main reserve currency.

When people lose confidence in markets, they shift their money into so-called “safe haven” assets – and gold has always been one of them.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

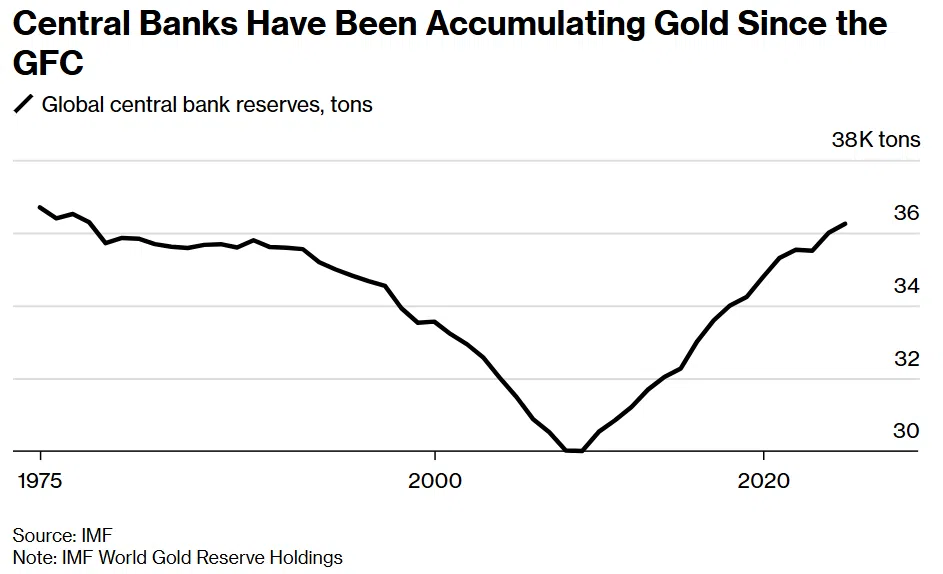

At the same time, central banks have been buying gold in large quantities. Many are trying to reduce their reliance on the US dollar in their countries’ reserves, especially as tensions between major economies grow.

Interest rates are also expected to fall next year. Gold doesn’t pay dividends or interest, so it becomes more attractive when the returns on cash and bonds start to drop.

Finally, the US dollar itself has weakened. Because gold is priced in dollars, it gets cheaper for investors who use other currencies – which helps lift demand.

📊 What gold does in a portfolio

Gold isn’t meant to make you rich. Its main goal is as a long-term store of value.

There’s only a fixed amount of gold in the world, and unlike money, it can’t be printed. That’s why people see it as a way to protect their wealth especially during times of high inflation when the value of money falls.

In an investment portfolio, gold’s job is to balance things out. It tends to move differently from other assets like stocks and bonds. That means it could help cushion losses during market downturns, or drag on your portfolio when the market rallies.

💸 Is gold still worth buying?

Gold’s rally has been huge, so future gains may be smaller – though like all investment decisions, you’ll never know.

Bloomberg notes that gold prices are looking stretched compared with copper, but not when compared with US stocks. Goldman Sachs raised its forecast for gold price this week to US$4,900 from US$4,300 by December 2026, citing strong demand from investors and central banks.

If the next few years stay uncertain – with slower growth, currency swings, or policy shifts – holding a small portion in gold can still make sense. But if the global markets continue to do well and investors start shifting out of safe-haven assets, then gold prices could lag behind equities.

In any case, investing in gold should be a long-term decision for diversification, not for quick gains.

Financial advisers typically recommend not holding more than 10 per cent of your portfolio in gold, in the same way you won’t want to hold too large a percentage of an individual stock.

💰 How to invest

The easiest way to invest in gold is through exchange-traded funds (ETFs). These track the price of gold and can be bought through your usual brokerage app, just like a stock.

ETFs are convenient because you don’t need to worry about storage, insurance, or resale – and they usually come with low annual fees.

For most people, ETFs are the simplest option. Common examples include the SPDR Gold Shares or iShares Gold Trust. Note that some are physical ETFs backed by real gold, while others are synthetic, meaning they use futures contracts instead of holding gold directly.

If you’re buying ETFs denominated in USD, keep in mind that you’re still partly exposed to US dollar movements, so you’re not diversifying completely away from it.

If you prefer something tangible, you can buy physical gold such as coins or bars from authorised dealers or banks such as UOB. The Business Times (BT) recently wrote a piece about the big players in this space.

But buying physical gold comes with extra costs: dealers charge a premium above market price, and you’ll need to pay for safe storage. Selling it later can also be less convenient and may come with a spread (meaning the dealer or bank’s buying price is lower than the selling price).

You could also buy shares of gold mining companies, but those are typically riskier or more complex because they depend on company performance, not just the metal’s price. There are even gold mining ETFs such as the VanEck Gold Miners ETF.

Or jewellery, though these will come up with a higher mark-up and may be less pure than gold bars.

But hey, at least you can wear it, which is more than you can say for an ETF.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.