Home loans are getting cheaper – should you stick with HDB or switch to a bank loan?

Straight to your inbox. Money, career and life hacks to help young adults stay ahead.

[SINGAPORE] If you’ve been eyeing your first flat or thinking about switching up your home loan, you’ve probably noticed that interest rates have fallen quite significantly.

After a few rough years of expensive borrowing, the tide is turning. The US Federal Reserve has started cutting rates for the first time since 2020, and the Singapore Overnight Rate Average (Sora) – the key benchmark most floating-rate home loans are tied to – has slipped to its lowest level in three years.

At present, a concessionary loan from the Housing and Development Board (HDB) has an interest rate of 2.6 per cent per year. Meanwhile, a three-year fixed rate HDB home loan from POSB – for instance – is approximately one percentage point lower, DBS tells thrive.

As a result, banks say more HDB flat owners are now refinancing to cheaper bank loans, while interest is growing for floating-rate packages – the ones that rise and fall with the market.

If you’re deciding between an HDB loan and a bank loan (or wondering if now’s the moment to switch), here’s how the current rate environment could shape your move.

🏡 HDB vs bank loan

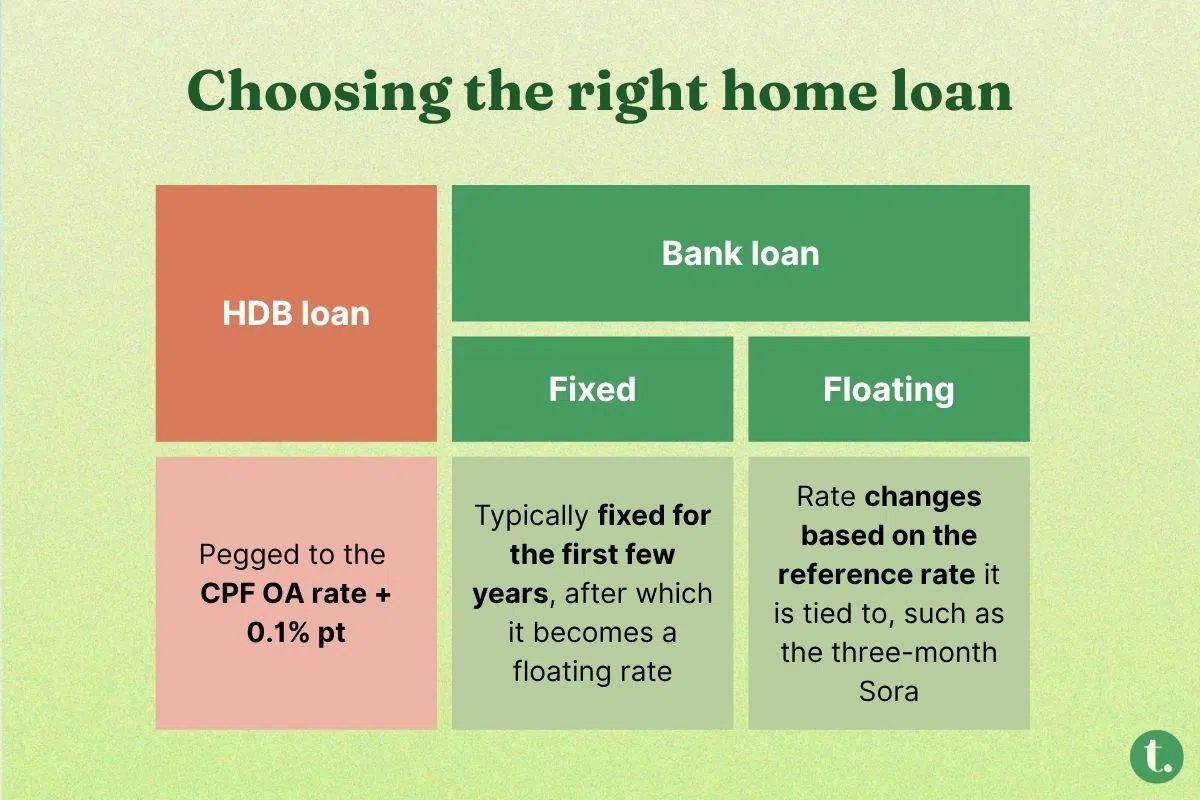

When you buy a new HDB flat, you typically have two options:

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

HDB loan: Pegged to the Central Provident Fund (CPF) Ordinary Account rate + 0.1 per cent, which works out to 2.6 per cent. It’s stable, predictable and rarely changes much – the last adjustment was nearly 20 years ago.

Bank loan: Comes in fixed or floating versions. In times of low interest rates, these loans can be cheaper than HDB’s 2.6 per cent.

Floating-rate loans fluctuate depending on the market conditions and are often tied to the three-month compounded Sora, an average of the rate over three months.

Banks then add a “spread” on top. With the three-month Sora at around 1.25 per cent, if your loan package has a spread of “+1 percentage points”, the interest rate you’ll have to pay is 2.25 per cent.

🔒 Why fixed rates aren’t “fixed forever”

Even though we call them fixed-rate loans, there’s a detail that might catch some first-timers off guard.

Most “fixed-rate” packages only guarantee your rate for the first two to three (sometimes five) years. After that, they typically revert to a floating rate – often one pegged to Sora plus a spread.

🔄 Should you refinance?

Between an HDB loan and a bank loan, the key trade-off is flexibility versus certainty.

An HDB loan offers peace of mind. While bank loans can be cheaper at times, you take on more risk.

Importantly, the switch works only one way. You can refinance from an HDB loan to a bank loan. But once you take out a bank loan, you can’t go back to an HDB loan.

Still, the gap between HDB and bank loan rates right now does open a window to save on monthly repayments. Switching from an HDB loan to the three-year fixed POSB HDB home loan could shave off roughly S$3,500 in the first year on a S$350,000 loan, says Chelsea Ling, head of deposits and secured lending at DBS Singapore.

Ling notes that the bank has seen a “remarkable tenfold increase” in customers refinancing their loans from HDB to the POSB HDB loan in the two months from September to October compared with January to February.

Clive Chng, associate director at Redbrick Mortgage Advisory, tells me that some banks are even offering a five-year fixed loan at 1.78 per cent. And while many banks may charge a penalty for paying down the loan early, he has seen such loans being offered with no penalty.

“To a lot of people, that’s a no-brainer,” he says. “With a five year minimum occupation period (for BTO flats), the timing is just nice and the amount of savings is quite tremendous.”

“I think today is a really good time to refinance. Some will always want to push the boundaries and wait for interest rates to come down… but I think that is going to be unrealistic.”

When comparing loans, Ling advises weighing not just your outlook on future interest rates and long-term financial plans, but also unique bank features. For example, some bank loans allow you to switch to a different home loan package within the same bank without paying a fee.

“It’s crucial for homebuyers to adopt a long-term perspective,” says Ling. “While lower interest rates are attractive in the short term, a property purchase is a significant commitment, and rates will fluctuate.”

🏗️ New BTO buyers

If you’re still waiting for your BTO to be built, you might be wondering whether to lock in a bank rate early. But fixed-rate bank loans typically aren’t available until the flat is ready, says Ling.

A common approach for many HDB homebuyers is to choose the HDB loan first.

HDB loans have a lower initial down payment requirement and no penalties for early repayment.

When you’re closer to collecting your keys, you can reassess the market and your own finances, then decide whether switching to a bank loan makes sense. By then, you’ll have a clearer picture of your financial situation that makes it easier to choose a loan that fits your needs.

TL;DR

- Interest rates have fallen, opening up potential savings for homeowners

- More HDB flat owners are now refinancing to cheaper bank loans

- Bank loans can be lower than HDB’s 2.6 per cent, but can be more volatile

- For BTO buyers, a common move is to start with an HDB loan, then review bank packages closer to key collection

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.