Hospitalisation insurance 101 and how the new rules change things

Straight to your inbox. Money, career and life hacks to help young adults stay ahead.

- Find out more and sign up for thrive at bt.sg/thrive

[SINGAPORE] If you’ve been keeping up with headlines, chances are, you’ve stumbled upon “Integrated Shield Plan” and something called a “deductible” in your news feed.

In case this sounds like noise to you, these have to do with your health insurance plans and how much you’ll need to pay out of pocket at the hospital. Hate it or love it, the new riders will be rolled out by April next year. Here’s a breakdown of the new updates to bring you up to speed.

🛡️ What are Integrated Shield Plans?

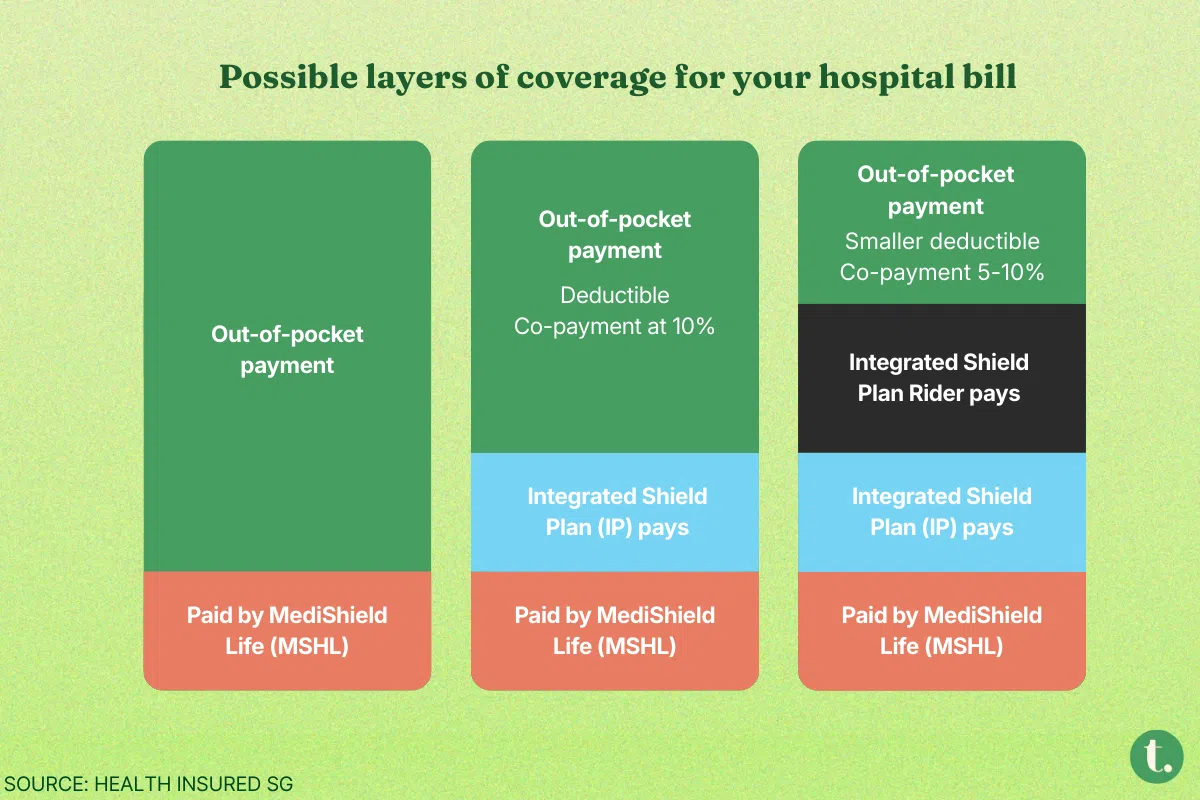

Integrated Shield Plans (IP) are optional private insurance plans that sit on top of MediShield Life, Singapore’s basic health insurance that covers hospitalisation and certain outpatient expenses. IPs are typically used to cover higher-tier wards in public and private hospitals, such as Class A and B1 wards. On top of an IP, you can add a rider to reduce your out-of-pocket costs – the amount that your insurer doesn’t cover. These out-of-pocket costs usually comprise a deductible and a co-payment. A deductible is the initial payment you’ll need to make during a medical claim, before your insurer can start reimbursing you for the rest of the bill. You usually only need to pay the deductible once in a policy year. The Ministry of Health (MOH) sets the minimum deductible based on ward class. For a Class A ward, that’s S$3,500.

You can add a policy rider to your health insurance that covers the deductible, meaning you won’t have to pay this part of the bill. Of course, this means your insurance charges will be higher. A co-payment is the portion of the bill that you’ll have to split with the insurer. This happens after you pay the deductible, and is usually expressed as a percentage. The standard co-payment is 10 per cent. But with a rider, you can bring down your co-payment to 5 per cent, subject to a cap. Insurers are required to set a co-payment cap of no less than S$3,000 per year. This means that even if your original 5 per cent of the bill exceeds S$3,000, you’ll only have to pay S$3,000 per policy year.

🔄 What are the new changes?

The changes:

- The minimum co-payment cap will be raised from S$3,000 to S$6,000 per policy year.

- Riders will not be allowed to cover the minimum deductible.

Existing policyholders – riders are typically renewed yearly – will not be affected for now. Insurers may continue selling current riders until Mar 31, 2026, though all policyholders who bought such riders between Nov 27 and Mar 31 must transition to the new requirements by Apr 1, 2028.

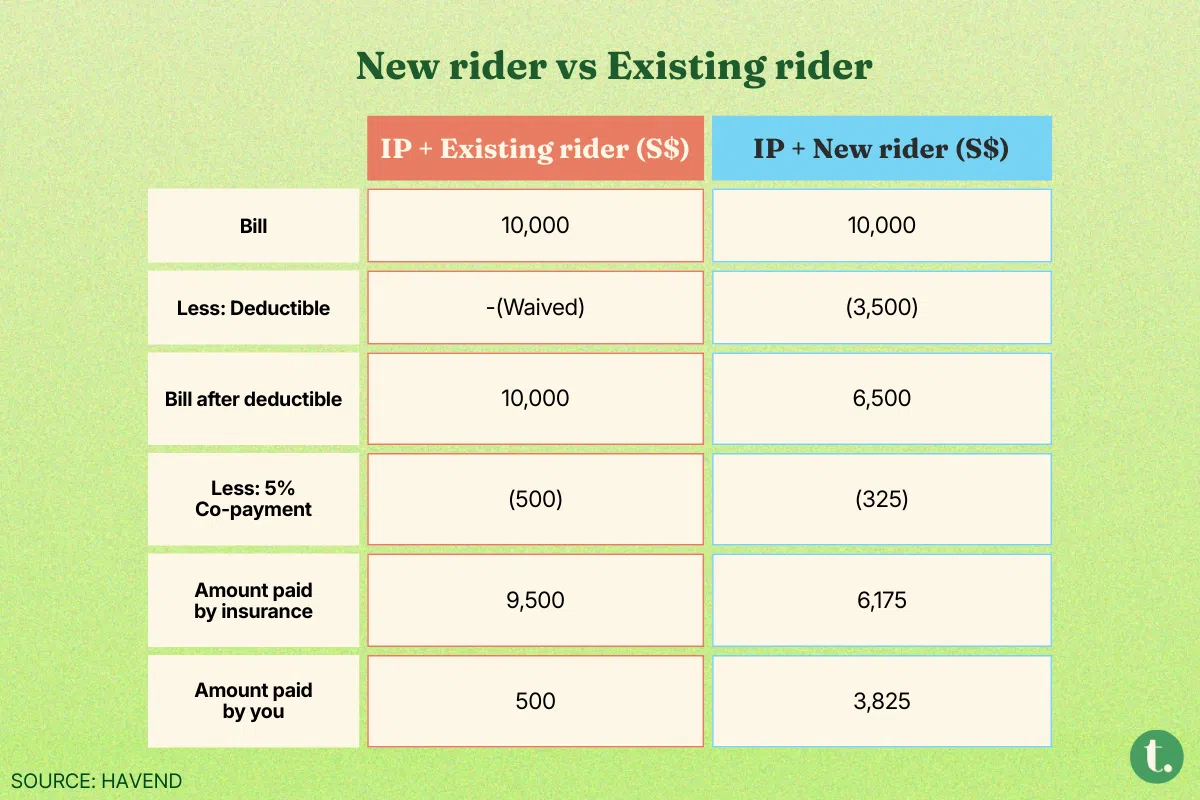

🛵 New riders vs existing riders

Let’s say you undergo surgery at a private hospital and your bill comes to a total of S$10,000. If you’re on a private hospital IP with an older rider that fully covers your deductible, you’ll only be paying for 5 per cent of the total bill, which is S$500. With the rider changes, you’ll first have to fork out the minimum deductible of S$3,500. Then, you’ll co-pay 5 per cent of the remainder after the deductible, which is S$325. In total, your out-of-pocket cost would be S$3,825. Do note that your final out-of-pocket cost may be covered by MediSave, subject to withdrawal limits.

🤔 Why is MOH setting new requirements?

MOH says that the changes are meant to reduce overconsumption of healthcare services and keep private insurance sustainable in the long run.

Health Minister Ong Ye Kung had previously noted that insurance products with generous coverage can contribute to a tendency to “use more than necessary”.

MOH data also revealed that private hospital IP policyholders with riders were 1.4 times as likely to make a claim as those without riders.

This has contributed to rising healthcare costs and premiums, with six out of seven insurers hiking premiums for their IPs this year alone.

With the new rules, the ministry expects premiums for new riders to fall by about 30 per cent.

🤓 Expert advice on IPs

All Singaporeans are covered by MediShield Life, which helps pay for large hospital bills. But many choose to enhance this with an Integrated Shield Plan (IP) – about 71 per cent of residents have one.

If you’re still deciding whether to get a hospitalisation plan, here’s what to consider.

IP plans come in tiers. Some cover higher-class wards in public hospitals, while others let you seek care in private hospitals. Your choice should depend on the type of care you expect and what you can sustainably afford.

Eddy Cheong, chief executive officer of insurance advisory Havend, wrote in a commentary for The Business Times: “If you are satisfied with staying in a subsidised public hospital (B2/C wards), there is no need to buy an IP as your MediShield Life would be sufficient.

“However, if you want the option of a higher ward type or even in private hospitals, then you will need to consider an IP.”

Other benefits of IP plans are that they offer additional benefits in covering pre- and post-hospitalisation expenses

Speaking to thrive, Cheong stressed long-term planning as premiums rise with age.

“It might be fine for Gen Z to go for a higher plan if they can afford it now… However, they should make sure they have the means to fund the premiums, not just now, but say in 10 years’ time,” he said.

Chan Wai Kit, executive director at Life Insurance Association, Singapore adds: “It’s a good habit to periodically review your insurance needs and coverages to ensure they stay updated with evolving circumstances and expectations.”

And if you’ve already gotten an IP and are wondering whether to switch riders, experts suggest waiting for clearer information. Insurers have until 2026 to adjust their products, and new premiums are not finalised yet.

Instead of being swept up by the rush to get existing riders before they’re gone for good, consider carefully your budget and healthcare expectations. Also, weigh how much out-of-pocket cost you’re prepared for against the potential savings in premiums.

If you’re gonna be forking up your hard-earned cash for health insurance, I’d say make your decisions with clarity rather than fear.

TL;DR

- New IP riders will soon not be allowed to cover minimum deductibles

- The co-payment cap will also be raised from S$3,000 to S$6,000 per policy year

- Changes are meant to address the overconsumption of healthcare services

- Experts advise balancing expectations and affordability by reviewing needs and coverage

* Amendment note: A previous version of this story incorrectly stated that the minimum deductible for a Class A ward is S$3,500 for those 80 years old and below. Minimum deductibles are not based on age. A previous version of this story had also mislabelled the column headers in a table comparing a new rider with an existing one.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.