🔥 Hot take: Forex trading isn’t investing, it’s speculation 🎲

Straight to your inbox. Money, career and life hacks to help young adults stay ahead.

- Find out more and sign up for thrive at bt.sg/thrive

📚 A classic tale

Around 10 years ago, my sister was invited to a seminar that she was told would teach her how to invest. Instead, she was introduced to a forex trading bot that would supposedly all but guarantee profits if left to run for long enough.

The bot ran on an algorithm that would trade on your behalf. All you had to do was deposit money into a trading account, and the bot would trade currencies automatically based on market signals.

My sister was swayed. Together with a friend, she pooled around S$5,000 from the money they saved up from their part-time jobs on the lofty promise that the bot would generate easy passive income.

Spoiler alert: They lost every cent of their deposit 💀.

Mind you, she was in university at the time and didn’t know better about investing. Yet, the salespeople felt it was fine to mislead students into thinking that forex trading was a legitimate form of investment.

The reality is that forex trading is highly speculative and extremely risky for those unfamiliar with the financial markets.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Of course, it’s possible to make money from forex trading. Likewise, it’s possible to make money from opening up Pokémon packs to resell the rare cards.

Currency trading is one of the hardest things to make sustained profits on. The majority of retail traders fail to turn a profit, and stats bear it out:

An analysis of 32 brokers regulated by the European Securities Markets Authority showed that an average of 72.2 per cent of forex traders lost money, since this metric was tracked from 2018.

🙋 What is forex trading?

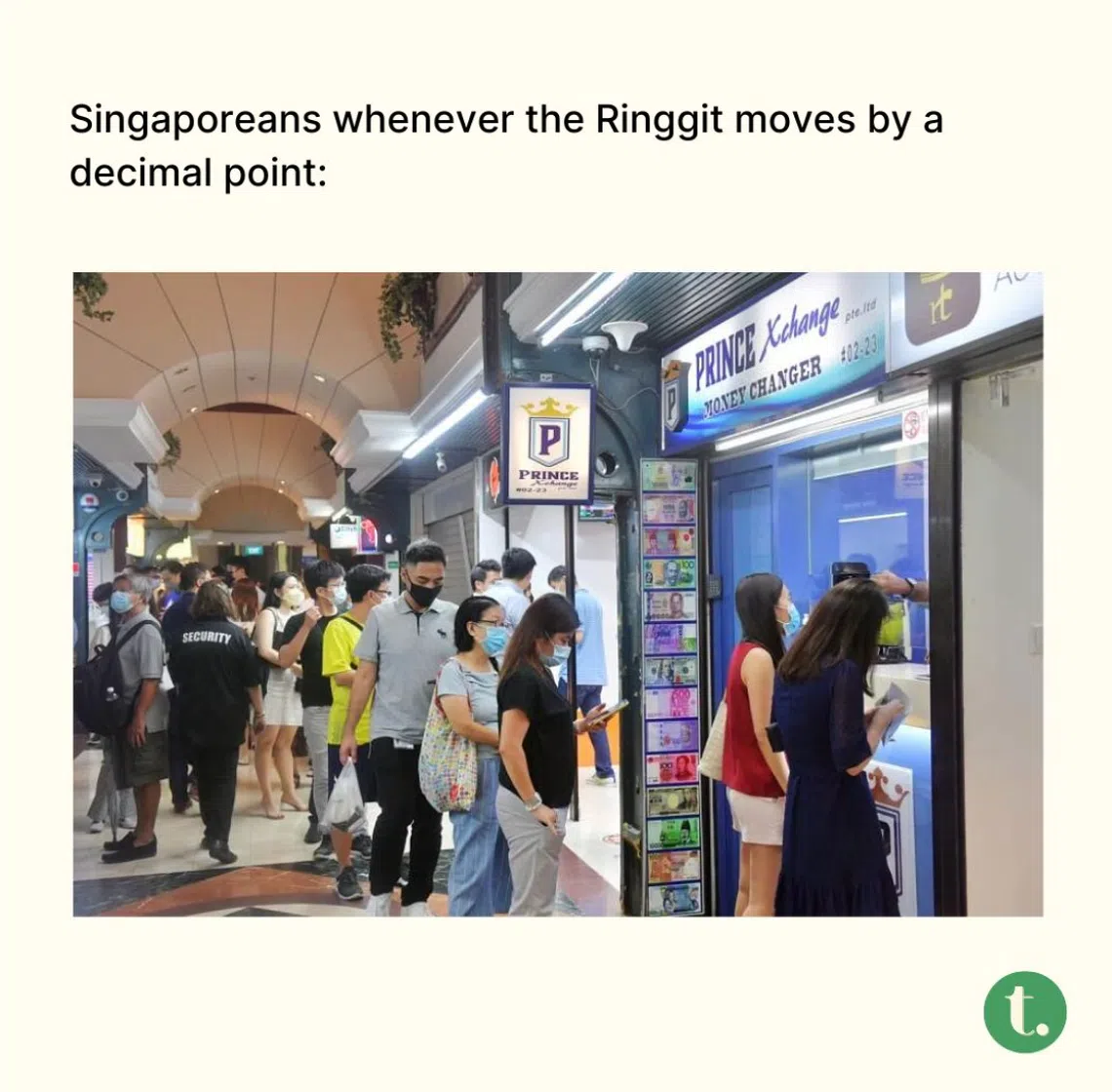

Say you’re travelling to Japan for vacation in a few months’ time 🍡. The news reports that the Japanese yen has fallen to a new low against the Singapore dollar, so you decide to exchange currencies ahead of time.

By the time you get on your flight, the yen has recovered. You now have more yen to spend on cute gacha toys than you would have had if you waited till later to exchange your Singdollar to yen.

That’s profit 🤑.

That’s the essence of forex trading: speculatively buying and selling currencies to make a profit. When the yen dropped, and you went to the money changer, you speculated that the yen would recover – and in this case, it did.

A side note on currency pairs

Forex trading is always done in currency pairs: SGD/USD, USD/EUR, JPY/SGD, etc.

When you’re making a trade, you buy one currency and sell another at a given rate. Say the USD/SGD rate is 1.34. That means the price of one unit of USD (the base currency) is 1.34 units of SGD (the quote currency).

The foreign exchange market, where banks and individuals buy and sell currencies, is the largest financial market in the world. The volume of transactions exceeds even the global stock markets.

Singapore is the third largest forex centre globally, after London and New York. Every day in Singapore, almost US$1 trillion worth of foreign exchange is traded.

Banks and investment funds make up most of the forex market – and for other reasons beyond speculating on currency movements for profit. Individual investors, meanwhile, make up only 5.5 per cent, according to a 2020 report by Visual Capitalist.

🤔 Why is it risky?

Here’s what the US Securities and Exchange Commission says about forex trading: “Forex trading can be very risky and is not appropriate for all investors.”

“The only funds that you should put at risk when speculating in foreign currency are those funds that you can afford to lose entirely.”

For one, currencies are influenced by a host of factors every other day, such as interest rates, economic policies and geopolitics.

That volatility is what attracts traders to forex because the more prices move each day, the more they can potentially make by buying and selling at the right times.

However, because daily or hourly price movements are very small, it is common for forex traders to employ leverage.

It’s another way of saying you’re borrowing money to invest. Many brokerage firms in Singapore offer a leverage ratio of up to 20:1 for forex trading. That means with S$100, you can buy currency worth S$2,000, or 20 times your capital.

By using leverage, you risk losing even more money than your initial capital.

On top of that, trading in forex often means you’re putting yourself up against skilled professionals who do this for a living.

🙅 Beware of scams

For some reason, the forex world tends to attract fraudsters. Perhaps it’s the nature of leverage that makes the potential of get-rich-quick scams more believable.

Always check the credentials of supposed “fund managers” and remember: If something sounds too good to be true, it probably is.

And be wary of self-proclaimed forex trading gurus who try to sell you an investing course. If their trading strategies are really that profitable, why would they give away their secrets?

TL;DR

- Forex is the largest financial market in the world, but individual investors only make up a small percentage

- Some seven in 10 retail investors lose money trading forex on average

- Many forex strategies can cause you to lose more money than your initial investment

- Beware of “fund managers” promising high returns or forex trading “gurus” trying to sell you a course

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.