🤷🏻 I’m a new investor but I have a fear of investing... What can I do?

Straight to your inbox. Money, career and life hacks to help young adults stay ahead.

🚨 Inaction is not “playing safe”

As John F Kennedy once said, “The price of inaction is far greater than the cost of making a mistake.”

Even though we all know we should start investing, loss aversion tends to kick in hard, making us feel like investing is a losing game.

The irony, however, is that avoiding investing altogether can actually lead to greater losses in the long run for two main reasons:

Compounding: The earlier you start investing, the more time your money has to grow. Conversely, the longer you take to start, the greater the potential gains that you’re losing out on.

Inflation: Letting all your money sit in a low-interest savings account will only erode its value over time. The interest earned often lags behind the rise in prices of goods and services. Keep in mind that core inflation for this year has been forecasted to be about 0.5 per cent to 1.5 per cent.

Understanding the “why” behind investing keeps you motivated, ensuring that you’re not just chasing trends, enabling you to take advantage of compounding while cushioning the impact of inflation.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

✍🏻 Investing in knowledge

When it comes to investing, jumping in without doing your homework is a risky move – especially with so many options out there.

Most new investors will usually go through more well-known brokerages such as IBKR or Tiger Brokers if they intend to do it themselves, but if you intend to seek help from a financial adviser, one first step is to check MAS’ financial directory to see if it’s licensed. MAS also has an Investor Alert List, which flags firms known for suspicious activity.

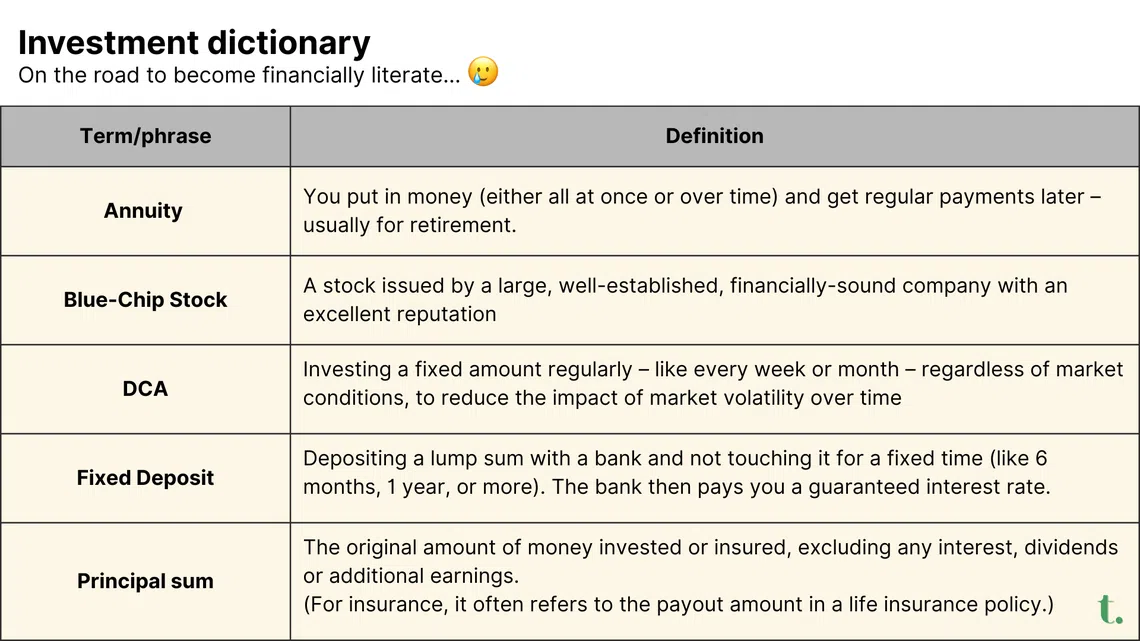

When I started researching investment methods, I would Google a phrase I didn’t understand, only to get bombarded with more complex jargon that can be intimidating.

Making my own investment dictionary (with easier language) helped me collate all the definitions I learnt into a single space, making it easier to refer to them when the need arose.

🚩 Keep your eyes open for promises of high returns with little or no risk

It is important to recognise that money takes time to grow.

When someone comes to you with a promising investment strategy, it helps to understand how the mechanics work and who is behind this investment, so that you can make a more informed decision. Higher returns always come with higher risk, so I would rather stick to well-researched and rational investments, even if it means starting small.

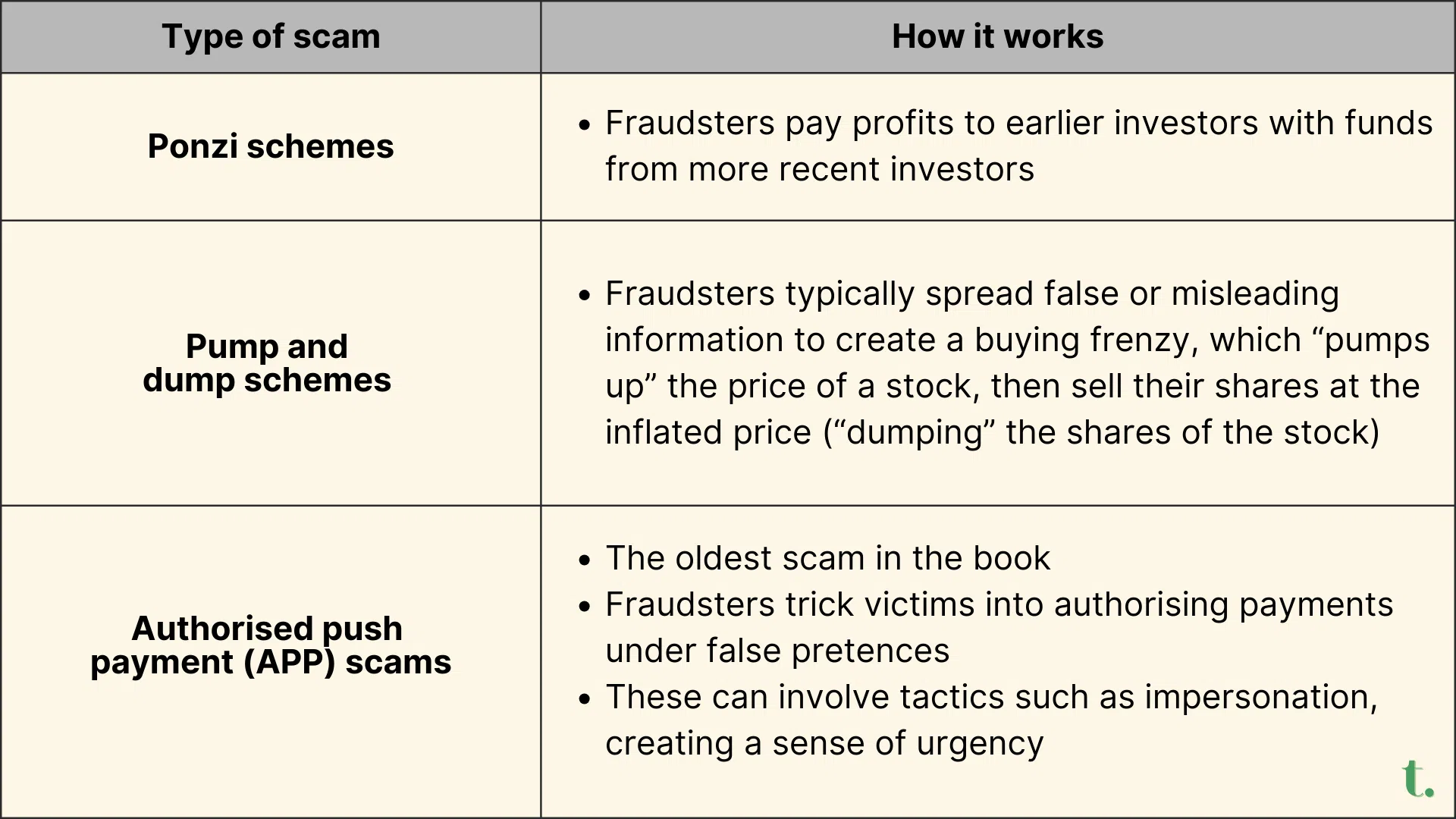

With scams at an all-time high, it makes sense to be cautious. You don’t want to be pennywise and pound-foolish when it comes to your money.

Below are some common types of investment scams we can look out for:

😮💨 Rein in your emotions before you start investing

When I first learnt about investing in stocks, I was so excited to start buying individual units from companies like Apple or Microsoft, as some of my friends did. Obviously, I did not do my research and only reacted on the spur of the moment, because I wanted my money to grow as fast as possible (don’t we all).

But after I started researching, I realised buying individual stocks might not be the best way to start, especially for someone with a pretty weak risk appetite like mine.

It always helps to stay sceptical, even when excited about a good investment. “Truth bias” is our tendency to believe what people tell us and brush off discrepancies as a “mistake” rather than a lie. As FT writer Jonathan Guthrie puts it, “When money is involved, doubt is the best default.”

Don’t invest because you feel excited or fearful. Invest only because you have done research, verified legitimacy and understand the risks. Eventually, I opted for a longer-term, more diversified option of Exchange Traded Funds (ETFs) like the S&P 500, deploying dollar-cost averaging instead of timing the market.

🆘 It’s okay to seek help

While some people say, “Keep your investments private,” that doesn’t mean you should navigate everything alone – especially when you’re unsure.

While scammers manipulate emotions, an outsider stays objective and can even offer better alternatives. Getting a second opinion from a trusted and knowledgeable person is a sign of wisdom, not weakness.

Granted, knowing who to ask is also important. According to MDRT’s latest consumer survey, even with the popularity of online sources and social media, Singaporeans still rely on traditional information sources for financial planning, such as family (62 per cent), schools (60 per cent), newspapers (54 per cent), and financial advisers (53 per cent).

While there’s no right or wrong way to do it (even Reddit can be a goldmine for newbie investors), consider the person’s agenda and track record.

After reading this, you might feel the urgency to start investing ASAP to make up for lost time, but be aware that this urgency can make you more vulnerable to those looking to take advantage of it.

Legitimate investments don’t expire overnight, and even though stocks and other assets have ups and downs, there’s always time to research. Hope this inspires you to take the first step!

TL;DR

- The real risk isn’t short-term losses – it’s never starting at all

- Emotions don’t usually lead to good investments, but doing thorough research and having a proper strategy does

- A trusted mentor or experienced investor can help spot red flags, but just be mindful of who you take advice from – random strangers and salespeople might not have your best interests at heart

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.