✈️💰 Is the miles game for you? We debunk three myths about this credit card strategy

Straight to your inbox. Money, career and life hacks to help young adults stay ahead.

❌ Myth 1: Miles cards make more sense because they have no minimum spend

They may not have a minimum spend, but low spending can make it an inefficient means to earn reward points for miles. This is because your points could expire before you even have a chance to redeem them.

Credit card points are typically converted in substantial batches, which is something I had previously overlooked. Let’s take the conditions for DBS credit card points on mile redemptions as an example:

- DBS credit card users can redeem their miles only in blocks of 5,000 points for 10,000 KrisFlyer miles, Qantas points or Asia miles. If users wish to redeem a smaller batch of points for miles, there is the option of exchanging 500 DBS points for 1,500 BIG points to be used for flights under budget carrier AirAsia.

- Under DBS, credit card points accumulated expire within a year from the quarterly period they were earned.

If you’re a low spender, you may end up with orphan points or fail to hit the 5,000-point minimum within the year to redeem your much-awaited miles for full-service carriers.

Under such circumstances, people usually end up using their points on cash vouchers at a less competitive rate before they expire.

This happened to me back when I spent less than S$750 per month on my credit card. I was barely reaching the minimum number of redemption points for the KrisFlyer miles I needed at the one-year mark of using my card. Eventually, I caved and used the expiring points on some (sub-optimal) vouchers.

Christopher Chong, the founder of personal finance YouTube channel HoneyMoneySG, tells thrive that the target audience for miles rewards credit cards are usually those who have sufficient income to cover bills of at least S$1000.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Miles do have a longer expiry period once they’ve been converted, however. KrisFlyer miles, for example, expire within 36 months at the end of the equivalent month from when the miles are redeemed.

But three years isn’t long if you’re an infrequent traveller or someone who doesn’t always use full-service carriers such as Singapore Airlines (SQ) for travel.

Personally, miles redemption can offer great rewards, but it might not be for everyone.

For individuals new to the game, the learning curve is “steep”, says Chong. It will take some time to understand how to redeem miles in a way that really gives you a bang for your buck 💵.

❌ Myth 2: Miles should only be used for business and first-class flights

The general rule is that the further the destination and the higher the seat class, the more optimised your miles will be.

Airlines such as SQ provide Saver Award charts that indicate how certain longer-haul flights, or business and first-class seats yield relatively high value per mile, too. “Saver” rates reflect a discounted amount of miles that flights can be redeemed for, while “advantage” rates offer mile redemption at a standard level.

There are, however, sweet spots for economy flight redemptions that exist, too.

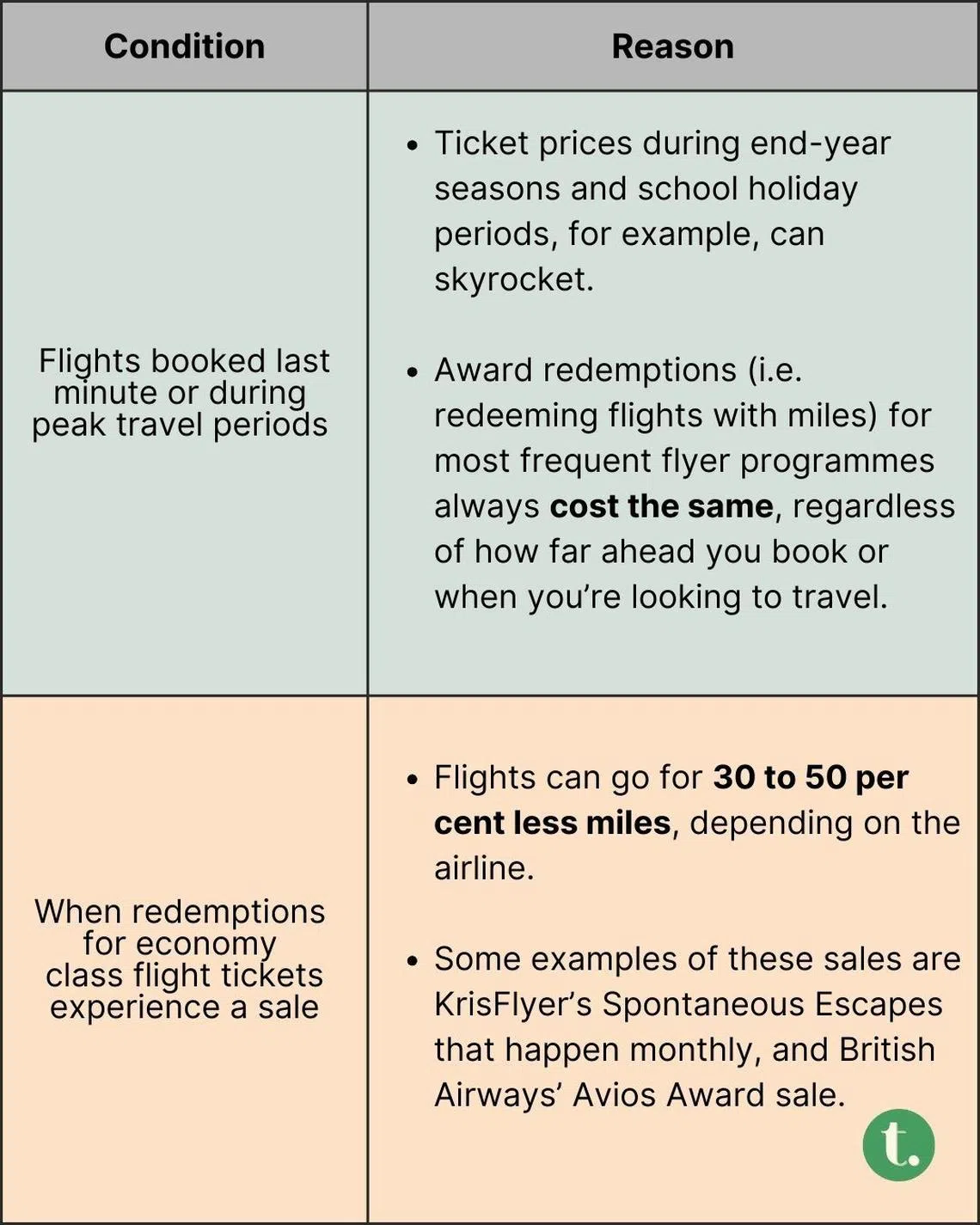

This can occur under the conditions such as:

It’s not impossible to redeem economy-class flights with your miles for a price that’s value-for-money, but travel content creators Marilyn and Jian Sheng of @shrugmyshoulder stress that it is typically harder to get good value for redeeming flights in this class.

“It also takes effort to keep track of the card used, miles earned, miles expiry, and these flight availabilities,” they said.

❌ Myth 3: Miles cards are always superior to cashback cards

The valuation of an air mile can vary widely and will usually depend on whether you are mixing cash with miles or redeeming entire flights in your purchase.

The latter option offers more value, but many use the former approach if they need to get rid of expiring points.

As mentioned above, a mile’s value can also spike further if you redeem your miles during sale periods that allow for as much as 30 per cent off mile redemptions.

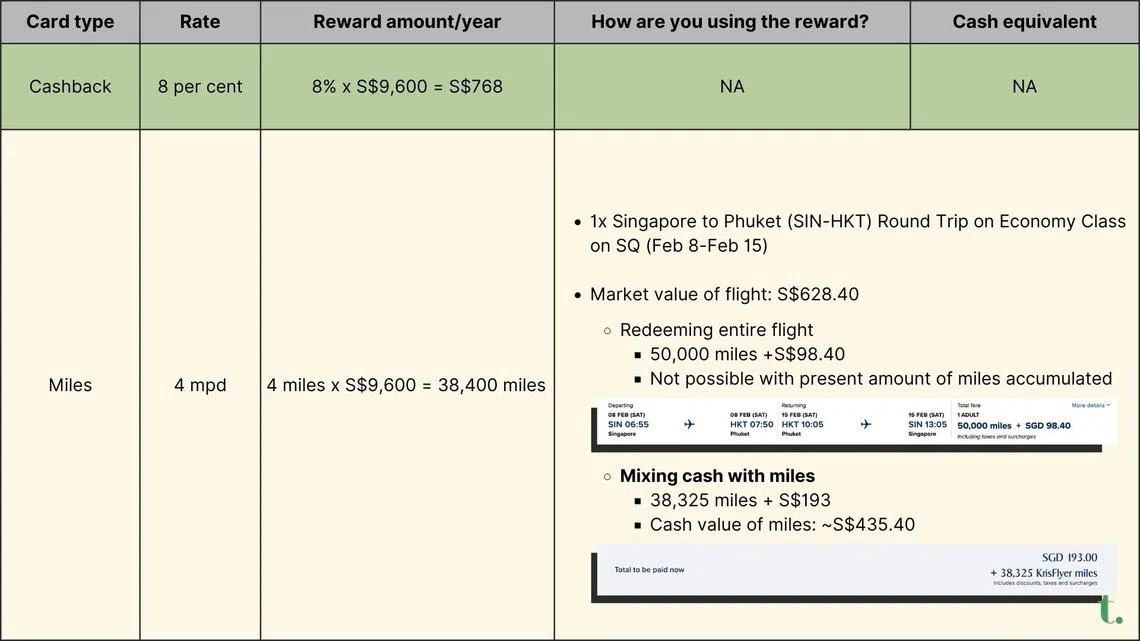

Generally, those who wish to accumulate miles at a competitive rate look for cards that offer returns at 4 miles per dollar (mpd) spent.

In some cases, cashback cards offering rebates of above 8 per cent can trump 4 mpd credit cards. This occurs when users are unable to optimise miles or meet the minimum reward points.

Let’s say an individual has an annual spending of S$9,600 (or S$800 per month). Here’s how the rewards offered by cashback and miles cards could differ:

In the example above, if the user was forced to use miles for the flight (perhaps due to an upcoming expiry), they would still have to fork out S$193 for a flight worth S$628.40.

Compare this with the cashback of S$768 generated, and you can see why miles cards are not necessarily better than cashback.

Ultimately, people should not blindly follow either a cashback or miles strategy when it comes to redeeming credit card points, Chong warns. Rather, he encourages a flexible and strategic approach to maximising rewards.

“Users should understand the importance of their own individual needs and preferences when choosing between miles and cashback credit cards,” he says.

🛫 Are you still in for the miles game?

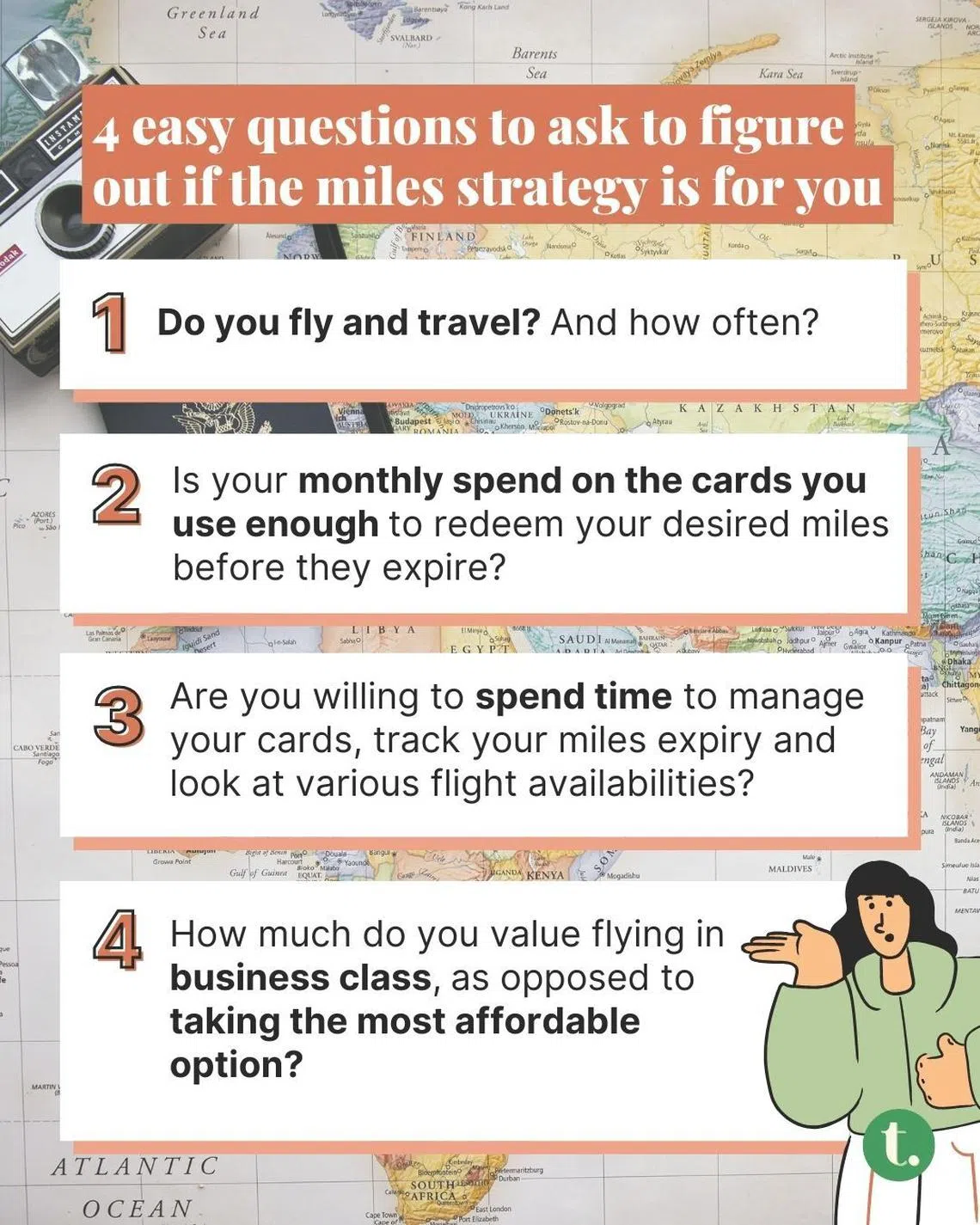

Whether you choose (and benefit) from a miles or cashback strategy is often determined by your personal style of engaging with money, too.

“The miles strategy is not suitable for users who cannot appreciate delayed gratification and hard work to find the suitable flight routes for redemption,” Chong explains.

Here are four easy questions you can ask yourself to gauge whether the miles strategy is for you:

All this said, no one is stopping a 25-year-old fresh graduate from going ham on miles, or someone earning six figures from staying true to a cashback strategy. As for me, I’ll likely continue playing the miles game, though I’m now inclined to consider a diversified strategy to better maximise my spending returns.

TL;DR

- Accumulating miles is not necessarily better than a cashback strategy, particularly if you’re not a higher earner or someone who travels regularly

- Miles can still be well used for economy-class flights, as long as they are redeemed the right way and the flights have a saver rate that is value for money

- Certain cashback cards offer competitive returns, too, as long as the minimum spending amount is met across the relevant categories per month

- A balanced rewards accumulation strategy is what should be strived for ⚖️ – one that accounts for your spending needs at your current life stage

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.