🕑 Picking when to start investing

- Find out more and sign up for Thrive at bt.sg/thrive

😎 Just “buy low, sell high”?

If you followed our previous issue, you should have picked a brokerage and set up a trading account by now. Great!

Considering that you’ve taken steps towards starting your investment journey, you should also have gotten a grasp of why it’s important to start young. (ICYMI: take a look at the second picture on this post.)

Now, it’s time to decide on a plan. When is the right time to buy a stock? Or any other types of investments – such as bonds, Reits, exchange-traded funds – for that matter. Should you buy every time the stock price dips? Or whenever there’s bad news about the company?

There are many types of strategies to employ in investing, and the examples mentioned earlier involve some degree of timing the market. Essentially, you’re trying to predict how the stock’s price will move in the future and buying when you think the price is at a low.

How often have you heard finance bros talk about how investing is as easy as “buy low, sell high”?

The catch is that it’s easier said than done. It takes a lot of effort and experience to track the market’s movement to pull off such a strategy successfully.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Even professionals struggle to get it right. A 2017 study by Boston College’s Centre for Retirement Research found that when investment fund managers try to boost returns by timing the market, their decisions do not seem to help and may even hurt returns.

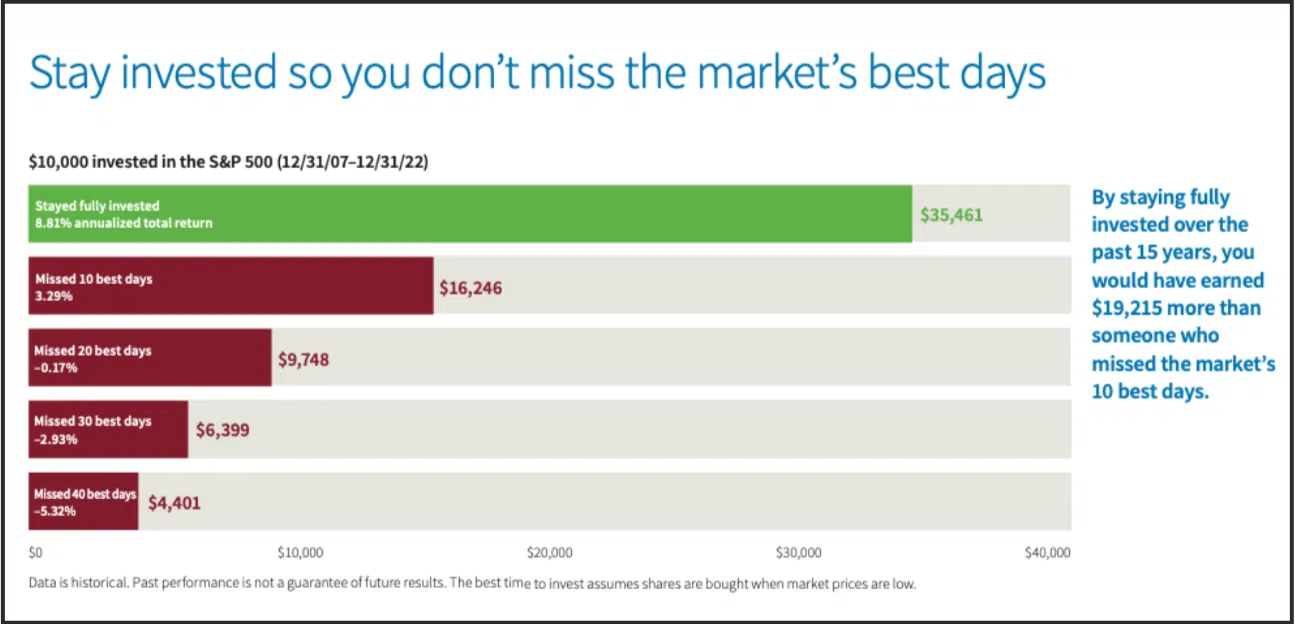

If you need more convincing, just look at this chart from US investment management firm Putnam Investments.

📝 The plan is simple

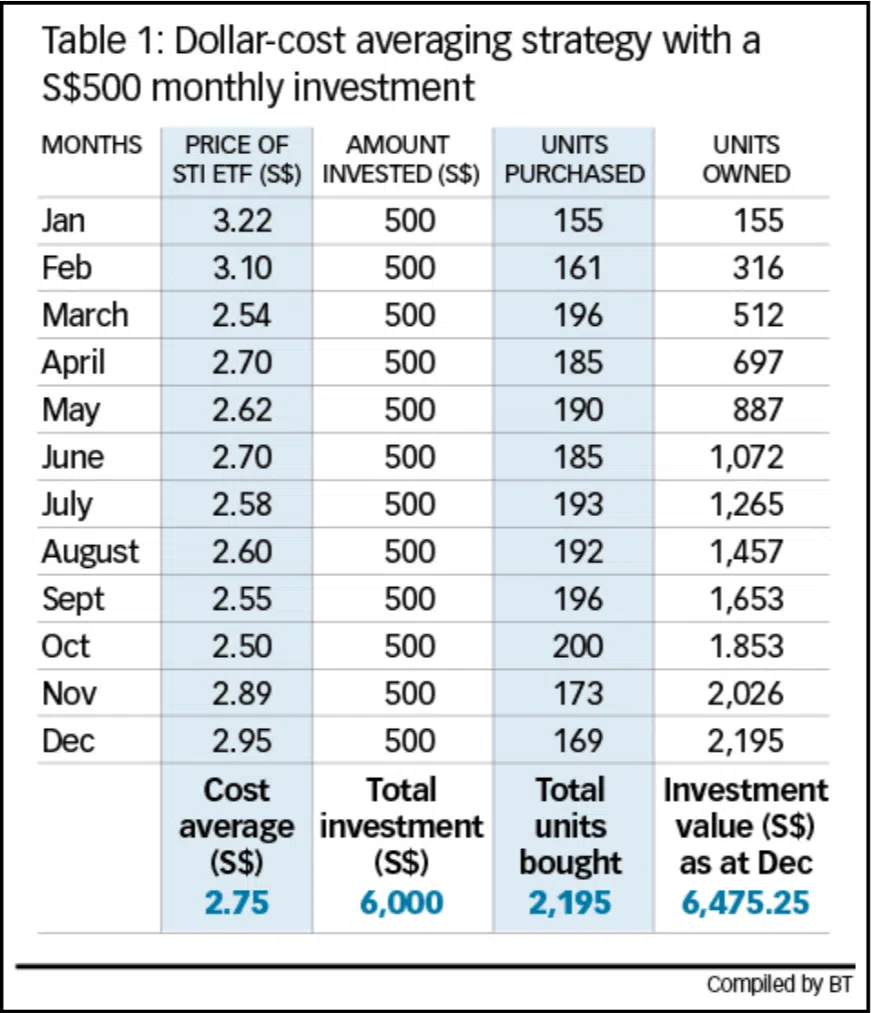

The popular alternative to investing based on market predictions is a strategy known as dollar-cost averaging. It means investing the same sum of money on a regular basis regardless of the share price, taking guesswork out of the equation.

It may sound simple and crude, but the idea behind it is actually quite ingenious: Say you put S$500 each month into an investment fund that tracks the Singapore market. What you’ll end up with is fewer shares when the price rises, and more when prices fall 🧠.

This brings down the cost of your investments even if you start at a bad time. It also helps to smoothen out volatility in price and limits the losses from a badly-timed investment.

Dollar-cost averaging protects new investors from falling into the common trap of letting emotions affect their decisions.

It’s easy to say “buy low, sell high” but when you’re bombarded with headlines about how the economy is in shambles, fear takes over and you start to question whether it’s the right decision to continue investing.

Conversely, when the market rebounds and your investment portfolio grows ever larger, it’s hard to resist the urge to pile more cash into your investments 🤤.

Putting into practice: One way is to set aside say, 20 per cent of your salary and invest that sum every month regardless of whether the market is in the green or in the red.

🤖 In fact, you can automate this process by setting up a scheduled transfer so the money goes into your trading platform the same day you receive your salary.

This can help you get past any investment inertia and prevents your salary from accumulating idly in your bank account.

💨 Possible exception: Getting a windfall

Perhaps you’ve received a large sum of money from an inheritance, insurance payout or your company’s bonus.

In such cases, investing that money in one lump sum may work better to your advantage than dollar-cost averaging.

A recent study by Vanguard, one of the world’s largest investment firms, found that lump-sum investments outperformed cost averaging 68 per cent of the time. This was based on the historical performance of global markets after one year.

But buying a lump sum’s worth of shares at one go can be daunting. Also, it can take years for your investment portfolio to recover from making a lump-sum investment at the wrong time 😓.

If you’re someone who has a lower tolerance for risk – dollar-cost averaging can still be a viable strategy to limit losses even if it may not be the most optimal strategy in theory.

That said, there are trade-offs for every strategy. For instance, with dollar-cost averaging, you could be missing out on higher returns due to potential delays in entry of capital. There are also transaction fees that can add up since it’s a monthly investment.

With any investment, there’s no guarantee that you’ll make money. The studies and examples cited earlier drew their conclusions from past results, which do not indicate how the market will actually perform in the future.

Even with a sound plan, you may still end up losing money if you pick a losing stock to steadily invest in. And remember: Never invest money you can’t afford to lose!

TL;DR

- Timing the market is an unreliable strategy and getting it wrong can be painful

- “Buy low, sell high” seems easy until emotions get in the way

- Buying a fixed dollar-amount at regular intervals helps to limit your losses

- Dollar-cost averaging takes less effort and reduces the inertia to start investing

- However, there are occasions when investing a lump sum at one go may be beneficial

Copyright SPH Media. All rights reserved.