🥕 Reflections from a Gen Z: What’s the deal with such a generous Budget this 2025?

Straight to your inbox. Money, career and life hacks to help young adults stay ahead.

- Find out more and sign up for thrive at bt.sg/thrive

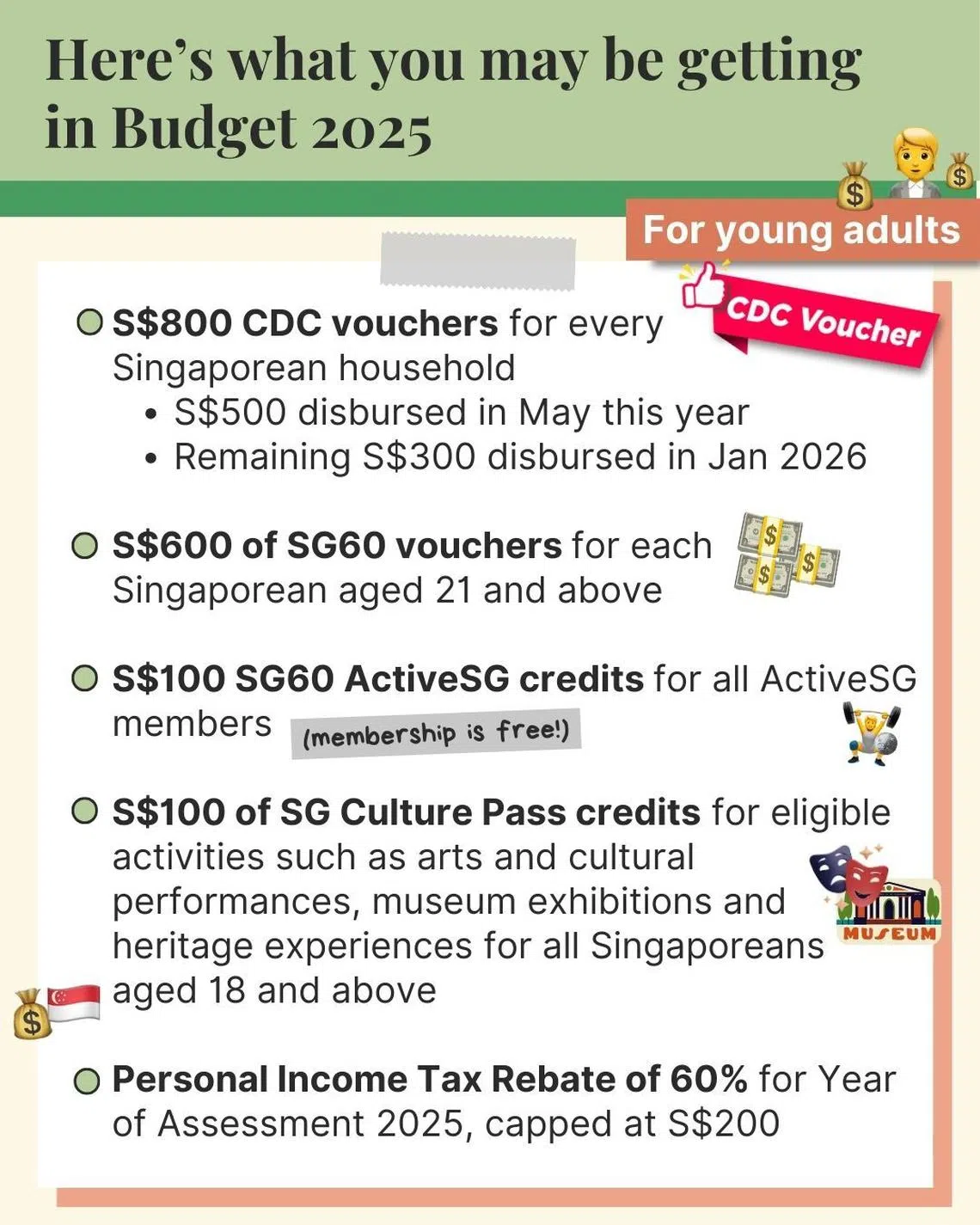

Budget 2025 is one for the record books – at least, when it comes to the sheer amount of 💰 dropped, in the form of vouchers, rebates, and support for virtually every segment of the population.

Not that I’m complaining, though. Questions have sprung to mind since Finance Minister Lawrence Wong’s speech on Feb 18, however.

Why exactly did this year’s Budget present more “carrots” than “sticks”? Is this solely in the spirit of an “election Budget”? Let’s get to answering them.

🙋🏻♀️ Question 1: This year’s Budget was generous AF. I find that sus. Do we really have that much money?

We went from goods and services tax (GST) hikes in recent times and “a tight fiscal position” just two years ago, to the government throwing money 💵 at us.

Well, the good news is that the government will be able to do so without going into the red. Here’s why.

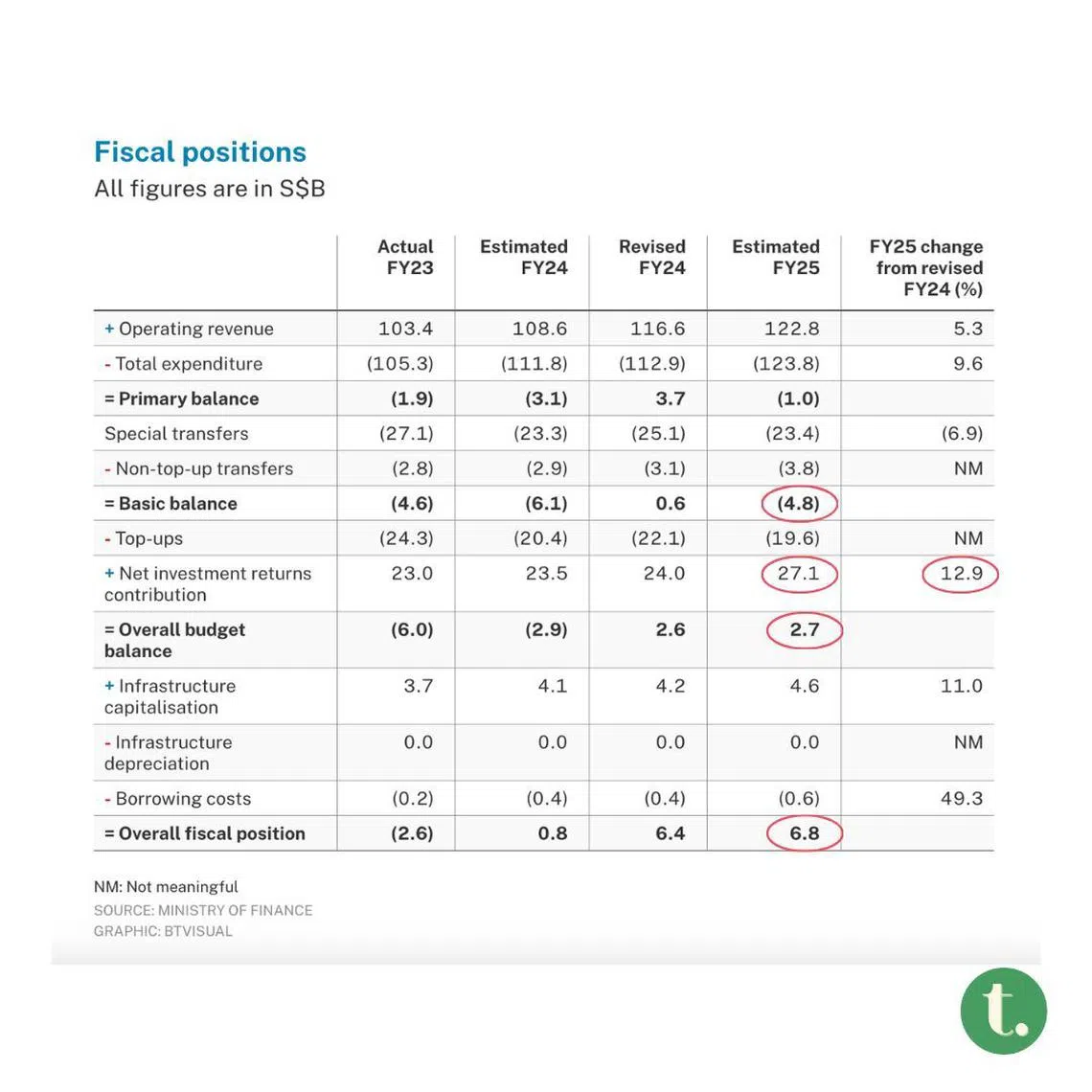

According to data from the Ministry of Finance, Singapore witnessed a 12.9 per cent rise in net investment returns contribution (NIRC) from the revised 2024 financial year (FY2024), to an estimated S$27.1 billion in the financial year 2025 (FY2025).

What’s NIRC?

The net investment returns contribution (NIRC) comprises up to 50 per cent of the expected long-term real return on assets invested by GIC, the Monetary Authority of Singapore and Temasek, and up to 50 per cent of net investment income derived from past reserves from the remaining assets.

But why does that matter? The basic deficit estimated for FY2025 is S$4.8 billion, after considering the difference between operating revenue and total expenditure yields, and accounting for special transfers.

However, the estimated NIRC value of S$27.1 billion would bring this deficit into an overall budget surplus of S$2.7 billion.

But NIRC aside, Singapore also saw higher operating revenue, with corporate income tax the biggest driver with an estimated S$32.7 billion in takings, up 5.8 per cent from the revised FY2024 figure.

This brings FY2025’s operating revenue to an expected S$122.8 billion, up 5.3 per cent from the previous year.

The city-state now expects a fiscal surplus of S$6.8 billion, or 0.9 per cent of GDP, for FY2025.

The surplus is contrary to economists’ expectations of a deficit for this final Budget of the government term. In response to this year’s surplus, DBS economist Chua Han Teng said it reflects Singapore’s strong fiscal position and “adherence to its long-held principle of fiscal prudence”.

So, the government’s generosity this year is backed by solid numbers, if that’s the concern.

🙋🏻♀️ Question 2: Is the government trying to “buy” our vote? “Election Budget”…right?

While it is true that this is the final Budget before Singapore goes to the polls, it’s hard to say whether it will have any impact on election results.

For context, surpluses earned in one term of government (typically about five years) cannot be carried over to the next term, with the current term ending in FY2025.

Hence, with this year’s planned surplus (on top of FY2024’s surplus), the government giving back to Singaporeans in the form of vouchers, tax rebates and institutional funding, makes sense.

In addition, a quick look at the country’s previous elections shows that stereotypical “election Budgets” don’t always pan out for the leading People’s Action Party (PAP).

Let’s take the 2011 General Election (GE) as an example. That year, it was announced that a majority of Singaporeans would receive S$600 to S$800 each as part of the “Grow & Share” package.

However, the 2011 GE was the first election where the PAP lost a group representation constituency (see: Aljunied 👀) for the first time.

The government can pour tons of money into the people – and it would still be impossible to please everyone.

Some of the cash benefits from Budget 2025 were very specific to certain groups of people.

The new Large Families Scheme introduced this Budget is a clear example, offering up to S$16,000 more in support for those who are considering having three or more children.

With this move, the government is clearly incentivising families of a certain size already to grow further. Many other family types, such as first-time parents, will not benefit from these initiatives.

My take as a young voter? Sure, the ruling party would certainly want to sweeten the ground before an election. But the government is surely aware that the electorate takes into account many other factors when it’s time to head to the polls.

🙋🏻♀️ Question 3: Bonus payouts > keeping funds for a rainy day?

I’ll never say no to more vouchers or rebates, but the sheer amount to be disbursed this year got me thinking: Will the country have sufficient reserves for the tumultuous seasons ahead?

Among the immediate, big-picture “rain clouds” I can think of is US President Donald Trump’s tariff war, which is causing turmoil in many parts of the world.

Singapore may be a tiny red dot, but experts have warned that we should still brace for impact. Even the various free trade agreements we have around the world may not be enough to shield us.

We’re bound to feel the ripple effects at some point: things getting pricier, in addition to slower job creation and wage growth.

But as a man on the street, I can’t decide what would be a better choice if I had a say in the Budget: distributing a large chunk of rebates and vouchers or the government storing our cash in its reserves instead.

For now, I’m just going to wait for those SG60 vouchers to drop and hope for the best 😟.

TL;DR

- Singapore now expects a fiscal surplus of S$6.8 billion, or 0.9 per cent of GDP for FY2025 📈

- A surplus earned in each term of government cannot be carried over to the next term 🙅

- Although “election Budgets” are typically expected to improve the ruling party’s vote share, this isn’t always the case (see: GE 2011 🗳️)

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.